I know many people have the Coronavirus (or COVID-19 as it has now been named) very much in their daily thoughts. As investors it was especially on the top of your mind last week as you watched each successive day bring more negative numbers. In the final tally, the last week of February saw the worst weekly decline in US stock markets since 2008. The selloff was broad-based and touched all areas of the world. Plainly speaking, it wasn’t much fun.

I wanted to give a bit more perspective on the last week and how to properly view things as an investor, going forward. I will start by going back to 2018. It’s probably long forgotten, but if you look back, it was the first negative year for global equity markets in a long while. The US market fought off negative numbers until late September of that year when it finally dropped just over 10%. That drop was highlighted by an awful December.

2019, however, was great for your portfolio. It was almost the polar opposite of 2018 where we started with decent returns and they just accelerated in the last quarter. Nearly every asset class had really strong results in 2019.

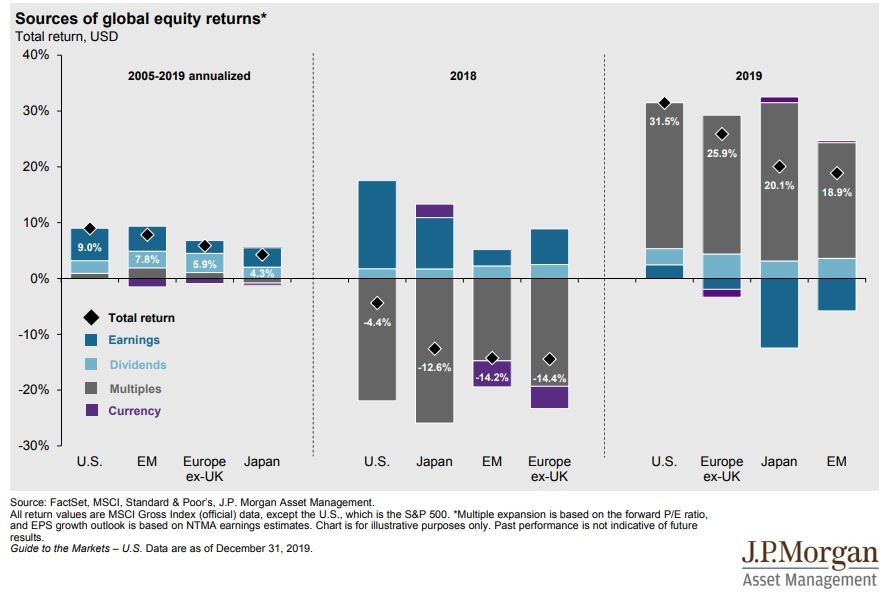

What caused such different results in consecutive years? This fantastic chart from the latest JP Morgan Guide to the Markets has done a pretty good job breaking it down for us. Let’s focus on the middle and right-hand portions which represent 2018 and 2019, respectively. In 2018, the earnings (dark blue) showed positive growth from the previous year, but the negative market return was driven almost entirely by multiples (grey). What are multiples you ask? Well that’s the price people are willing to pay for a dollar’s worth of earnings. It’s most commonly expressed as Price to Earnings or P/E Ratio. Now look further right and notice how 2019 earnings showed a more muted growth but it was those multiples that drove most of the return.

It seems strange when you think about it because you’ve been told that earnings and dividends MATTER. That’s not a lie but in any given year, it’s the price people are willing to pay for earnings and dividends that drive the trend in returns up or down. Investor sentiment matters over small time horizons.

Which brings us back to last week. In mid-February, we knew about COVID-19 and that it was very impactful in China. The market was weaker as the number of people impacted grew but it was relatively calm and orderly. What changed last week was the news that the disease had spread to Korea, Iran and Italy. Once it was obvious the disease had now spread beyond China, sentiment (the price people will pay for a dollar’s worth of earnings) dropped. It worsened when concerns of the virus coming to North America were brushed off in a haphazard manner even in the face of active cases in Toronto and Washington State.

That sentiment drop hit two ways. People sold their stocks that were the market’s favourites and then kept cash rather than buying anything new. Darlings from the end of 2019 were among some of the biggest drops last week. The second hit comes as we now start to make predictions on the economic impact of the spread of the disease around the world. A respiratory illness that is very contagious obviously could have an impact on the ability for workers to actually work. Going forward, this is going to be the hardest part of gauging how you should react. This is one of those three-body problems that I talked about not too long ago.

How should you react to COVID-19’s spread then? As an investor, wild sentiment changes will definitely have you questioning your tolerance for risk. If you find yourself worrying about the negative impact to your retirement your first step is to review your targeted allocation. After a big year in 2019, it is very likely you were over weighted in equity to begin with. Bonds are part of your portfolio exactly for weeks like the one that just happened. I know rates are low so they're not really a money-maker but they still have value in almost anyone’s portfolio to reduce volatility due to market sentiment.

The other thing you can do is to scroll back up and look at the left hand side of the JP Morgan chart. That’s the annualized source of returns for the past 13 years. Remember how sentiment drove returns up or down? Well over longer time horizons, it’s earnings and dividends that drove nearly all return. That’s how to look at your stock exposure. Has anything changed in the long term? Are we still going to make new products and grow our economies? Absolutely we will. It may not happen in 2020 because COVID-19 will have an impact, but much like SARS, MERS, H1N1 and the Avian Flu, we will find a way around this disease and if you can remain calm and patient you will be rewarded in the future.