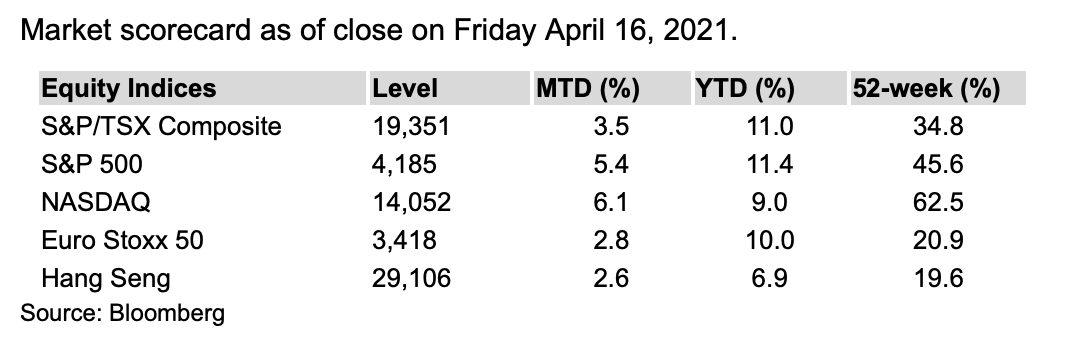

Markets

- It was relatively quiet over the weekend from a headline perspective. Earnings activity will pick up this week with 81 S&P 500 companies reporting. Meanwhile, investors are starting the week on a cautious note over concern that the rollout of COVID-19 vaccines continues to face setbacks. To date, roughly half of U.S. adults have now received at least one dose of the vaccine and about a third of Americans have been fully vaccinated.

- U.S. stocks were biased to the upside during the week. However, trading volumes were relatively light as investors prepared for the onslaught of Q1 2021 earnings season, which started in earnest on Apr. 14 with positive announcements by the major U.S. banks. Banks’ profits were boosted by the release of loan-loss reserves that had been built up in 2020 as a precaution against bad debts, which ultimately proved much less impactful than originally feared.

- The Technology sector, which had lagged the market in March, continued its rebound during the week. Shares of market bellwether Apple (AAPL), which accounts for 5.7% of the S&P 500 Index, reacted positively to news the firm plans a new product announcement on Apr. 20. Apple shares had been flat in 2021 after a strong close to 2020, due partly to a global microchip shortage. Investors cheered the prospect of new products coming out to meet pent-up post-COVID demand from global consumers.

- As we enter the Q1 reporting season, we believe company results should generally be a supportive factor for Pan-European equities in the weeks ahead, given global economic activity indicators, such as purchasing managers’ indexes, are robust and continuing to improve on the whole. Consensus is projecting earnings per share for the STOXX Europe 600 Index to be up almost 35% y/y, though this is clearly against a depressed comparative base period as we lap the onset of the pandemic. Notably, European earnings upgrades are outpacing downgrades by the most on record, according to a report from Bloomberg.

Economy

- U.S. economic data came in surprisingly strongly during the week. March retail sales were up 9.8% compared to February, and beat expectations of a 5.5% gain. Sales of motor vehicles, gasoline, and food all posted outsized increases. Gains were more dramatic on a year-over-year basis, with sales up nearly 28% compared to the lockdown low of March 2020. Initial claims for unemployment benefits fell sharply to 576,000 during the week.

- The Canadian economy added an impressive 303,000 jobs in March, as reported by Statistics Canada, triple what economists were expecting. The unemployment rate has now dropped to the lowest level since the pandemic started, despite an encouraging increase in the participation rate. The March report came after another very strong print in February, bringing the labour market to just 296,000 jobs below the pre-pandemic level.

- Markets will be looking forward to the Bank of Canada’s (BoC) Apr. 21 meeting, where updated guidance should be provided. For months, the data has shown an economy gaining strength, and market participants are expecting the BoC to announce that it will reduce the pace of its purchases of Government of Canada bonds, currently at around CA$4 billion per week.

- China’s economy grew at a record pace in in Q1. China’s economy surged 18.3% in Q1 from a year earlier, a record rate of growth that reflected the recovery from a deep coronavirus-induced trough in early 2020 and the continued momentum of the world’s second largest economy. The result was full-year GDP growth of 2.3%, making China the only major economy in the world to expand in a pandemic scarred 2020.

- The Fed continues to push back against the idea that rate hikes are anywhere on the horizon, with Fed Chair Jerome Powell stating this week that the conditions necessary for liftoff are highly unlikely before the end of 2022, let alone this year.

- Globally consumers stockpile $5.4T in savings and offer hope for post-COVID spending. Households around the world have stockpiled an excess of $5.4T of savings since the pandemic began compared with the 2019 spending pattern and equating to more than 6% of global GDP at the end of Q1 2021, according to estimates by credit rating agency Moody’s.

Feel free to contact me with any questions and/or to discuss investment ideas.