Mid-Year Review

Markets at Inflexion Point

Market Review: First half 2023

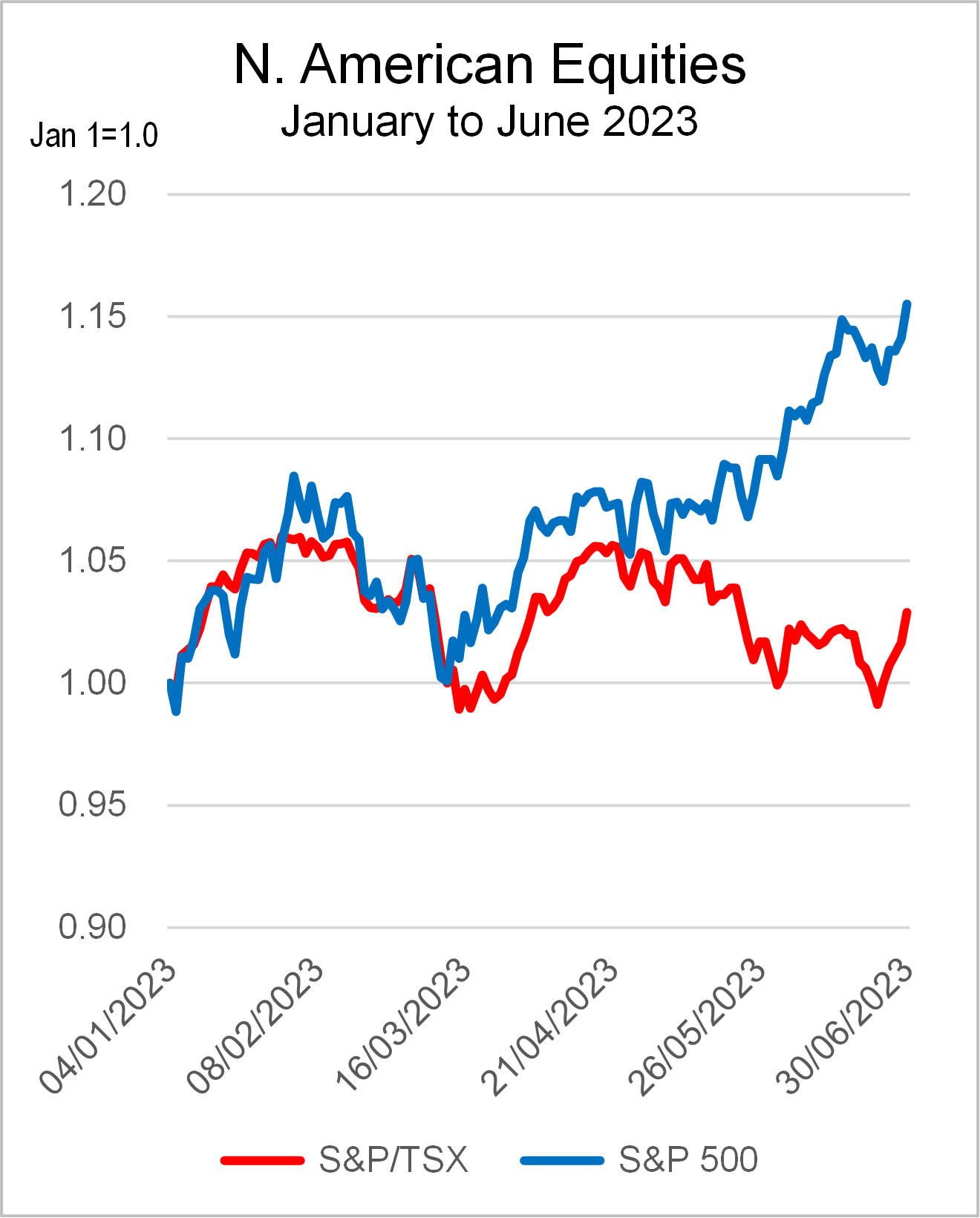

Equity markets in North America finished the first half of 2023 in positive territory. However, the indices followed different paths. In Canada the S&P/TSX Composite Index (TSX) essentially traded sideways, finishing up 3% as of June 30 – see the red line in the chart below. The S&P 500 Index (S&P 500) in the U.S. was up almost 16% during the same period – see the blue line in the chart below.

Source: FactSet June 30, 2023

There is much debate about whether the rally in U.S. equities is the start of a bull market, or if it is just getting ahead of itself. Current signs point to possible further hikes in interest rates that may well dampen the stock market. Bond prices have remained steady in the first half of the year, providing a decent income to investors.

Concentration of Returns

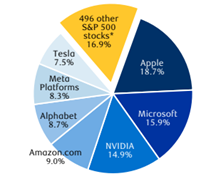

A casual observer may conclude from the previous chart on North American Equities that the U.S. market far outperformed the Canadian counterpart. The truth is that this outsized gain was driven largely by seven of the largest companies in the S&P 500, all in the technology sector. The return from the other 496 stocks was 2.6%, similar to the performance of the TSX.

Source: RBC Wealth Management, FactSet data as of June 23, 2023

Why the concentration

It is about mathematics. The S&P 500 is weighted by market capitalization of the companies so the largest ones account for the highest share. The average return of these seven large companies was 69% which was why the overall index return was so high despite the majority of the companies posting a return of 2.6%.

Intelligent or artificial

With the rise in prominence of artificial intelligence (AI), investors have scrambled to identify potential winners in this field. These seven companies all have a hand in AI so their prices have been bid up as a result of this trend. As of June 30, 2023 the Technology sector made up 28.3% of the S&P 500 by far the largest—the next largest is Health Care at 13.4%.

A Conundrum

Investors need to balance trying to achieve a well-diversified portfolio, and the fear of missing out (FOMO). It is prudent to place upper limits of how much a company or a sector you should own within a diversified portfolio without taking undue specific risk.

Broader Perspective

RBC Wealth Management has been warning of the possibility of a recession later in 2023. During a recession, corporate profits may be revised down, leading to lower stock prices. While consumer spending remains strong, the effect of higher interest rates will eventually work their way through to slow the economy down.

Estate Planning Basics

It’s been said that two of life’s certainties are death and taxes. While I am not qualified to give advice on Wills and Estate issues, I have introduced clients to work with my colleagues within RBC Wealth Management who are specialists in this area. Over the years I have learnt that we all need to address the following four questions.

1. Who will inherit what I own?

The Will is a legal document in which you specify who gets what. When done properly your intentions will be expressed clearly without ambiguity, which will avoid disputes amongst your heirs or other claimants. We all need a Will, and some may wish to have more than one to handle overseas assets or corporate assets. An important decision will be the naming of an executor, a decision not to be taken lightly.

2. Who can run my finances?

When a person is incapacitated they may rely on an attorney to make financial decisions for them, such as pay bills or select investment options or even to sell property. You will need to have a legal document called the Power of Attorney to nominate such a person. For many it is their spouse or adult child.

3. How will I be cared for?

We all wish to remain healthy in body and in mind until the day we leave this world. Ironically, thanks to the advances in medical science we can now keep very sick people alive for much longer than we could a century ago. A Representation Agreement lays out how we wish to be cared for and how decisions are made.

4. How much will taxes be?

Many clients are surprised when they realize how much potential tax liability they may have upon their passing. All assets in registered retirement savings (RSP) or income plan (RIF) will be liquidated and taxed as income, unless you have a spouse. Non-registered assets including property (not primary residence) will be deemed to be disposed with capital gains assessed. Assets overseas will add a layer of complexity. Clients may adopt different strategies to minimize taxes including the use of life insurance.

How RBC can Help

Creating an appropriate estate plan can be an overwhelming project, and I have only touched on the bare minimum here. Having proper guidance and resources is essential. You can start with reviewing the Estate Planning Guide from my website, which also contains other useful material and videos. If your situation warrants it, meeting with a Wills and Estate consultant may be a good step towards developing an estate plan. You will need to engage your own legal representative to draft the documents mentioned above. Some clients have chosen to nominate Royal Trust to be their corporate executor, power of attorney or trustee, in the main role or as a backup. The advantage is that they are professionals and will always be available and free from personal conflict.

Shiuman’s Corner

Reaching a Tipping Point

No cash in sight

My relationship with paying gratuities has evolved over the years. Having lived in different countries where there is less pressure to tip, it took some adjustment to deal with this custom in Canada. In Hong Kong or London there is usually a service charge of 10 to 12 percent already added as a line item in the bill. In North America, an unsuspecting visitor may make the mistake that gratuities are discretionary based solely on your experience of the service received. Of course, for outstanding service one may be happy to pay a little more, but there seems to be an invisible minimum regardless of the level of service. And that invisible line seems to have crept higher over the years. Restaurants may pre-print tip amounts (helpfully) corresponding to 15, 18 or 20% in case guests cannot do mental arithmetic. And it’s always based on after-tax amount! There was a time when I did not tip at cafes or other self-service establishments. But I softened during Covid lockdowns when I tried to do my part to support small businesses. But recently I am often confronted by a payment terminal at a coffee shop with tipping options starting at 15%, going as high as 25%. Could this be caused just be higher cost of living? It truly requires a re-examining what is discretionary and why some business models rely on gratuities to survive. Maybe I will simply pretend to be a tourist who does not understand local customs.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.