Every January for the last several years we have attempted to make predictions about the year ahead. Each year we are then reminded that making predictions, though fun, is far from a reliable science. Over the years we have often been right, but there are also plenty of examples where events have followed the often-cited financial theory of a “random walk”.

The unpredictability of markets was on full display in 2023. At the beginning of the year, the average projected closing level of the S&P 500 for 2023 was 4,078 according to strategists (a gain of 6.2% from 2022 closing levels). According to Bloomberg, by mid-December these same strategists had revised up their forecasts to an average of 4,750 (actual close of 2023 was 4,769.83).

Forecasts like this are far from scientific, and in our experience are completely offside just as often as they prove accurate. However, these predictions receive a ton of press, and often influence investor decision-making – and bottom-line results. This is one example of a sub-optimal aspect of the investment industry, but it also serves to provide opportunities for those who simply follow the facts.

This is why this year, instead of predictions, we have decided to share four relevant facts about markets – which we believe can serve as a strong basis for achieving success as an investor. Note that whenever we refer to the “market” in this post, we are referring to the S&P 500 – in our view the gold standard for equity investing.

Fact #1: Long-Term Market Returns – Predictable and Reliable

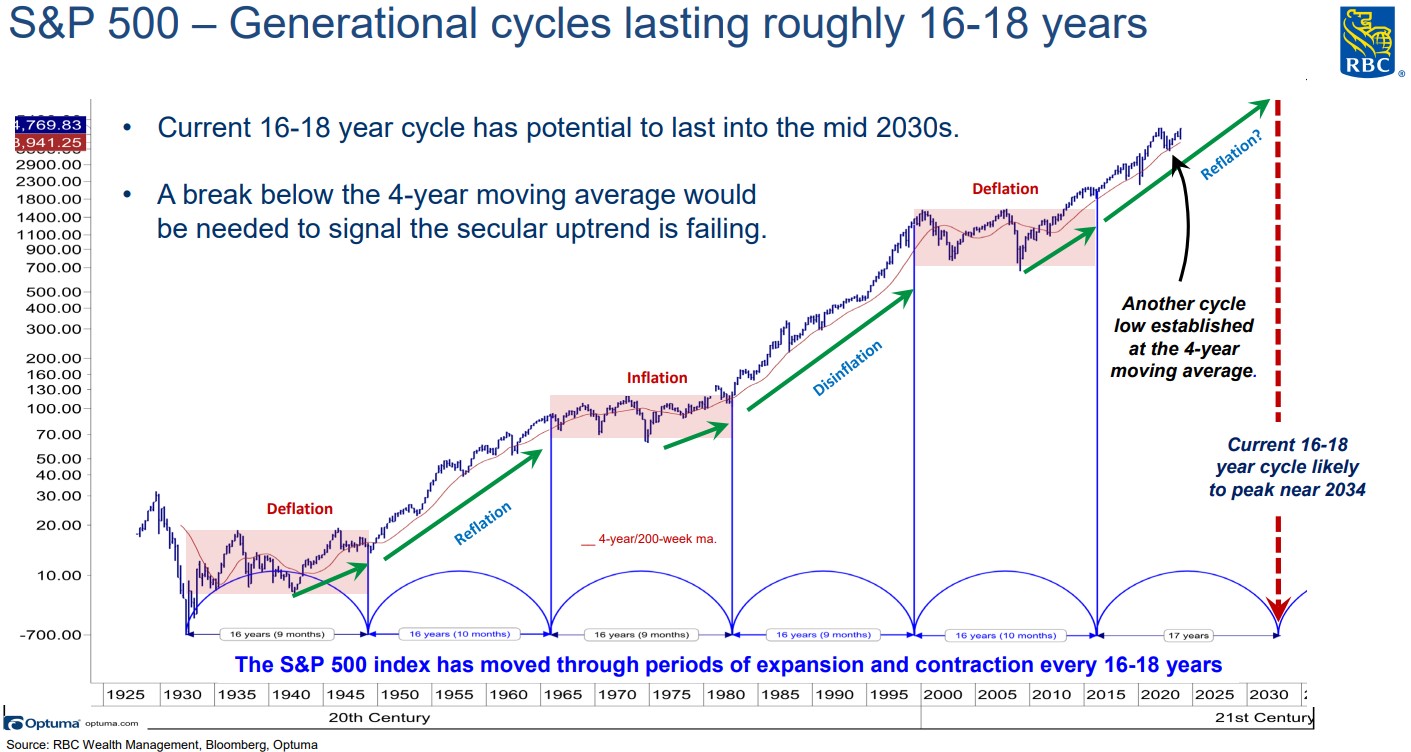

At the risk of repetition, we once again return to the long-term “Generational Cycles” theory. Without delving into a full-scale explanation of the chart below, the last 100 years or so of S&P 500 performance is shown. A repetitive cycle of “Generational” bullish and bearish markets is illustrated, characterized by “healthy” or “unhealthy” inflationary conditions, as well as overall technological advancements driving productivity gains.

Source: RBC Wealth Management

This theory demonstrates is that over the long-term, the S&P 500 is an excellent growth compounder. This is particularly true during the 16-18 year bullish cycles (in which we find ourselves today), but also true when looking at long-term returns that include a mix of bullish and bearish periods (ex. the 20 and 50-year returns listed below).

S&P 500 Price Returns (as at Dec. 31st 2023):

10 years (2014-2023): 9.99%

20 years (2004-2023): 7.61%

50 years (1974-2023): 8.11%

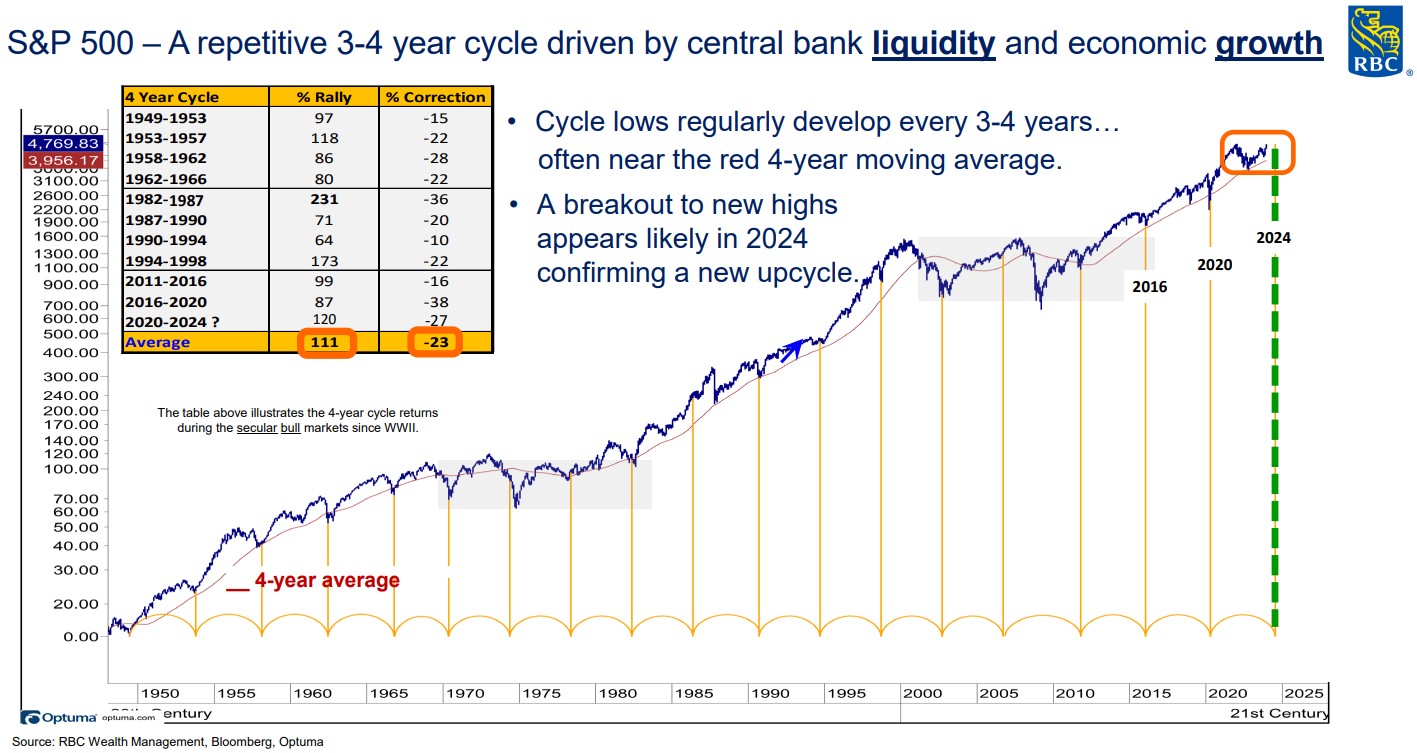

Fact #2: Short-Term Market Cycles – Repetitive and (Potentially) Surprising

Something shared in our recent post, Leveraging Shorter-Term Cycles Within Generational Trends, is a look at a more “immediate” concern to most investors: What will the market do over the near-term? For a more in-depth overview please feel free to read this post, but the key takeaway from this repetitive cycle is that during so-called “secular bull markets” (see above), markets have a tendency to put up extremely strong 2-3 year rallies following the “corrective” phases of a repetitive 4-year cycle. If we think of 2022 as this corrective phase, this would indicate potential for strong near-term returns in the coming couple of years.

Source: RBC Wealth Management

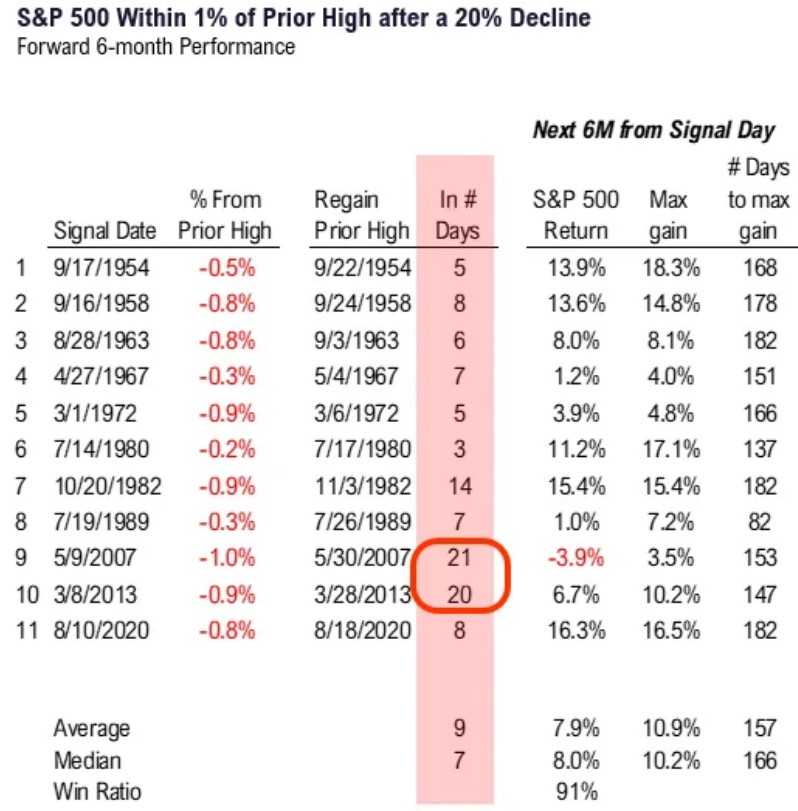

Fact #3: All-Time Highs – Not Necessarily a Reason to Sell

We believe that history can serve as one of the best guides to investors, keeping with the saying “this time is not different”. As markets have touched new highs in early 2024, we have had several inquiries about whether it would be better to wait for a new pullback before investing.

One of our favorite research firms, Fundstrat, put together some statistics about how markets perform following a return to all-time highs after a decline of 20% or more. Of the 11 instances of this dating back to the 1950s, the S&P 500 continued to move higher over following 6 months 10 of 11 times (and 7 of 11 times over the next 18 months).

Source: Fundstrat

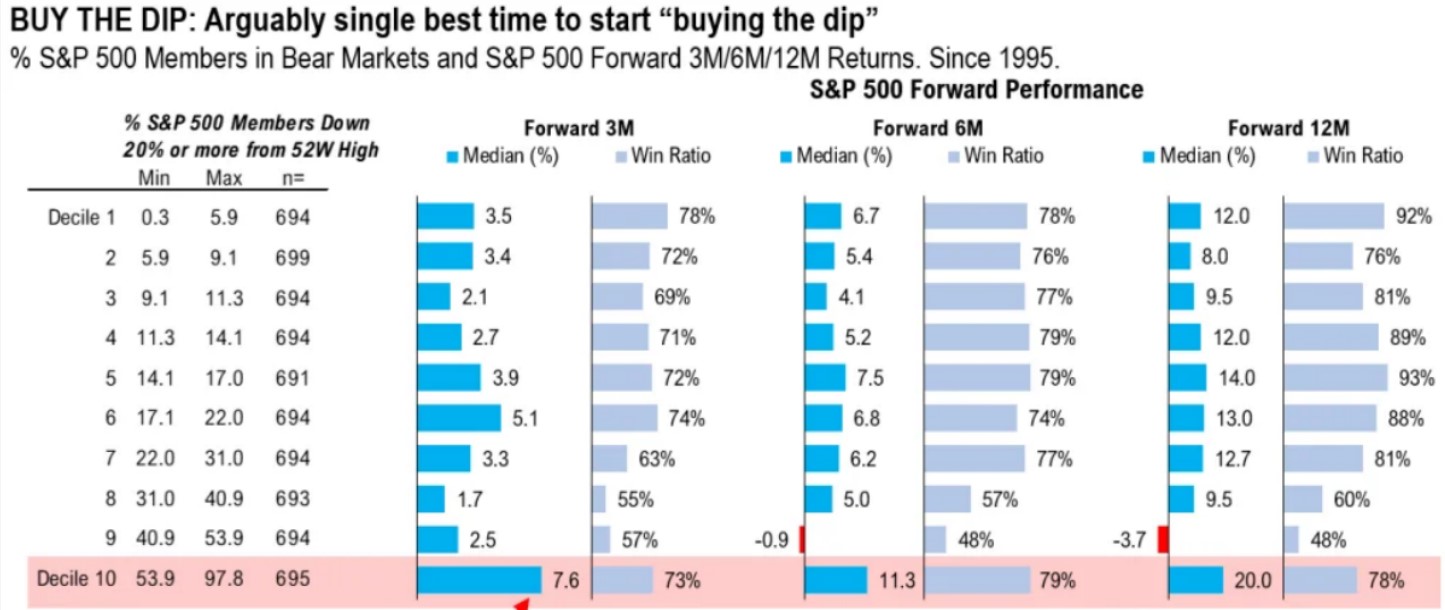

Fact #4: Market Drawdowns – Often a Reason to Buy

Unsurprisingly given the facts shared above about both short and longer-term returns, buying or holding in times of volatility is one of the best ways to increase returns (or accelerate recoveries) over time. Something we shared near the lows of mid-to-late 2022 explored the type of correction we had seen during the year, comparing it to others of similar magnitudes, and projecting forward the returns and probability of success over the coming 3, 6, and 12 months. This chart is shown below – and actual results mirrored the “averages” shown below with a high degree of accuracy.

Source: Fundstrat

In closing, we want to highlight that these facts have led us to an increasing emphasis on passive market exposure at the core of our portfolios. Over time, it is clear to us that portfolio construction with a this as an “anchoring” position both increases the likelihood of long-term success, and reduces the “frictions” that can come along with investing (ex. taxes, trading, etc.). For more on this topic, please refer to our previous post: The Benefits of a Passive Core, from February 2022.

As always, if you’d like to discuss anything in this post or about your portfolios with us in greater detail, do not hesitate to contact us directly.

Di Iorio Wealth Management