Some people naturally have a more pessimistic perspective than others. Such individuals often expect things to go wrong, even when all seems to be going well. While a healthy dose of skepticism can keep one vigilant to negative outcomes, always expecting the worst can result in such risk aversion that opportunities are missed. Of course, at the other extreme is blind enthusiasm, which can result in excessive risk taking.

Presented with the same set of facts, individuals at either end of the spectrum may come to opposing conclusions. When it comes to investing, pessimists often seek out bearish points of view to confirm their nervousness, while optimists tend to lean on bullish commentaries to support their positive stock market outlooks. Either bias can cause one to turn a blind eye to data that disagrees with their perspective.

Consider the recent activity in financial markets. Stocks had a strong first quarter of 2024, with the S&P 500 and TSX indices gaining 10.2% and 5.8%, respectively. What makes these returns even more impressive was that they came on the heels of 13.7% and 11.0% gains, respectively, in the last two months of 2023. The resulting 25.3% move in the S&P 500 index was its strongest 5-month return since 2020, when stocks were recovering from the March 2020 Covid-related collapse. Moreover, this is only the seventh time over the past 80 years when the US index has gained more than 24% over a five-month period.

The pessimist is likely to point to the consensus view that the rally is solely due to a handful of artificial intelligence-related stocks and argue that we must be due for a big decline after such a rare 25% gain. The optimist, on the other hand, may state that this rally only supports the case for placing 100% of one’s investments in equities because of the stock market’s return potential.

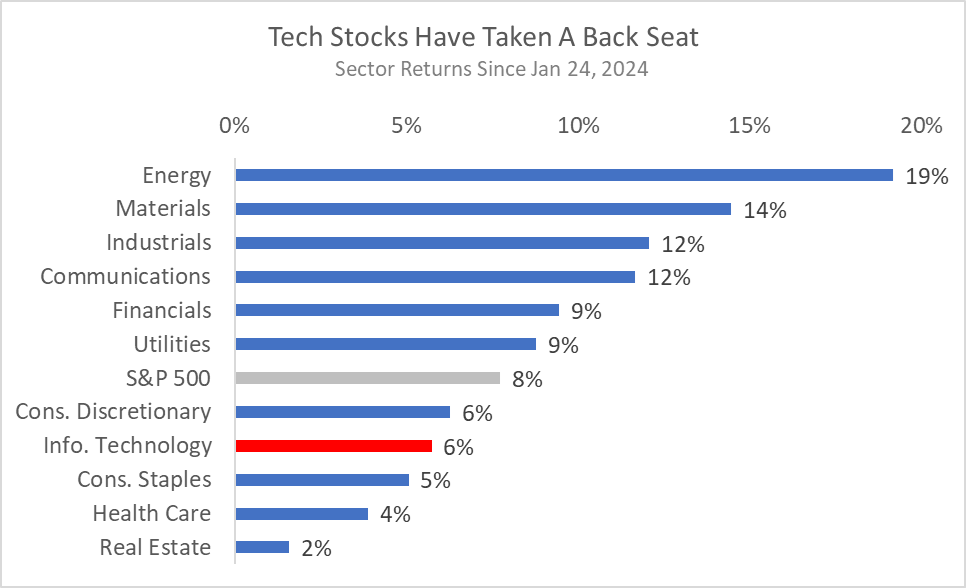

There is a kernel of truth in both points of view, but each paints an incomplete picture. What the pessimist might be missing is that the market rally has broadened out over the past couple of months, with sectors tied to global economic improvement outperforming. In fact, since late January, the US technology sector has underperformed. The best-performing groups were Energy, Financials, Industrials and Materials. If the recent better-than-expected US economic data continues, corporate earnings forecasts are likely to rise, making the bull market more durable.

It may surprise one to know that a five-month rally of 24% or more has historically been a bullish signal for further stock market gains. After the previous six such occasions, the S&P 500 has gained an average of 20% (ranging from 9% to 29%) over the subsequent 12 months – more than double the index’s average annual return. Any pessimist claiming that stocks can’t rise further should consider this track record.

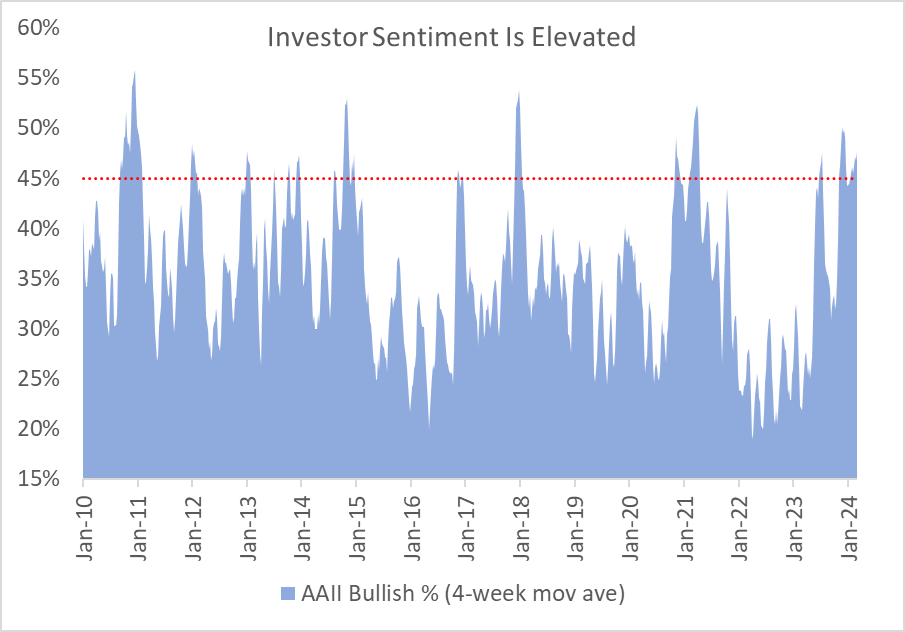

The optimist, of course, may point to such data as further rationale to be all-in on equities. But there are several other data points regarding elevated investor sentiment and stock valuations that increase the risk that the above winning streak may come to an end. The below chart shows the percentage of investors surveyed by the American Association of Individual Investors (AAII) that are bullish on stocks (on a 4-week moving average). At any given time, it is normal for 25 to 40% of investors to have a positive outlook on stocks. When this figure rises above 45%, however, stock market gains tend to be more muted over the subsequent year.

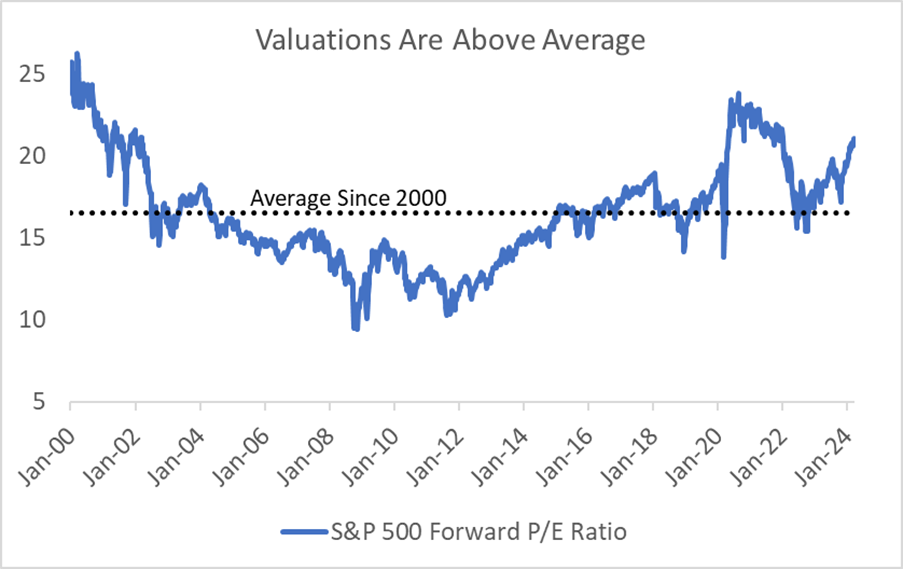

Valuations are another reason to be more cautious at the moment. The forward price-to-earnings (P/E) ratio on the S&P 500 has risen to its highest level in more than 20 years (excluding the two Covid-impacted years when earnings were temporarily depressed for some companies and valuations were stretched for others).

Lastly, we are seven months from what should be a contentious US presidential election. The stock market tends to be relatively rangebound with some elevated volatility in the months leading up to elections — not enough reason to reduce equity exposure, but certainly not a time be overly bullish, either.

Balancing all these considerations leaves us somewhat cautious in the near term, as stock prices may need to pause while earnings expectations play some catch up and investor sentiment cools amidst the coming tumultuous election campaign. Should the US economy remain resilient, however, we believe there isn’t an elevated risk of a significant downdraft in the overall market.

In the short term, stock markets can move around due to rising and falling investor sentiment, expanding and contracting valuation multiples, presidential election cycles and various other macroeconomic forces. In the long term, a company’s stock price tends to follow its earnings growth. We believe our portfolios are built on a foundation of solid companies that will grow their earnings at a healthy pace over time. This conviction keeps us from being swayed too far in one direction or another by the ever-present winds of excessive pessimism or unfettered optimism.

If you have any questions, please do not hesitate to Contact us!