Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

Markets

Market scorecard as of close on Friday April 1, 2022.

| Equity Indices | Level | 1 week | YTD | 52-week |

| S&P/TSX Composite | 21,953 | -0.2% | 3.4% | 15.6% |

| S&P 500 | 4,546 | 0.1% | -4.6% | 13.1% |

| NASDAQ | 14,261 | 0.7% | -8.8% | 5.8% |

| Euro Stoxx 50 | 3,919 | 1.3% | -8.8% | 12.4% |

| Hang Seng | 22,040 | 1.6% | -5.8% | -22.2% |

Source: Bloomberg, RBC Wealth Management

-

TSX finished higher Friday in first day of Q2 trading, just off best levels. Sectors mixed, materials, energy and communication services the leaders with industrials, staples and health care the laggards. Canadian equities logged a modest weekly decline, but TSX still up ~3.5% for 2022 and Q1 marked widest quarterly outperformance vs S&P 500 in 13 years.

-

US equities finished higher in Friday trading, ending near best levels after a late-session surge. Nevertheless, major indices made no definitive move far beyond the unchanged mark. Energy, China tech, homebuilders, insurance, precious metals, HPCs, food were among the stronger groups. Transports, machinery, banks, semis, tech hardware, software, apparel, casual diners, were areas of weakness. Treasuries were mixed with short end coming under pressure and curve notably flattening; 2Y/10Y and 5Y/30Y spreads both finished well into negative territory.

-

WTI crude settled down 1.0% in choppy trading, down more than 10% on the week finishing below $100/barrel. Canadian dollar edged lower against USD (U.S. $1.00= $1.25 Canadian).

Update on Russia-Ukraine War

-

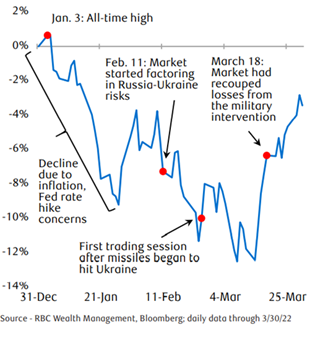

Equity markets have continued to stabilize of late, regaining the lost ground that occurred a few weeks ago just before and during the early phase of Russia’s military intervention in Ukraine. Barring escalation that would involve NATO countries, markets seem to have largely absorbed the military phase of the Russia-Ukraine crisis, as the S&P 500’s behavior has been similar to previous military conflicts and other geopolitical events (see chart below).

-

Commodity and equity markets will likely have to contend with a longer period of uncertainty about inflationary and supply chain shocks associated with anti-Russia sanctions. In addition, keep in mind that Russia has barely begun to roll out its counter-sanctions. “No rubles, no gas” was its first major announcement in this regard.

-

We think energy, metal, and agriculture commodities will continue to be priced with a “sanctions premium” (also called a “geopolitical risk premium”)—higher than they would have been had the Ukraine crisis not occurred—and this will exert pressure on global inflation, supply chains, and economic growth for at least the time being.

-

The silver lining is that the U.S. and Canadian economies are better equipped to handle these risks than European economies. The U.S. and Canada, especially in combination, are much more self-sufficient due to natural resource abundance, and they have fewer direct and indirect ties to the Russian economy.

Economy

Canada

-

A speech by BoC Deputy Governor Sharon Kozicki, indicated that the central bank is prepared to act “forcefully” in order to return inflation to target levels, with the pace and magnitude of future hikes likely to be a focus of deliberations by the BoC’s Governing Council when it convenes ahead of April’s meeting. Having priced in almost two percentage points of additional rate increases over the balance of this year, the bond market is expecting the BoC to deliver one of the most aggressive tightening cycles in recent decades.

-

Throughout H1 2021, the Canadian dollar steadily gained against the U.S. dollar with the support of very favorable short-term rate differentials as Canadian rates rose significantly above their U.S. counterparts. While the influence of interest rates has decreased in recent months, the surge in oil prices has allowed the loonie to maintain its lofty exchange rate against the USD.

U.S.

-

The U.S. Treasury yield curve has continued to flatten, with parts of it inverting as investors price in an aggressive rate-hiking plan by the Federal Reserve as it attempts to bring inflation down from 40-year highs. On Tuesday, we saw the spread between the yields on the 2-year and 10-year U.S. Treasury bills briefly invert for the first time since 2019.

-

While we believe the flattening yield curve is worth keeping an eye on, we note that the spread between the 1-year and 10-year yields, which the Global Portfolio Advisory Committee monitors as part of its U.S. recession scorecard, has not inverted. This leads us to believe recession speculation is likely premature, and we would take a wait-and-see approach before writing off the current expansion.

Further Afield

-

Eurozone economic sentiment retreated in March, with consumer confidence suffering the largest drop. Manufacturing business sentiment also declined, though to a lesser extent, and mostly due to supply chain disruption. By contrast, services sentiment improved, benefiting from the relaxation of COVID-19 restrictions. These indicators may well deteriorate in the coming months due to the impact of the Russia-Ukraine war and its proximity.

-

Unemployment in the euro area is lower than it has been in 40 years. European Central Bank President Christine Lagarde recently cited concerns around a tight labour market and potential wage growth effects.

-

Shanghai, home to the Chinese headquarters of many international companies and the country’s largest port, has imposed a two-phase lockdown to conduct a mass COVID-19 testing blitz. China’s zero-tolerance approach to COVID-19 is putting pressure on growth, even though authorities pledged strong support for the economy and markets via a slew of initiatives earlier this month.

Notes About Companies in Model Portfolio

-

RBC (RY) announced on Thursday its offer to acquire Brewin Dolphin. Brewin Dolphin is a multi-award winning, independently-owned wealth management firm, listed on the FTSE 250 and with assets under management (AUM) of £59 billion as at December 2021. Brewin Dolphin has a network of more than 30 offices and over 2,100 employees across the UK and Ireland.

-

Commenting on the acquisition, Doug Guzman, Group Head, RBC Wealth Management, RBC Insurance and RBC Investor & Treasury Services, said: "The UK is a key growth market for RBC, and Brewin Dolphin provides us with an exceptional platform to significantly transform our wealth management business in the region, giving RBC Wealth Management a # 3 market position in the UK and Ireland, in addition to being a market leader in Canada, with a growing position in the United States.”

-

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman