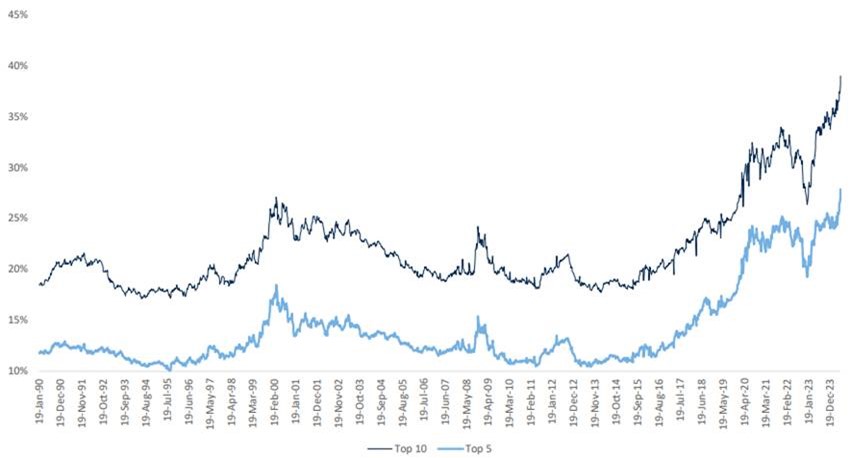

The biggest investing story of the first half of 2024 is how concentrated the US stock market has become. The five largest US stocks (Microsoft, Apple, Nvidia, Amazon and Meta Platforms) now comprise more than 27% of the S&P 500 Index – the highest concentration in the top five companies in more than 60 years (see chart below). The worst performer of these five (Apple) was up a still-respectable 9% in the first half of the year. The other four were up between 19% and 150% — much better than the S&P 500’s 14% return.

Largest Stocks as a % of S&P 500 Index

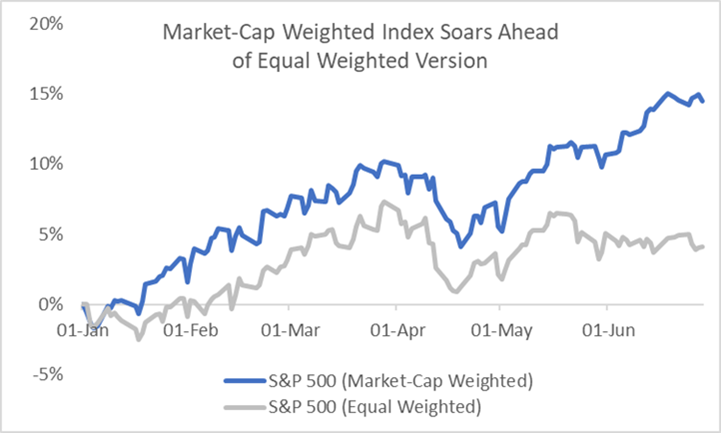

But even that 14% benchmark return is misleading because of how it is calculated. The S&P 500 is a market-capitalization weighted index, meaning the bigger companies have a larger impact on the index returns. When the largest companies are all moving in the same direction, it can give one a distorted view of what happened to the average stock. The year-to-date return on an equal-weighted version of the benchmark was a mere 4%.

The 10% difference between the S&P 500 Index return and those of the “average” stock is a big challenge for most portfolio managers that are trying to outperform the benchmark. Most mutual funds are overly diversified and, thus, have a much smaller weighting in the stock market leaders. As such, they underperform when only a handful of large stocks are rising together.

Momentum: A Key Differentiator

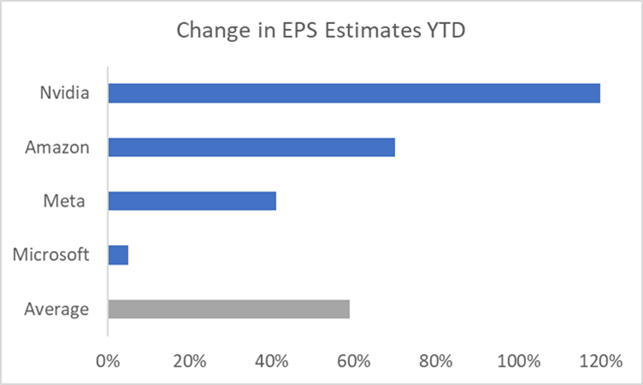

Fortunately for us, we use the Momentum factor as part of our stock selection discipline. On average, stocks that score well on Momentum measures – meaning they have outperformed recently – tend to continue performing well. The four best-performing mega-cap stocks all have high momentum rankings and, thus, have been part of our portfolios. This, along with the more concentrated nature of our portfolios, has allowed our US model to track the benchmark more closely than the average stock in the index.

The reason stocks that have been rising tend to continue doing so may be because the strong share price is an indication of improving corporate fundamentals that tend to have an inertia of their own. For example, Microsoft, Nvidia, Amazon and Meta Platforms all outperformed the S&P 500 in the second half of 2023. In the first six months of 2024, those four companies have seen their full year estimated earnings per share (EPS) rise by an average of 59%. Thus, the strength in their share prices last year foreshadowed the improvements in their earnings power.

Could the Elections Cause a Momentum Shift?

Some may be wondering if the upcoming US presidential election could cause a major shift in the market. First, it should be noted that we have seen four years of each presidential candidate, so there are fewer unknowns than there would be with first-time nominees. Secondly, there are checks and balances in place that limit unilateral actions by any US president. Lastly, there is no evidence suggesting the relationship between the U.S. president’s party and stock market returns is statistically significant. While there are always doomsayers that claim one candidate or the other would be disastrous for stocks, there is little support for such an assertion.

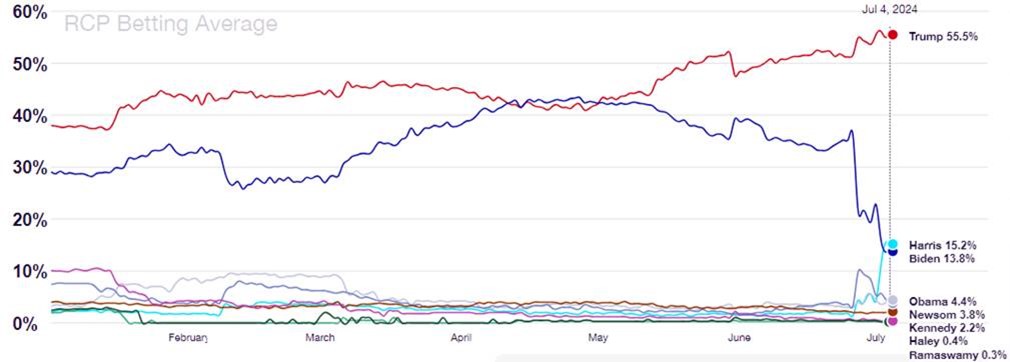

That is not to say that the fortunes for all stocks are the same under either candidate; we would just caution investors from making any drastic changes based on the election outcome. But since the oddsmakers are favouring Donald Trump in the wake of the first debate, it is worth assessing Mr. Trump’s stated policies and how they may impact different parts of the market.

RealClearPolitics Betting Average: US President

Under Mr. Trump’s first term in office, stocks responded positively when he cut corporate taxes from 35% to 21%. Those cuts are set to expire in 2025, but he has said he will not only make them permanent, but that he would lower them further. He has also said that he would reduce regulations, which may also be seen as broadly supportive for corporations.

On a sector level, oil and gas producers are generally viewed as beneficiaries of Mr. Trump’s energy policies, while those in the renewable energy industry could see some support removed if Republicans repeal the tax credits in the Democrat’s Inflation Reduction Act.

One of the biggest risks for stocks is a US-China trade war under a second Trump administration. He has said he would significantly raise tariffs on Chinese imports, which would likely result in retaliation. This could lead to lower profit margins for companies that import and export goods – consumer discretionary companies are most exposed – as well as raise inflation and interest rates. That would not be welcomed by the stock market. In 2018, Mr. Trump initiated trade actions against China, which in part caused that year’s heightened stock market volatility.

Conclusion

Election years can see an elevated level of uncertainty, which often causes a modest market pullback leading up to the vote. But after the election, regardless of which party wins, markets tend to experience a strong relief rally. We don’t believe investors should make any meaningful asset allocation changes in anticipation of some potential market volatility. Instead, we will keep a close eye on developments and may tread more carefully in some of the more exposed areas of consumer discretionary and renewable energy stocks. Outside of that, we shall remain calm and patient amidst any noise and will look for opportunities should markets overreact one way or the other.

If you have any questions, please do not hesitate to Contact us!