Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

To read my latest 2023 Q1 Smart Investor newsletter (What 2023 Holds, How to Invest, my list of books from last year), and catch up on back issues, go to my website.

Markets

Market scorecard as of close on Friday February 3rd, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 20,758 | 0.2% | 7.1% |

| U.S. | S&P 500 | 4,136 | 1.6% | 7.7% |

| U.S. | NASDAQ | 12,007 | 3.3% | 14.7% |

| Europe/Asia | MSCI EAFE | 2,119 | 0.5% | 9.0% |

Source: Bloomberg, RBC Wealth Management

-

TSX finished slightly higher Friday, settling in around unchanged after giving back some midday strength. Canadian equities ended the week with 0.2% weekly gain, higher for a fifth straight week and now up over 7% on the year.

-

US equities were lower in Friday trading. The market reversed early weakness through midday though slid back down to finish just off worst levels. However, S&P and Nasdaq both still higher for the week (Nasdaq for the fifth-straight week).

-

While “Fed Week” and earnings season are typically volatile periods for equities, investors cheered the combination of a slower pace of interest rate increases and earnings releases that were less bad than feared.

Economy

Canada

-

The Canadian economy remains on a slowing path as a result of the Bank of Canada’s (BoC) interest rate hikes over the past year in response to excessive inflation. Real gross domestic product rose 0.1% m/m in November, according to figures published on Tuesday by Statistics Canada.

-

There is, however, a clear loss of growth momentum towards the end of 2022. The latest estimates imply the economy grew at an annualized rate of 1.6% in Q4 2022. This is nearly half the growth seen in Q2 and Q3 2022, which came in at 3.2% and 2.9%, respectively.

U.S.

-

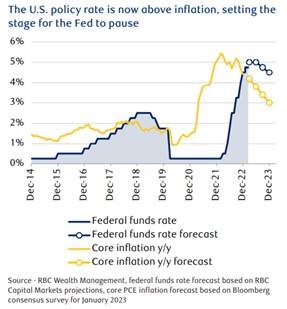

The Federal Reserve had another downshift in the pace of rate hikes, with an increase of 25 basis points (bps) bringing U.S. interest rates to a target range of 4.50 percent to 4.75 percent.

-

At his post-meeting press conference, Fed Chair Jerome Powell noted early signs that “disinflationary pressures” are beginning to take hold; in our view, this could lay the foundation for the Fed to begin lowering its inflation forecasts when policymakers next update their economic projections at the March meeting—and, as a result, its rate hike forecasts as well.

-

Many software workers had less to cheer in January as the Tech sector continued to cut costs against a slowing demand environment. RBC Capital Markets, LLC Software Analyst Rishi Jaluria noted 33 publicly traded software companies had announced workforce reductions over the past four months, mostly in January. The most common figure was 10% of the workforce across a range of small to large companies.

Further Afield

-

Spending by China residents in categories such as catering, tourism, and other in-person businesses recorded big jumps over the Chinese New Year holiday. Data also show residents were more willing to travel and spend money following the end of strong zero-COVID restrictions.

Notes About Companies in Model Portfolio

-

The week started with about one-third of the S&P 500 by market cap having reported Q4 2022 earnings, and will end with another one-third’s results in the books as the tech giants report. Results have generally beaten expectations, and by midweek the quarter was on track to post aggregate revenue growth of 4% y/y and earnings declines of 4% as higher costs impacted profit margins.

-

Apple (AAPL) reported December-quarter revenue of $117 billion was down 5% year over year with declines in iPhone (down 8%), Mac (down 29%), and wearables (down 8%), partially offset by growth in iPad (30%) and services (6%). Apple now enjoys over 935 million paid subscribers (up from 900 million last quarter), which we think bodes well for continued services growth as the firm increasingly monetizes its valuable installed base.

-

-

Results highlighted a rare earnings miss for the company, led by a plethora of headwinds, including FX pressures (~800 bps y/y), supply constraints from COVID-19 lock downs in China, as well as broader macro challenges, such as inflation, conflict in Eastern Europe, etc.

-

-

Brookfield Infrastructure Partners L.P. (BIP.UN) announced its results for the fourth quarter ended December 31, 2022. Net income attributable to the partnership was $0.4 billion compared to $1.1 billion for the prior year. Funds From Operations (or FFO) of $2.1 billion for the year reflects a 20% increase compared to 2021. “Results benefited from organic growth for the year of 10%, capturing elevated inflation in the countries where we operate and volume growth across the majority of our critical infrastructure networks.” (company statement).

-

Johnson & Johnson (JNJ) The Federal Appeals Court ruled against JNJ’s structure to consolidate all of its outstanding talc claims (~40k) and transfer all liabilities into a separate legal entity, LTL Management, under the Chapter 11 bankruptcy process. This ruling, if upheld, will require JNJ to litigate talc claims on a state-by-state basis. JP Morgan estimates the potential impact to be $8 to $10 billion. Given JNJ’s overall size, every $5bn of potential liability payments only equals ~1% of JNJ’s market capitalization.

-

McDonald’s Corp. (MCD) reported 4Q 2022 revenues of $5.93 billion and earnings per share (EPS) of $2.59, which beat estimates for both Company and Franchise. Global comparable sales grew 13% year-over-year on strength across all segments. For FY 2023 outlook, MCD expects net restaurant unit expansion (400 in Operated markets and 1500 in Developmental Licensed) to contribute 1.5% of sales growth and operating margin ~45%.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman