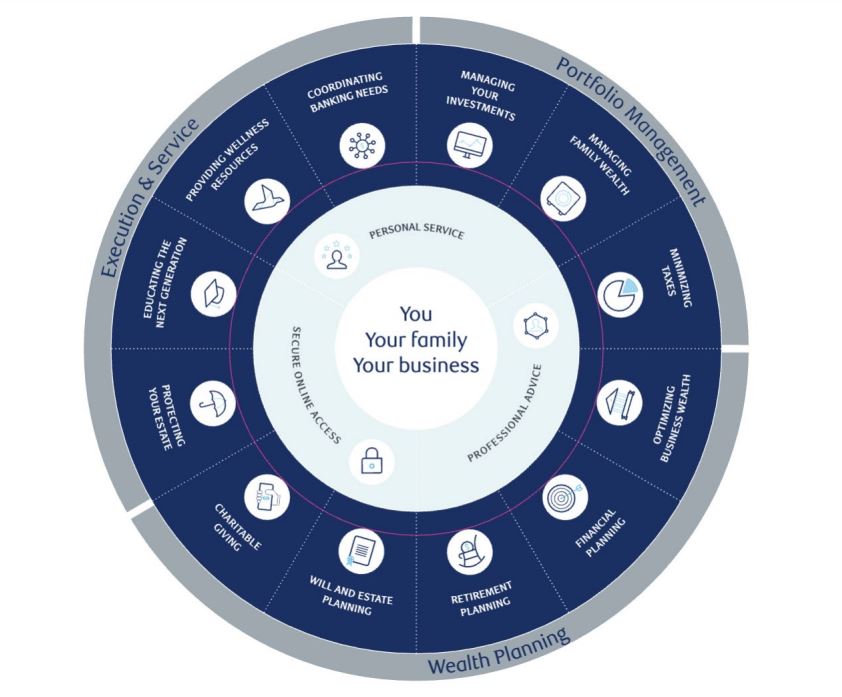

What does Wealth Management mean?

Your investment portfolio is just one key part of your wealth management plan. To help you meet your various goals, we take a comprehensive approach that extends beyond investing to encompass lifestyle protection, retirement planning, intergenerational wealth transfer and legacy creation. With the expert support of our industry-leading RBC Wealth Management Services team, we can help you address your specific financial, tax, retirement and legacy planning concerns.