Preparing for a Recession

Inflation is retracting, though still high

Market Review Q1 2023

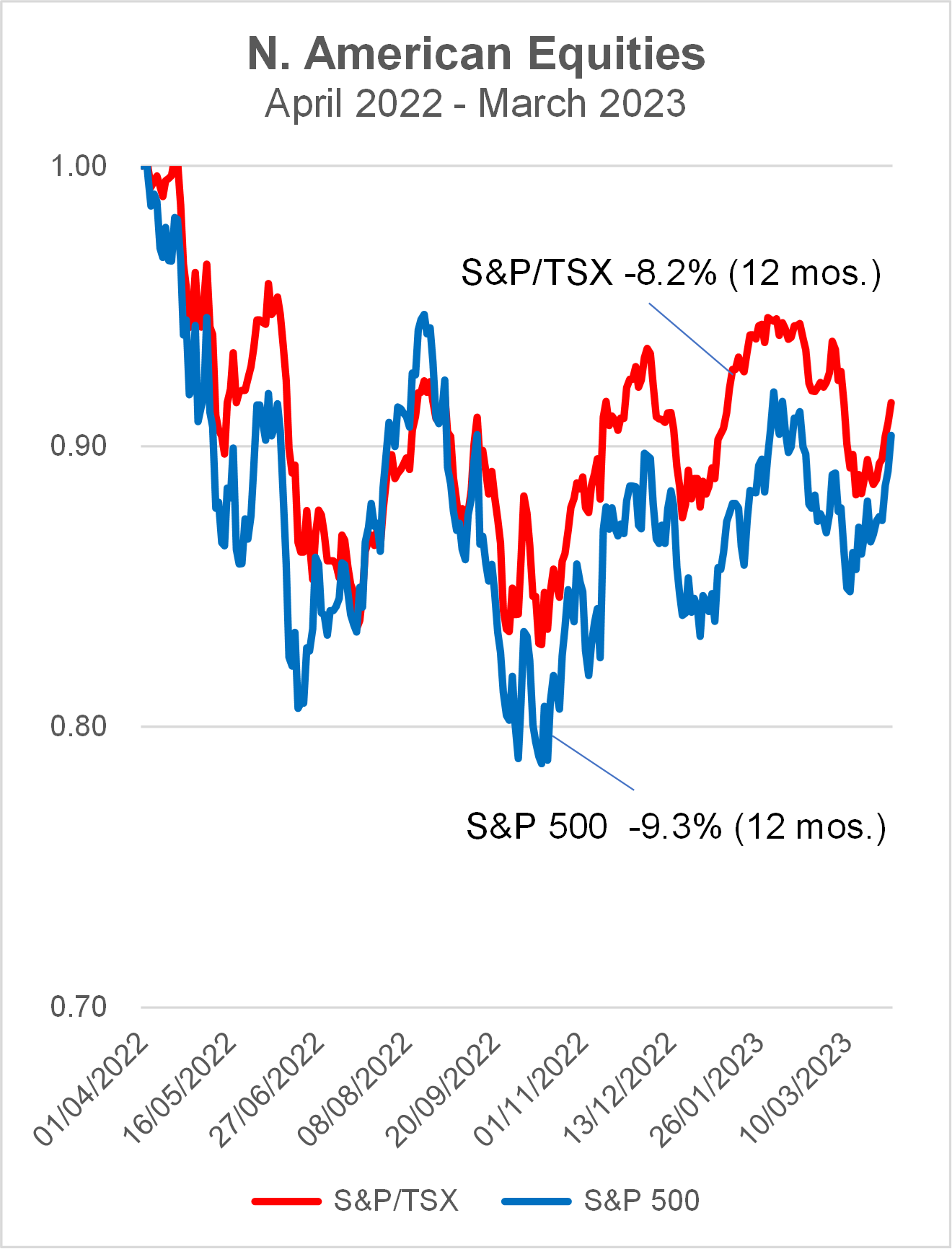

After a challenging 2022, the S&P 500 Index (S&P 500) finished the first quarter of 2023 up 7%. In Canada, the S&P/TSX Composite Index (TSX) gained 3.7% in the same period. The chart below shows the relative return of the S&P 500 and TSX for the 12-month period up to March 31, 2023.

Source: FactSet Mar 31, 2023

The chart shows the saw-tooth pattern of volatility in both the U.S. and Canadian equities, driven mostly by uncertainty in the direction of central bank interest rate policies. That in turn is dictated by whether inflation is under control. You can see in the following chart that inflation is heading down from its peak for both U.S. and Canada, although it’s still some way from the target of 2 percent.

Inflation has peaked

Source: RBC Wealth Management

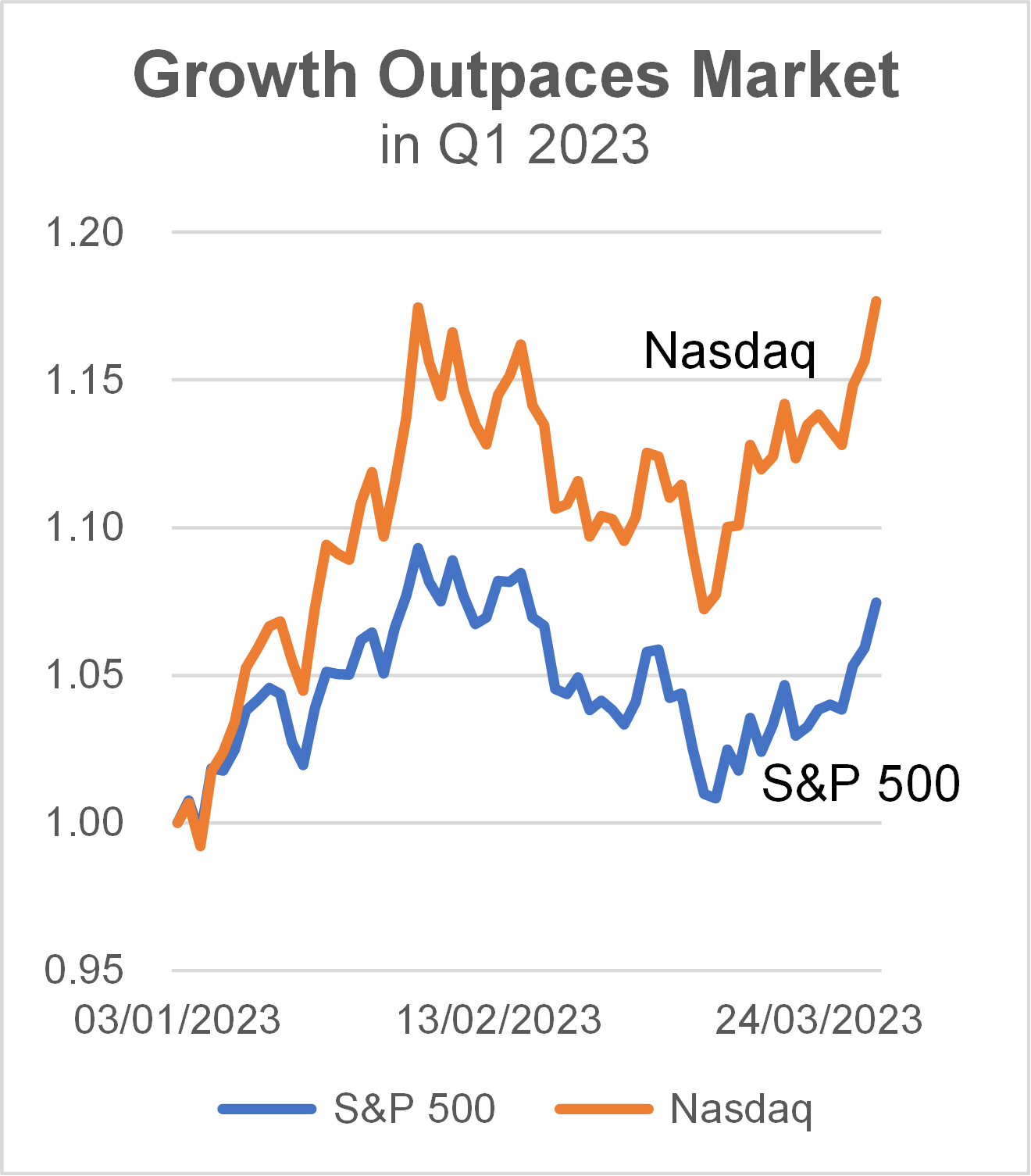

The most surprising result in the first quarter was to see the growth-oriented Nasdaq Composite Index outperform the S&P 500. When interest rates rise, high growth companies such as those in the technology field tend to lag the general market as in 2022.

Source: FactSet Mar 31, 2023

Recession Scorecard

The research team at RBC Wealth Management track seven indicators to determine the likelihood of an impending recession. The latest scorecard has three of the four pointing to a recession whereas four are still in expansion mode.

Yield curve inverted

If you are a bond investor you would expect to earn a higher yield from a 10-year bond than from a one-year bond. At the time of writing a 10-year U.S. government bond yielded 3.4% whereas a one-year bond yielded 4.7%. This is known as an inverted yield curve, and for the past 75 years, such a condition always preceded a recession in the U.S.

Conference Board Leading Economic Index (LEI)

This index, which is a reliable early warning indicator of a recession, turned negative in Q3 2022.This suggests we may have a recession in the U.S. sometime in 2023.

Purchasing Managers’ Index

This is a monthly survey of over 400 manufacturing companies in the U.S. to gauge the health of the business sector. An index above 50 indicates expansion whereas below 50 signals contraction. The index declined steadily in 2022 and dropped below 50 in Q4 2022. However, manufacturing accounts for only 15% of the U.S. economy.

Unemployment remains low

In January the unemployment rate in the U.S. was 3.4%, the lowest since 1969. If this figure starts to move higher, then it may mean that a recession is on its way. In the meantime, we see a strong labour market.

Looking at the aggregate

“Weighing up the current positioning of all seven indicators and projecting their likely paths over the next couple of quarters continue to point to a growing probability the U.S. will enter recession late in the first half or in Q3 of 2023,” according to Global Insight Monthly from RBC Wealth Management, April 2023.

Focus on Bonds

Reset Asset Allocation

One of first things I would do to prepare your portfolio to weather a recession is to make sure the asset allocation is aligned with your objectives and risk tolerance. The allocation tends to shift away from its target after a period of volatility. Or after a rally in equities, your bond allocation may be below target.

Attractive yields

Since the financial crisis of 2008-2009 the bellwether U.S. 10-year Treasury note yield had been either side of the 2% mark. At the beginning of the Covid-19 pandemic the yield dropped to close to 0.5%. After over a decade of low interest rates, the 10-year yield is now 3.4% having been as high as 4%. Corporate bond yields are even higher. If you have been used to disappointing returns on bonds in the past, they are looking more attractive now.

Why own bonds

The three main reasons for owning bonds are for diversification from equity risk, regular income and capital preservation. Having an appropriate portion of your portfolio dedicated to bonds will allow you to sleep at night.

Outlook for bonds

Last year was a rare instance where bonds declined in sync with equities, with increase in interest rates as the main culprit. The silver lining is that after the correction, bond yields are now in healthy territory (see “attractive yields” above). In the previous column we presented the case that we may have to face a recession. In the past, central banks would cut interest rates during a recession in order boost the economy. When that happens bond yields will fall. Since bond prices move up when yields decline, we may see price gains as part of the return in bonds.

While I would never advocate timing the market, but having a slight overweight to bonds at this time may be a way to hedge your bet in case of further volatility in the equities markets.

Shiuman’s Corner

Lost for words – Wordle

My daily ritual

After poring over various newspapers from north America, the UK and Hong Kong and checking emails, it’s time for a cup of tea and my daily brain twister. I never had the smarts or patience to solve cryptic crossword puzzles. Sudoku is manageable on Mondays and Tuesdays but they get harder as the week progresses. Wordle is the perfect word game for my money. It was developed by Josh Wardle, and later acquired by the New York Times. You have to guess what the word-of-the-day is, consisting of five letters. On a very good day I can solve it in two attempts within a minute or two. On average I take four tries, while once or twice I failed to solve it even after my sixth go; that counts as a “fail”, and I would lose my “streak”. The game is addictive in the sense that it draws you back every day, but you cannot work on one after another non-stop because it is limited to once a day. After each attempt, which must be a real word, the program light up each letter as green (correct letter and position), yellow (correct letter only) or grey (not part of the word). There are, in theory, over 13,000 words in the English language that comprise five letters, although only 2,300 are in common use. Occasionally I may have to look up the meaning of the word after I solve it. The program allows players to share their result without revealing the word, a great way to brag. My wife, daughter and I have a daily challenge amongst ourselves. It is all about the BOAST.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.