Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

Markets

Market scorecard as of close on Friday October 21, 2022.

| Equity Indices | Level | 1 week | YTD |

| S&P/TSX Composite | 18,861 | 2.9% | -11.1% |

| S&P 500 | 3,753 | 4.7% | -21.3% |

| NASDAQ | 10,860 | 5.2% | -30.6% |

| Euro Stoxx 50 | 3,477 | 2.8% | -19.1% |

| Hang Seng | 16,211 | -2.3% | -30.7% |

Source: Bloomberg, RBC Wealth Management

-

TSX ended sharply higher in Friday afternoon trading, near best levels. All sectors higher, materials, health care, energy, staples, industrials, consumer discretionary and financial the outsized leaders with communication services the laggard. Canadian equities recorded a 2.9% weekly gain despite a two-day pullback following the big Monday/Tuesday rally.

-

US equities finished higher in Friday trading, ending near best levels. Major indices logged big weekly gains, with Friday's performance added to a notable Monday/Tuesday rally. Industrial/precious metals, chemicals, vaccines, insurers, airlines, energy, banks, retail, and streaming outperformed.

-

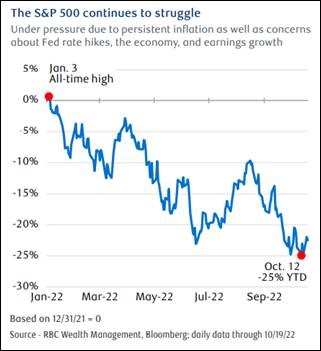

For the past two months the U.S. equity market has been battered by persistent inflation, the Fed’s aggressive rate hikes (and plans for more), the further spike in Treasury yields, and heightened expectations of recession and cuts in corporate earnings estimates. Instability in the UK has also weighed on the market lately.

-

Q3 earnings reports have been good thus far, especially among big banks and investment firms. Surrounding the previous 11 recession periods since the 1950s, S&P 500 earnings fell 23.6 percent, on average, from peak month to trough month, according to RBC Global Asset Management. Interestingly, during the four periods that were associated with inflation shocks, there was a lesser 17.7 percent average earnings decline.

Economy

Canada

-

The Canadian Consumer Price Index (CPI) rose 6.9% y/y in September, topping consensus expectations of 6.7%. In the latest CPI report, Statistics Canada said the slight deceleration from 7.0% inflation in August was mostly attributable to lower gasoline prices, which fell 7.4% m/m in September.

-

Following the elevated inflation readings for September, RBC Economics expects the Bank of Canada to raise the overnight rate by at least 50 basis points this week.

U.S.

-

Last week’s housing market data continued to disappoint as rising mortgage rates weighed on demand from prospective homebuyers across the country. Residential housing starts dropped 8.1% in September, while building permit applications for new single-family homes fell 3.1% to just above a two-year low.

-

October’s Empire State Manufacturing Survey showed a third consecutive month of contraction in business activity. According to the report by the Federal Reserve Bank of New York, about 36% of respondents expect general business conditions to worsen over the next six months.

Further Afield

-

Following a series of U-turns and missteps, UK Prime Minister Liz Truss announced her resignation after less than two months in office, making her tenure the shortest in UK history.

-

UK assets benefiting from confirmation that former chancellor Rishi Sunak to become prime minister after Boris Johnson and Penny Mordaunt withdrew from contest. Based on Sunak's comments during summer initial focus likely on stabilizing economy, tight fiscal policy and winning market confidence back.

-

The 20th National Congress of the Chinese Communist Party (Party Congress) kicked off on Oct. 16. President Xi Jinping delivered a speech at the opening ceremony that reviewed the party’s work in the last five years and set the future policy agenda. We think the speech shows policy continuity as the development focus going forward remains on high-end technology, new energy, and domestic consumption, etc.

Notes About Companies in Model Portfolio

-

Apple (AAPL) Unveiled a completely redesigned iPad featuring a large 10.9-inch Liquid Retina display, the powerful A14 Bionic chip, advanced cameras, fast wireless connectivity, USB-C, support for the new Magic Keyboard Folio.

-

Apple also announced the next generation of Apple TV® 4K. Driven by the A15 Bionic chip that delivers faster performance and more fluid gameplay.

-

-

Berkshire Hathaway Inc. (BRK.B) and Alleghany Corporation announced the completion of Berkshire Hathaway’s acquisition of Alleghany. Holders of Alleghany common stock as of immediately prior to the closing of the transaction are entitled to receive $848.02 per share in cash, representing a total equity value of approximately $11.6 billion. Alleghany Corporation owns operating subsidiaries and manages investments, anchored by a core position in property and casualty reinsurance and insurance. Upon the closing of the transaction, Alleghany became a wholly-owned subsidiary of Berkshire Hathaway.

-

Johnson & Johnson (JNJ) reported Q3 2022 results on Tuesday with sales growth of 1.9% to $23.8 billion with operational growth of 8.1%* and adjusted operational growth of 8.2%*. Earnings per share (EPS) of $1.68 increasing 22.6% and adjusted EPS of $2.55 decreasing by 1.9%*

-

The Procter & Gamble Company (PG) reported first quarter fiscal year 2023 net sales of $20.6 billion, an increase of one percent versus the prior year. Diluted net earnings per share were $1.57, a decrease of two percent versus prior year EPS

-

Very busy week ahead with 165 S&P 500 companies reporting (nearly 45% of S&P 500 earnings on tap for this week), including all the Big Tech names.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman