As markets continue to undergo one of the more prolonged and severe periods of volatility in recent memory, we have continued to remain focused on the longer-term lessons that we have learned – both from experience, as well as from insight shared by some of the greatest investors of this generation.

Most recently, we’ve been reading The Tao of Charlie Munger (“The Tao”, a Chinese philosophical principle, translates to “the way” or “the path”). One quote in particular that resonated with us in the context of the current market was “It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.” As investors, patience is almost always the most important skill we can have, especially during market environments like the one we’ve seen prevail since late-2021. History has proven time and again that for investors with the necessary time horizon, the only significant risk of permanent loss of capital from a well-diversified portfolio stems from selling in reaction to a market downturn.

1. Most end up being wrong (at least) as often as being right

Many are tempted to try to time entries and exits from their investments based on the prevailing market conditions and economic headlines. However, as we have discussed many times over the years – doing so with any sort of consistent accuracy is nearly impossible. During downturns like we are seeing today, it is simple to point to the situation leading up to the present and think it was easy to predict what would happen. However, choosing to always act on indicators of a potential market correction would inevitably result in missing out on returns just as often (or more so) than simply staying the course.

For example, in September 2019 we wrote a blog discussing how the consensus view at the time was that we were heading for a recession. The yield curve had inverted, there was an ongoing trade war with China, interest rates were causing concern, and geopolitical issues included social unrest in Hong Kong, Brexit, and more. Fast forward to today, other than a sharp correction and ensuing recovery in 2020 at the onset of the pandemic (a concern to add on top of the large list from September 2019), the market continued higher for the remainder of the year, generated strong returns over calendar 2020, and continued to the upside throughout 2021.

2. The danger of being wrong – even by a few days

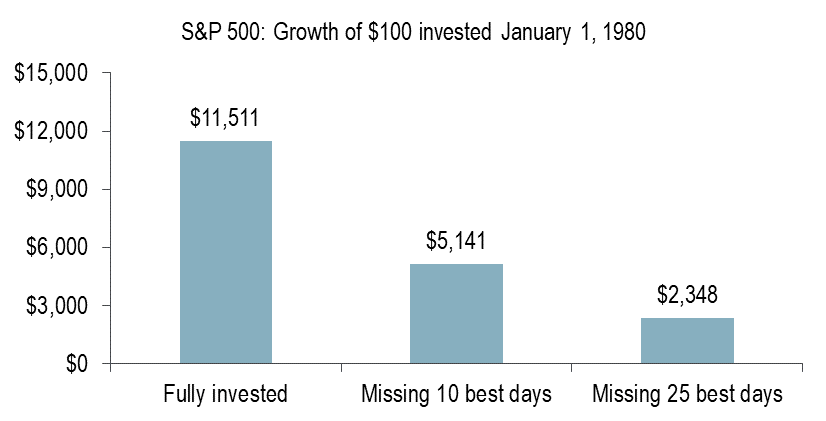

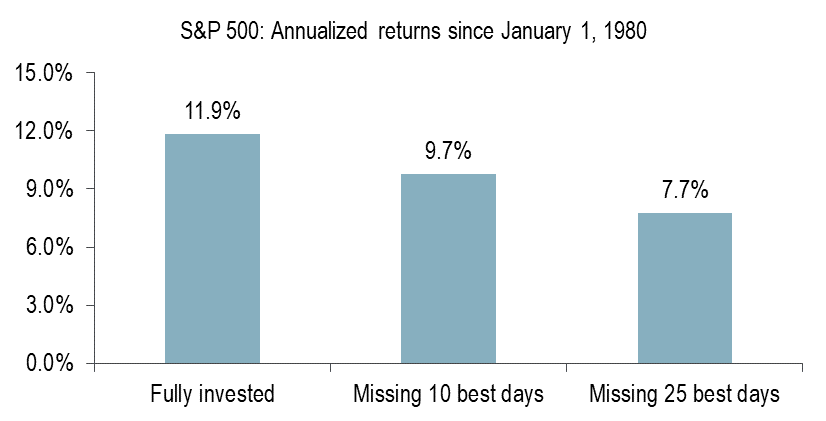

Mistiming entries and exits of the markets by only a few days can make a significant difference in returns. To illustrate the importance of remaining invested in market downturns, we wanted to share a chart we have referenced before, which shows the returns an investor would have generated by investing in the S&P 500 on January 1st 1980 under the following scenarios: remaining fully invested throughout, missing the 10 best days, and missing the 25 best days. This highlights the futility and risk of trying to time the market, as many of the “best days” actually occur during or in the immediate aftermath of downturns like we are seeing now.

Source: RBC Wealth Management, Bloomberg; data through 4/30/22; calculations based on daily data from January 1980 to April 2022 (page 8)

3. Missing the best opportunities due to fear

Today, we can easily look back at so many periods where markets corrected sharply, and reminisce on the buying opportunities that were available to us. The most commonly cited examples are buying in the aftermath of the 2008 financial crisis, or buying after the onset of COVID in early 2020. Lesser referenced examples include buying technology in early-2019 after names like Google, Amazon, and Apple had dropped by as much as 40%. We believe that today we are living through one of these moments – we think that there are opportunities to purchase incredible businesses today at levels which in hindsight will make us wish we had bought even more.

Though today it feels very difficult to be an investor, especially one that focuses on investing for the future, this won’t be the case forever. The decisions we make today will be the ones which drive the results we experience over the coming years. We believe that the Tao of Charlie Munger will prove valuable for investors who can stay the course – maintaining perspective and patience will prove fruitful.

As always, please do not hesitate to reach out if you would like to know how this applies to you, or if you have any questions.

Thanks for reading.

Di Iorio Wealth Management

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this newsletter is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Investment Advisor. The commentary, opinions and conclusions, if any, included in this newsletter represent the personal and subjective view of the investment advisor [named above] who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2022. All rights reserved.