An Individual Pension Plan (IPP) or a Personal Pension plan (PPP) is a defined benefit pension plan put in place through an incorporated company to provide greater retirement and tax benefits to certain individuals.

We like to think of it as an “RRSP on steroids”, designed for people who own an incorporated business. Just as companies like RBC have pension plans in place for their employees, business owners have the ability to create a pension plan for themselves. In essence, an IPP replaces an RRSP, and comes along with several advantages.

Here are the main benefits of IPPs/PPPs:

- Higher annual contribution limits vs. a traditional RRSP for individuals over the age of 40, enabling substantially higher retirement savings.

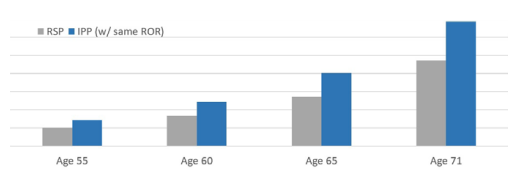

Thanks to higher contribution limits, there are additional assets with which to compound returns over time and grow an IPP. For example, a 50 year old business owner can contribute $10,290 more in 2022, and $11,600 more in 2023 to an IPP vs. a traditional RRSP. The graph below illustrates how the values of an IPP and an RRSP scale over time, subject to the same rate of return.

Source: RBC Wealth Management

- Companies contribute directly to an IPP/PPP using corporate funds, bypassing a layer of tax.

Instead of drawing a salary and then contributing to a traditional RRSP, contributions to an IPP are made directly by the operating company. Additionally, contributions and IPP-related expenses are tax-deductible for the sponsoring company.

- It is possible to recapture contributions for past years of employment.

With IPPs missed-contributions for prior years are not an issue. Catch-up deposits are possible as far back as 1991, or the individuals date of employment with the company. This can amount to a substantial sum, and the amounts not used from previous years would once again flow tax-free from the operating company to the personal pension plan.

- Investments are allowed within IPPs, and plans are also creditor-proof.

Similar to RRSPs, IPPs can hold investments in stocks, bonds, funds, GICs, and more – all while protecting these assets from creditors.

- IPPs can grow at 7.5% yearly, even if investment returns fall short of that mark.

The funds in an IPP can grow at a prescribed 7.5% annualized rate. In the event that the returns generated by the investments fall short of this mark, the amount of the shortfall can be topped-up with additional tax-deductible contributions by the company. This means that, assuming the availability of funds in the company, the future value of the pension plan can be more accurately calculated.

Who are IPPs for?

Incorporated business owners or professionals, generally 40 years of age or older, earning T4 income of $100K or more. Those who fit within these parameters, and desire/are capable of contributing more than their RRSP allowance, are prime candidates to set up an IPP.

How to setup an IPP?

Our team can put you on track towards upgrading your retirement benefits and reducing your tax bill. We have decades of experience in creating IPPs tailored to your situation, and can connect you with the necessary resources (ex. accountant and actuary) to make the process as seamless as possible.

If you, a family member, or a friend fits the above criteria, please reach out to us via email diioriowealthmanagement@rbc.com or via LinkedIn. Our team can show you how an IPP applies to various different situations through a customized IPP illustration.

Thank you,

Di Iorio Wealth Management

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this newsletter is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Investment Advisor. The commentary, opinions and conclusions, if any, included in this newsletter represent the personal and subjective view of the investment advisor [named above] who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2022. All rights reserved.