Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

Markets

Market scorecard as of close on Friday February 4, 2022.

| Equity Indices | Level | 1 week | YTD | 52-week |

| S&P/TSX Composite | 21,284 | 2.6% | 0.3% | 17.3% |

| S&P 500 | 4,518 | 1.9% | -5.2% | 15.8% |

| NASDAQ | 14,157 | 2.8% | -9.5% | 1.7% |

| Euro Stoxx 50 | 4,087 | -1.2% | -4.9% | 17.0% |

| Hang Seng | 24,573 | 4.3% | 5.0% | -16.2% |

Source: Bloomberg, RBC Wealth Management

-

TSX finished higher Friday, a bit off best levels. Most sectors higher, with health care and tech the big gainers, consumer staples, utilities and real estate the laggards. Canadian equities posted a 2.6% weekly gain, with the TSX back into the green on the year.

-

WTI crude settled up 2.3%, capping a seventh straight week of gains. Canadian dollar lower against USD after strong US jobs report vs weaker Canada print.

-

US equities were mostly higher in Friday trading, though finished off best levels. Major indices all posted solid weekly gains despite big tech-led selloff on Thursday. FANMAG group all higher, led by very strong Amazon performance (it reported stronger-than-expected Q4 results).

-

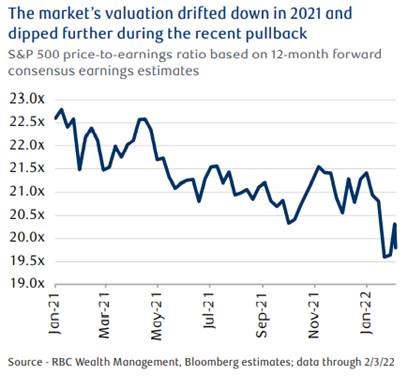

One silver lining to the rough January is that the air has come out of the U.S. market’s most expensive stocks. The good news is that the highest valuation stocks retreated the most—by far—during the recent pullback. In the S&P 500, low P/E stocks pulled back only two percent while high P/E stocks corrected by 13.6 percent in January. In other words, the reduction in the market’s valuation has primarily come from the right places—the most expensive stocks. We view this as healthy.

Economy

Canada

-

Canada’s GDP grew 0.6% m/m in November, according to Statistics Canada, exceeding the consensus forecast of 0.4%. The economy was firing on almost all cylinders in November with 17 of 20 industries expanding relative to the prior month. Service-producing sectors continued to benefit from the economic reopening, boosted by a rebound in restaurant activity and increased attendance at major league sporting events.

-

November’s stronger-than-expected GDP report further reinforces the central bank’s decision to begin raising rates in the coming months.

U.S.

-

Economic activity has been mixed this week. The ADP Employment Change numbers showed a significant and unexpected drop, with private payrolls falling by 301,000 for January versus Bloomberg’s estimated gain of 180,000. This was the first reported net job loss since December 2020 and came as surging omicron cases hit hiring.

-

On the positive side, the Institute for Supply Management Manufacturing and Services Purchasing Managers’ Indexes registered 57.6 and 59.9, respectively, both beating consensus expectations and indicating a continued and robust expansion of the manufacturing and services segments of the economy compared to last month.

Further Afield

-

The Bank of England (BoE) made a historic decision and delivered the first back-to-back interest rate increases since 2004. The BoE raised interest rates by 0.25%, as expected by the market, while the central bank will cease bond reinvestments and plans to fully unwind its stock of corporate bonds.

-

China’s official manufacturing purchasing managers’ index (PMI) registered 50.1 in January, down from 50.3 in December. The official results contrasted with those from a private survey of mostly small manufacturers in coastal regions, which showed activity fell at the fastest rate in 23 months Key factors weighing on the manufacturing sectors were a resurgence of new COVID-19 cases and the associated tough lockdowns, a weakening housing market, and Beijing forcing high-polluting plants to shutter during the Olympics to improve air quality.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman