Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

Markets

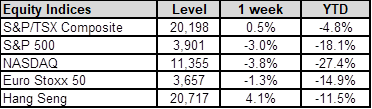

Market scorecard as of close on Friday May 20, 2022.

Source: Bloomberg, RBC Wealth Management

-

Strong bouts of equity market volatility usually don’t disappear overnight, and the current multi-month swoon is proving this to be the case once again.

-

While equity indexes attempted to stabilize early in the week, on Wednesday the S&P 500 and Dow Jones Industrial Average traded down 4.0 percent and 3.6 percent, respectively, the biggest single-session declines since Q2 2020 during the acute COVID-19 period.

-

High inflation, ongoing supply chain problems, and concerns about economic growth—along with wariness about the Fed’s ability to effectively right the ship—continue to weigh on the market.

-

The S&P/TSX Composite Index continues to hold its own relative to global developed peers due to robust commodity prices and the Energy and Materials sectors accounting for nearly one-third of the index.

-

With the Q1 earnings season just about finished, the S&P 500 has delivered much stronger earnings per share growth compared to the consensus forecast before reporting began (11.8 percent versus 4.7 percent) and higher revenue growth (13.8 percent versus 10.8 percent) on a year-over-year basis.

-

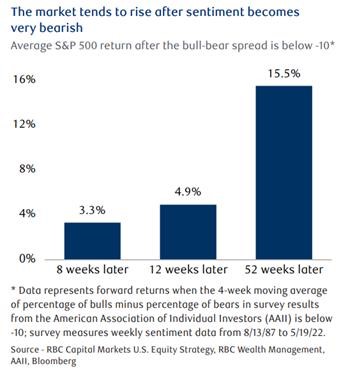

To us, the very gloomy attitudes about the market signal that even if volatility persists and there is additional downside in the near term, if history is a guide, the market has the potential to upend the majority’s expectations and deliver worthwhile gains within 12 months from now. This is one of the reasons we think long-term investors should stay the course.

Economy

Canada

-

The Canadian headline inflation rate reached 6.8% y/y in April, modestly ahead of the 6.7% consensus projection. It appears the primary culprits were strong contributions from the shelter and food categories which advanced 7.4% and 8.8% y/y, respectively. We believe this will ultimately strengthen the Bank of Canada’s position to increase its overnight rate at the June 1 meeting.

-

Geopolitics, scarcity, and demand have been placing pressure on Canadian oil producers to increase output. Given the disruptions throughout the global energy market brought on by the war in Ukraine and the furry of economic sanctions that followed, energy scarcity has become a growing driver of inflationary pressure throughout much of the global economy. U.S. and Canadian diplomatic channels have begun to search for alternative sources of fossil fuels to increase domestic and European energy supply.

U.S.

-

Changing Fed expectations do not appear to be the primary driver of the most recent price volatility; instead, investors appear to be struggling to determine how the combination of tighter policy and high inflation will affect the U.S. consumer and growth more generally. We expect government bond volatility to remain elevated in the near term.

Further Afield

-

UK consumer prices accelerated 9% y/y in April, the highest level of inflation in 40 years, mostly due to an increase in the household energy cap (which sets price hikes for domestic gas and electricity) and escalating food prices. RBC Capital Markets expects UK inflation to peak in Q2.

-

The European Central Bank’s (ECB) hawkish cohort is gaining momentum as there is now broad agreement that negative interest rates should end “relatively quickly.” Furthermore, one of the most hawkish members of the ECB’s rate-setting body also stated that “an interest rate hike would be possible already during the month of July.” Markets have now fully priced in a 25 bps hike at the July meeting.

-

The Shanghai lockdown has put significant pressure on China’s April macroeconomic data, with credit growth, industrial production, and retail sales coming in far below consensus estimates. In response to the weak data, Premier Li Keqiang has asked local governments to act decisively and launch measures to support growth as soon as possible. Although we don’t expect a change to China’s zero-COVID policy in the near term, we note the booster shot vaccination rate has increased to above 60% for people above 60 years of age, from only 50% in April.

Notes About Companies in Model Portfolio

-

Brookfield (BAM.A) Reported first quarter 2022 results. Funds from operations (“FFO”) and net income totaled $1.6 billion and $3.0 billion for the first quarter. Total operating FFO increased by 43% to $1.1 billion compared to the prior year quarter, driven by the growth in asset management earnings, contributions from new acquisitions and the benefit of an increased ownership in our real estate business that we privatized last year.

-

Canadian Apartment Properties Real Estate Investment Trust (CAR.UN) announced continuing strong operating and financial results for the three months ended March 31, 2022. Consistent with prior periods, CAPREIT has maintained a very high level of rent collection, with over 99% of rents collected year to date. CAPREIT's financial position remains strong, with $228.9 million of available liquidity on CAPREIT's Acquisition and Operating Facility.

-

Walt Disney Company (DIS) Reported Second Quarter and Six Months Earnings for Fiscal 2022. Revenues for the quarter and six months grew 23% and 29%, respectively, despite a $1.0 billion reduction for the amount due to a customer to early terminate license agreements for film and television content delivered in previous years in order for the Company to use the content primarily on direct-to-consumer services. Earnings per share from continuing operations for the six months ended April 2, 2022 increased to $0.89 from $0.52 in the prior-year period.

-

Fortis Inc. (FTS), a well-diversified leader in the North American regulated electric and gas utility industry, released its first quarter results and announced a 2050 net-zero target. Adjusted net earnings of $0.78 per common share, up from $0.77 in the first quarter of 2021.

-

Intact Financial Corporation (IFC) reported Q1-2022 results. Net operating income per share increased 13% to $2.70, driven by accretion from RSA and growth in distribution income. Earnings per share (EPS) of $2.53 in the quarter reflected solid operating results but declined from the prior-year period, which included a large investment gain.

-

TELUS Corporation (T) released its unaudited results for the first quarter of 2022. Consolidated operating revenues and other income increased by 6.4 per cent over the same period a year ago to approximately $4.3 billion. This growth was driven by higher service revenues in two reportable segments: TELUS technology solutions (TTech) and Digitally-led customer experiences – TELUS International segment (DLCX).

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman