Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can view the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2023 edition covers Market Review, Concentration of Returns in U.S. equities and Estate Planning Basics.

Markets

Market scorecard as of close on Friday September 22, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 19,780 | -4.1% | 2.0% |

| U.S. | S&P 500 | 4,320 | -2.9% | 12.5% |

| U.S. | NASDAQ | 13,212 | -3.6% | 26.2% |

| Europe/Asia | MSCI EAFE | 2,065 | -2.1% | 6.2% |

Source: FactSet

-

Canadian Equities finished slightly lower Friday, near worst levels after an earlier bounce attempt failed to hold. Sectors were mixed. Comes after TSX fell 2.1% on Thursday (worst session since Sep-2022) with the Canadian benchmark posting a 4.1% weekly decline (biggest weekly drop in 12 months).

-

US equities finished lower in Friday trading, with major indices ending off best levels and logging declines for the week. The S&P suffered its worst day since March on Thursday.

Economy

Canada

-

Canada’s headline inflation accelerated in August, coming in at 4.0% y/y—20 bps above expectations in a Bloomberg survey of economists and 70 bps above the prior month’s reading, with a month-over-month figure that doubled expectations. Like last week’s U.S. Consumer Price Index reading, a surge in energy prices was a primary culprit, adding 0.7 percentage points to the headline figure.

U.S.

-

U.S. stocks had another tough week as investors digested the Federal Reserve’s “higher for longer” view of the trajectory for interest rates. It wasn’t all bad news; employment indicators remained strong, with initial claims for unemployment hitting eight-month lows.

-

However, these bright spots were overshadowed by multiple factors: mounting concerns over the impact of the auto workers strike and its potential to snowball through the broader economy, as well as continued high energy prices.

-

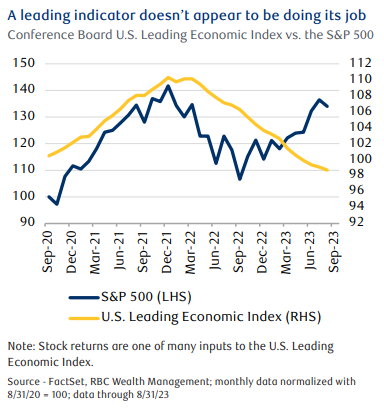

The Conference Board’s Leading Economic Index posted its 17th successive monthly decline, even though the broad stock market has rallied over the last 11 months. In our view, the apparent disconnect between these two typically correlated data series suggests equity investors appear to be ignoring the dislocations caused by a tightening Fed.

Further Afield

-

UK inflation dropped to 6.7% y/y in August from 6.8% y/y in July. In a narrowly balanced decision, the Bank of England (BoE) kept the Bank Rate at 5.25% on Thursday.

-

We perceive investors remain cautious on the Chinese economy following a string of weak macro data. The recent report of a rebound in Macau visitors to levels last seen in 2019 has failed to boost sentiment. Bloomberg reported that net foreign outflows from Chinese stocks showed no sign of abating, with sales of 24 billion yuan so far this month after a record 90 billion yuan selloff in August.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman