If you opened your local newspaper/internet browser you saw headlines like:

Stock Selloff Spreads Around the World (source: wsj.com)

You probably felt an intense and sharp clenching somewhere in your stomach as you read further and saw that the Dow Jones Industrial Average dropped over 1000 points yesterday after a 600+ point drop on Friday. That clenching is a visceral response to losing something and it happens when your favourite sports team loses a big game or when your 2 year old son gets a little too close to the stairway and you are a little too far away.

We all remember the Financial Crisis when the world’s economy was like that unstable 2 year old venturing too close to the top of the stairs and that emotional pain is going to be with all of us for the rest of our investing lives. It will frame our reactions to any market correction when it happens {Narrator: Corrections will happen.}.

The emotional response to a “loss” is not going to leave us after the fact because avoiding loss is innate to our development as a species. Early man learned the best way to survive was to limit exposure to harm (i.e. wild cats, raging rivers, that menacing looking smoking mountain) and those that did not learn that lesson paid for it.

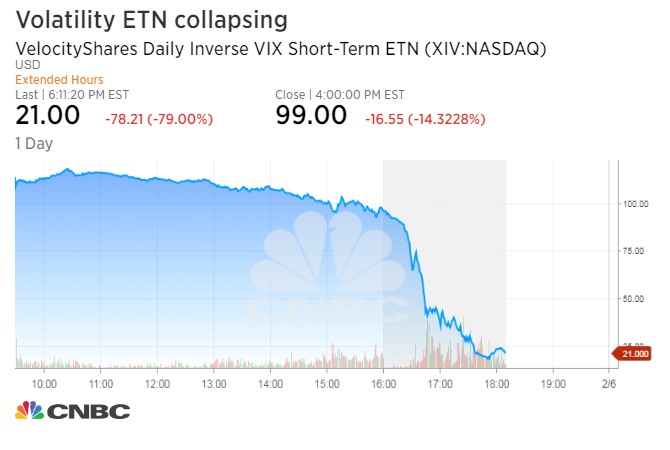

In modern times, life is typically much more comfortable so we don’t try to wrestle lions or jump into volcanoes. However, we do something far stranger in an effort to protect against risk/volatility- we buy Inverse Volatility Exchange Traded Notes like the XIV. The XIV is the VelocityShares Daily Inverse VIX Short-Term Exchange Traded Note which is designed to profit when the VIX Volatility Measure goes lower in a neat and orderly manner; which happened from December 2016 to January 2018. This was totally going to last forever! {Narrator: It did not last forever}

Here is what happened to the XIV after just TWO DAYS of normal market volatility (yes, this is normal)

(Source: https://www.cnbc.com/2018/02/05/xiv-exchange-traded-security-linked-to-volatility-plummets-80-percent.html -watch the video for a great explainer on the XIV)

This is cover-your-eyes awful as the product looks to have been completely wiped out overnight! Now remember, people were sold this for a bunch of different reasons but chiefly because they could make some income with stable markets. Which is a complete crock of s&%t reason in the long run. Markets are not stable because people make markets and we are emotional beings that make rash decisions. The XIV is just another example of financial products designed to give investors a false sense of security, to prey upon our visceral worry of another “Financial Crisis”. They always work great…until they don’t.

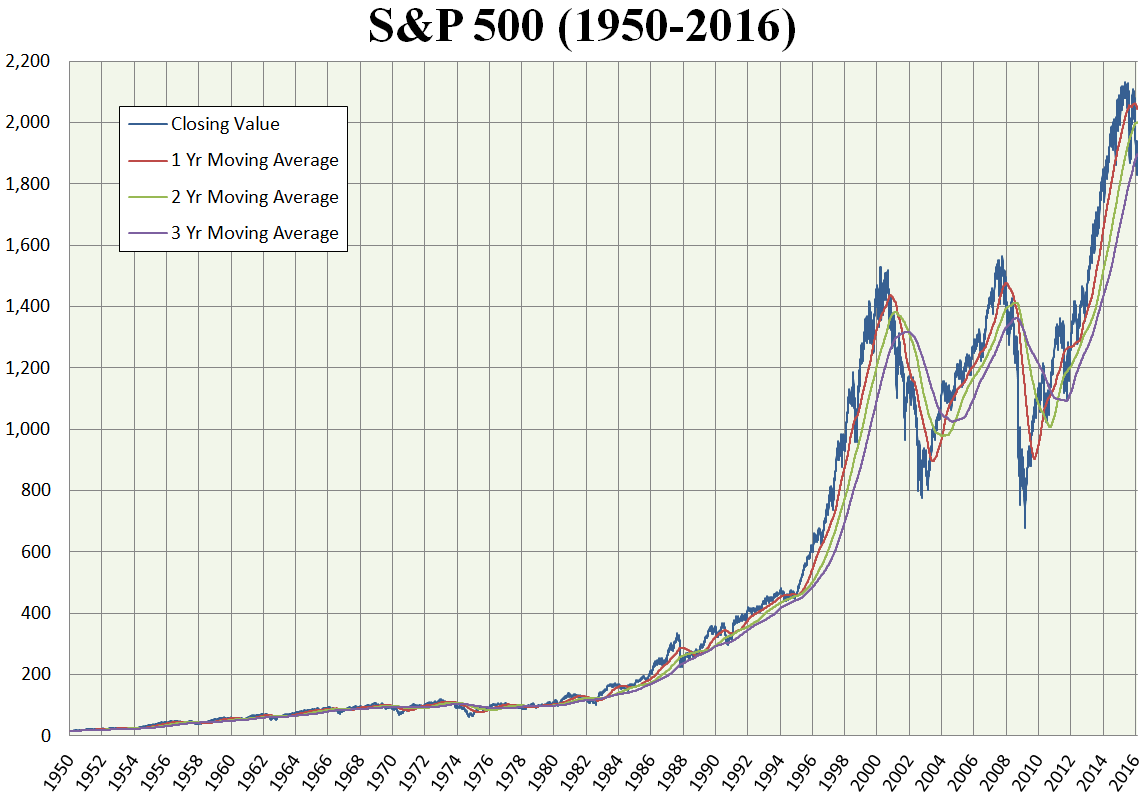

I will leave you with one last item. Almost all “investing” is long-term in nature. If you are needing money for a house or a vacation or something else in the next couple of years, you are actually “saving” and that money should always be very secure and easily accessible. Investing requires patience. Investing requires the mindset that volatility actually improves your long term performance. Investing will be hard and test your resolve but if you stick with it, it can be rewarding. (see below)