Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

Markets

Market scorecard as of close on Friday August 19, 2022.

| Equity Indices | Level | 1 week | YTD |

| S&P/TSX Composite | 20,111 | -0.3% | -5.2% |

| S&P 500 | 4,228 | -1.2% | -11.3% |

| NASDAQ | 12,705 | -2.6% | -18.8% |

| Euro Stoxx 50 | 3,730 | -1.2% | -13.2% |

| Hang Seng | 19,773 | -2.0% | -15.5% |

Source: Bloomberg, RBC Wealth Management

-

TSX finished lower in Friday afternoon trading, near worst levels. Most sectors lower, tech, health care, materials, real estate and financial the laggards with utilities and communication services the leaders. Canadian equities fell 0.3% on a weekly basis.

-

While over 90% of companies in the S&P/TSX Composite have reported earnings, investors will likely assess the strength of the Canadian economy when the banks begin reporting Q3 2022 earnings this week.

-

US equities closed lower in very quiet Friday trading, ending just off worst levels. Major indexes finished lower on the week and S&P snapped a four-week winning streak. The week ended on a risk-off tone with another very hot inflation print out of Europe keeping some upward pressure on bond yields. Renewed dollar strength was another overhang.

-

Markets will be monitoring developments in Jackson Hole this week, as policymakers from around the world make their way to the Fed’s annual symposium.

Some thoughts on the stock market

(Excerpted from Global Weekly Insight by the Global Portfolio Advisory Committee, RBC Wealth Management. August 18, 2022)

-

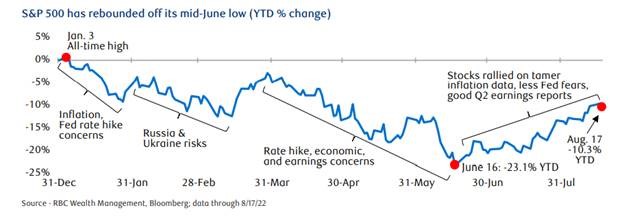

After the S&P 500 reached a low point on June 16, closing down 23.1 percent year to date, the market rallied notably, regaining much of that lost ground. The S&P 500 ended Friday’s session down “only” 11.3 percent.

-

These positive signals are encouraging, but now is not the time to become complacent, in our view. The inflation battle has not yet been won. Economic data seem vulnerable to further slowing and a formal, broad-based recession is not out of the question.

-

Some technical indicators are flashing positive signals. In the post-WWII era, when the S&P 500 recovered 50 percent of its bear market losses (like it has recently), the market did not subsequently trade down to a new lower low during the cycle, according to CFRA Research.

Economy

Canada

-

StatCan published retail sales increased 1.1% beating the 0.3% forecast, core retail sales edged up 0.2%. The agency estimated sales decreased 2.0% in July. RMPI fell 7.4% m/m and was 19.1% higher compared with July 2021. BoC widely expected to hike by at least 50 bp at the 7-Sep meeting, with market pricing in roughly even odds of a 75 bp move. CFIB published a report that showed small businesses are struggling even if they have gone back to normal levels due to higher costs.

-

Canadian CPI growth has likely peaked in Q2, according to RBC Economics. Inflation was at 7.6% y/y in July, abating from an 8.1% reading in the previous month.

U.S.

-

The minutes of Wednesday’s Federal Open Market Committee meeting showed that policymakers aren’t quite as hawkish as they were over the past few months. The language suggests the Fed may begin dialing back the pace of interest rate hikes going forward. While a third consecutive 75 basis point (bps) rate increase remains on the table for September, we believe a smaller 50 bps hike is more likely based on signs that inflation may be easing and policymakers are considering the potential risks of overtightening.

Further Afield

-

UK inflation rose to 10.1% y/y in July, from 9.4% y/y in June, outpacing the expectations of the Bank of England (BoE) and economists in a Bloomberg survey, and marking the first double-digit reading in 40 years.

-

China’s latest economic data were weaker than expected. Retail sales, industrial production, and fixed asset investment data for July missed analysts’ expectations and marked a slowdown from June.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman