The Canadian government has recently announced a new registered investment plan, the First Home Savings Account (FHSA), as part of its 2022 budget. This savings account is designed to help Canadians save toward the purchase of a home in a tax efficient manner and is set to come into effect in April 2023. The FHSA combines some of the tax benefits of two existing registered plans: the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA).

Can I Get an FHSA?

To open an FHSA, you must be a Canadian resident and a first-time homebuyer. First-time homebuyer in this context means that you or your spouse or common-law partner did not own a qualifying home that was lived in as your principal place of residence in the year the account was opened or in any of the four preceding calendar years. You must also be at least 18 years old or the age of majority in your province.

What’s in it for me?

1. Contributions can go up to $40,000 (max. $8,000 yearly).

2. Savings in the FHSA must be withdrawn 15 years after the opening to purchase a home (more on this later).

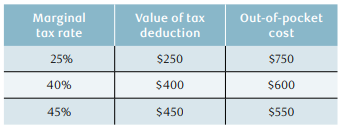

3. Contributions are tax-deductible, like in the RRSP. This means, depending on your tax rate, the “out-of-pocket” cost of a contribution is significantly lower (see below for examples of a $1,000 contribution, courtesy of RBC Wealth Management).

4. Qualifying withdrawals are not subject to withholding taxes, like in the TFSA.

5. Qualified investments are identical to the TFSA.

6. The Home Buyers’ Plan may be combined with the FHSA. *

*The HBP allows first-time homebuyers to withdraw up to $35,000 from their RRSP, tax and penalty free. These withdrawals must be repaid into the RRSP.

Up to $116,846 saved for a home!

With yearly deposits of $8,000 for five years growing at 6%, your FHSA will have grown to $81, 848. Add the $35,000 from the Home Buyers Plan (HBP) and that becomes $116,846 saved tax efficiently for a house purchase. If you are moving in with a partner, you may combine your FHSA and HBP, which means savings of just over $230,000 when using all the tools available.

What if?

- I want to withdraw the funds: The withdrawal(s) will be tax-free if a written agreement is provided as proof of home ownership before October 1st of the withdrawal’s year. The account must be closed at the end of the year.

- I don’t use the money: The funds can be transferred to an RRSP, contributing towards retirement.

Act now!

The FHSA rules begin on April 1, and it may be of interest for a future homeowner to open an FHSA regardless of contribution possibilities for 2023, as carry-forward contributions are only available once the account is opened, and carry-forward tax deductions are possible.

You are not on your own to figure this out, our team will proactively reach out to the youngest generation of our clients in the coming weeks and months to help.

As always, if you have questions or would like to discuss how this can apply to you, please feel free to reach out. We are here to help.

Di Iorio Wealth Management

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this newsletter is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Investment Advisor. The commentary, opinions and conclusions, if any, included in this newsletter represent the personal and subjective view of the investment advisor [named above] who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2021. All rights reserved.