Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q4 2025 edition covers Market Review up to Q3 of 2025, the Artificial Intelligence (AI) boom and gold’s surge. Shiuman’s Corner is a about my cycling adventures for fund raising.

Markets

Market scorecard as of close on Friday October 31, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 30,261 | -0.3% | 22.4% |

| U.S. | S&P 500 | 6,840 | 0.7% | 16.3% |

| U.S. | NASDAQ | 23,725 | 2.2% | 22.9% |

| Europe/Asia | MSCI EAFE | 2,798 | -0.5% | 23.7% |

Source: FactSet

- TSX finished higher on Friday, bit off best levels. Most sectors higher. Canadian equities end the week off 0.3% and up 0.8% in October.

- US equities finished higher in Friday trading. S&P, DJIA, and Nasdaq logged gains for the week, with S&P notching its sixth straight monthly gain. Breadth was positive after three days negative. Big tech was mostly lower.

- The S&P 500 has continued to advance, reaching another new all-time high earlier in the week as the corporate earnings season has exceeded consensus expectations. With just over 50% of the market by capitalization having reported Q3 results so far, S&P 500 revenue growth is pacing at 7.3% y/y versus the 5.9% consensus forecast at the start of earnings season, according to Bloomberg data.

- With corporate earnings season off to a broadly positive start and central banks moving to support growth, the foundation for cautious optimism in equity markets appears to be intact. The combination of interest rate cuts and resilient earnings reinforces our view that maintaining an “invested but selective” stance remains appropriate.

Economy

Canada

- The Bank of Canada (BoC) delivered its fourth rate cut of 2025. The target for the overnight rate is now 2.25%, at the bottom end of its neutral range. Since reaching the 5% peak in 2023, the BoC has cut the policy rate by 275 basis points (bps).

- The BoC noted that tariff impacts are becoming more evident, dampening business sentiment and economic activity. These effects have continued to put pressure on business investment and hiring plans, particularly in trade-sensitive sectors such as autos, steel, aluminum, and lumber. As a result, the BoC expects GDP growth to remain weak in the second half of the year.

U.S.

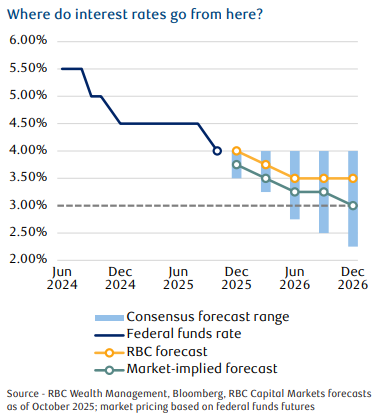

- Amid limited economic visibility caused by the ongoing government shutdown, the Federal Reserve opted to trim its benchmark rate by 0.25% last week. With many official reports unavailable, policymakers leaned on alternative data sources and commentary from the business sector to gauge inflation dynamics and consumer demand. While inflation remained above the Fed’s 2% goal, the softer-than-expected reading and steady underlying trends gave officials confidence to ease policy.

- Fed Chair Powell cautioned, however, that continued data disruptions could complicate future decisions. He noted that another rate cut in December “is not a foregone conclusion,” stressing the Fed’s need to balance “upside risks to inflation and downside risks to employment” amid an increasingly uncertain data environment.

- Further Afield

- The European Central Bank (ECB) stated that its policy continues to be “in a good place,” and the Governing Council unanimously decided to maintain the deposit rate at 2% on Thursday, Oct. 30. The central bank sees underlying inflation remaining consistent with the 2% target and “broadly unchanged.”

- The focus in Asia was very much on the first summit between the leaders of the world’s two biggest economies since Donald Trump’s return to the White House. The meeting between President Trump and Chinese President Xi Jinping yielded results that were mostly in line with market expectations, as the U.S. reduced fentanyl-related tariffs on Chinese goods, while Beijing will pause sweeping controls on rare earth magnets.

- The Bank of Japan (BoJ) kept rates unchanged at 0.50%, in line with market expectations, in what was the central bank’s first rate decision since Sanae Takaichi became Japan’s first female prime minster.

Notes About Companies in Model Portfolio

- Alphabet (GOOG) reported Q3 earnings with sales growing 16% to $102 billion and adjusted operating margins expanding 160 basis points to 34%. Google Cloud continues to fire on all cylinders, accelerating sequentially to 34% growth in the quarter, constituting 15% of total sales. Operating income grew 9.5% y/y to $31.2B, with margins at 30.5%.

- Apple (AAPL) reported Q4 2025 results. The Company posted quarterly revenue of $102.5 billion, up 8 percent year over year. Diluted earnings per share was $1.85, up 13 percent year over year on an adjusted basis. The company achieved a September quarter revenue record for iPhone and an all-time revenue record for Services.

- Berkshire Hathaway (BRK.A/BRK.B) released on Saturday Q3 and first nine months 2025 operating results. Operating earnings in the first nine months was $34.3 billion compared with $32.9 billion the year prior. Investment gains/losses for any particular period are not indicative of quarterly business performance. The company’s cash balance sits at $358 billion.

- CN Rail (CN) reported on Friday its financial and operating results for Q3 ended September 30, 2025. Revenues of C$4,165 million, an increase of C$55 million, or 1%. Operating income of C$1,606 million, an increase of $91 million, or 6%.

- Eli Lilly (LLY) reported Q3 2025 results. Revenues of $17.6 billion, up 54% year-over-year. Overall, LLY reported a very strong quarter with topline coming in >$1bn above consensus driven primarily by robust Mounjaro (GLP-1) growth internationally.

- Microsoft (MSFT) Q1 results easily topped the high end of guidance. Revenue increased 17% year over year in constant currency to $77.7 billion, compared with the high end of guidance of $75.8 billion, while operating margin was 48.9%, compared with the high end of guidance at 47.2%. Demand for Azure AI services is surging, which is a long-term positive. While Azure remains capacity-constrained, both traditional and AI workloads were strong. Azure growth was 39% in constant currency for the quarter and surpassed guidance of 37%.

- Visa (V) reported Tuesday Q4 and full-year 2025 results with net revenues of $40.0 billion, an increase of 11%, and net income of $20.1 billion an increase of 2%. Net revenues were driven by healthy consumer spending. Payment volume was up 8% and cross-border volume was up 13% for the year.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.