We are committed to transparency when it comes to compensation as we believe we provide excellent value for our services, which are all included in the portfolio management fee.

Our Value

-

Discretionary Portfolio Management:

A customized investment plan traded with a disciplined, discretionary methodology.

A MyGPS or more complex financial plan if required. Access to RBCs full wealth management team of lawyers, accountants, bankers and business specialists as needed.

-

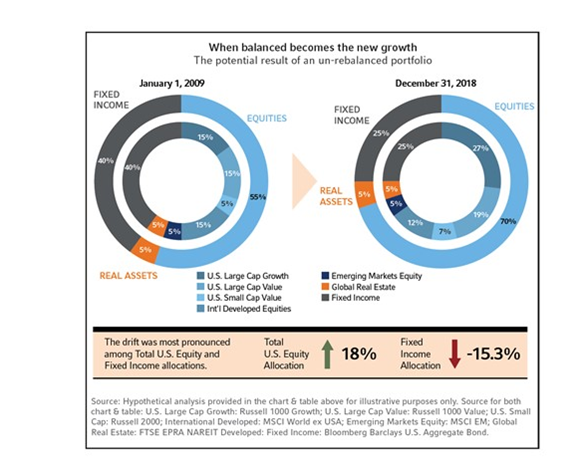

Quarterly Portfolio Rebalancing:

So that we buy low and sell high, keep the risk within your comfort level and smooth out the ride. Research shows that over the long term a disciplined rebalancing strategy enhances returns.

-

An Accountability Partner:

To keep you from making bad, emotional decisions during periods of market volatility. An objective voice of reason developed from years of experience in good, bad and ugly markets.

-

Tax Smart Planning & Investing:

Whether it be optimizing the tax efficiency of your portfolio, identifying tax saving vehicles and opportunities, or conducting annual tax loss harvesting in non-registered accounts, we try to minimize the amount of tax you pay.

Our Fees

Our fees for discretionary managed portfolios (called Private Investment Management (PIM) at RBC) are based on two, variable factors:

1. The total value of your investments in managed accounts

2. The allocation of your investments; that is, whether they are primarily equity or fixed income

You can see that based on these factors, the fees for service cannot be established until the investment plan is created – hence, it is not possible at the Discovery Meeting to give a precise answer to the question of compensation.

Fees are charged as a percentage of assets under management. This approach incentives me to grow your portfolio – the more you make, the more compensation we receive. Of course, the less you make, the less we make which is fair too. Note that there is a sliding scale of percentages fees – the greater the market value of assets under management, the lower the percentage fee.

The percentage charged by us is also based on the mix you have in each individual account and more specifically, the percentage of individual stocks in the account. If more than 25% of the account value (whether it is an RRSP, LIRA, Non-Registered, or Tax-Free Savings Account) is in individual company stocks then the percentage fee is established using the equity fee rate; if less than 25% of the account is in individual stocks then the fee is established using the fixed income rate. Percentage fees for accounts classified as equity accounts are higher than those classified as fixed income accounts because they are traded more frequently.

Once the individual percentage fees for each account are established, the overall total percentage fee for all accounts combined can be established using a weighted average of the percentage fees for each type of account.

Given this explanation of our compensation model, you can see that just as all the portfolios that we manage are customized, so are the fees. Fees paid cover portfolio management as well as all other wealth management services. Hopefully, this explanation is clear but during our initial meeting we will review this compensation model with you and then provide a range of likely annual fees to expect given your portfolio size and asset allocation.

Our fees are charged based on the end of the month balance in the account and paid quarterly from the account. Fees are shown on quarterly statements and you will receive a report in your annual tax package summarizing the total fees paid to us for portfolio management for your non-registered accounts. Fees for non-registered accounts are tax deductible while registered (i.e. RRSP, RIF, LIRA, LIF, TFSA) fees are not. Of course, although we manage and collect the fee, Whitehead Wealth Management only receives a portion of the fee paid with the remainder going to RBC Dominion Securities.