December’s central bank meetings were generally more hawkish than expected as policymakers placed more weight on rising inflation and shrinking economic slack than emerging risks from Omicron. The BoE became the first G7 central bank to raise interest rates from pandemic lows and the Fed accelerated its QE tapering, opening the door to rate hikes in the first half of this year (we now expect three rate increases in 2022). The ECB also laid out a plan to slow bond buying by more than expected—we think rate hikes remain a distant prospect though some hawkish ECB officials are starting to talk up an eventual move.

But with the fast-spreading variant now driving record case growth, the question is whether central banks will continue to look through Omicron risks in early-2022. Despite generally causing less severe illness, the sheer number of cases still threatens to overwhelm health care systems. Some jurisdictions have started to re-impose containment measures (but not lockdowns) and a large number of infected individuals staying home and isolating could exacerbate near-term supply challenges. We should get more information on the severity of this wave in the coming weeks but at this stage we are treating it as a speed bump in an economic recovery that will otherwise continue to progress in 2022.

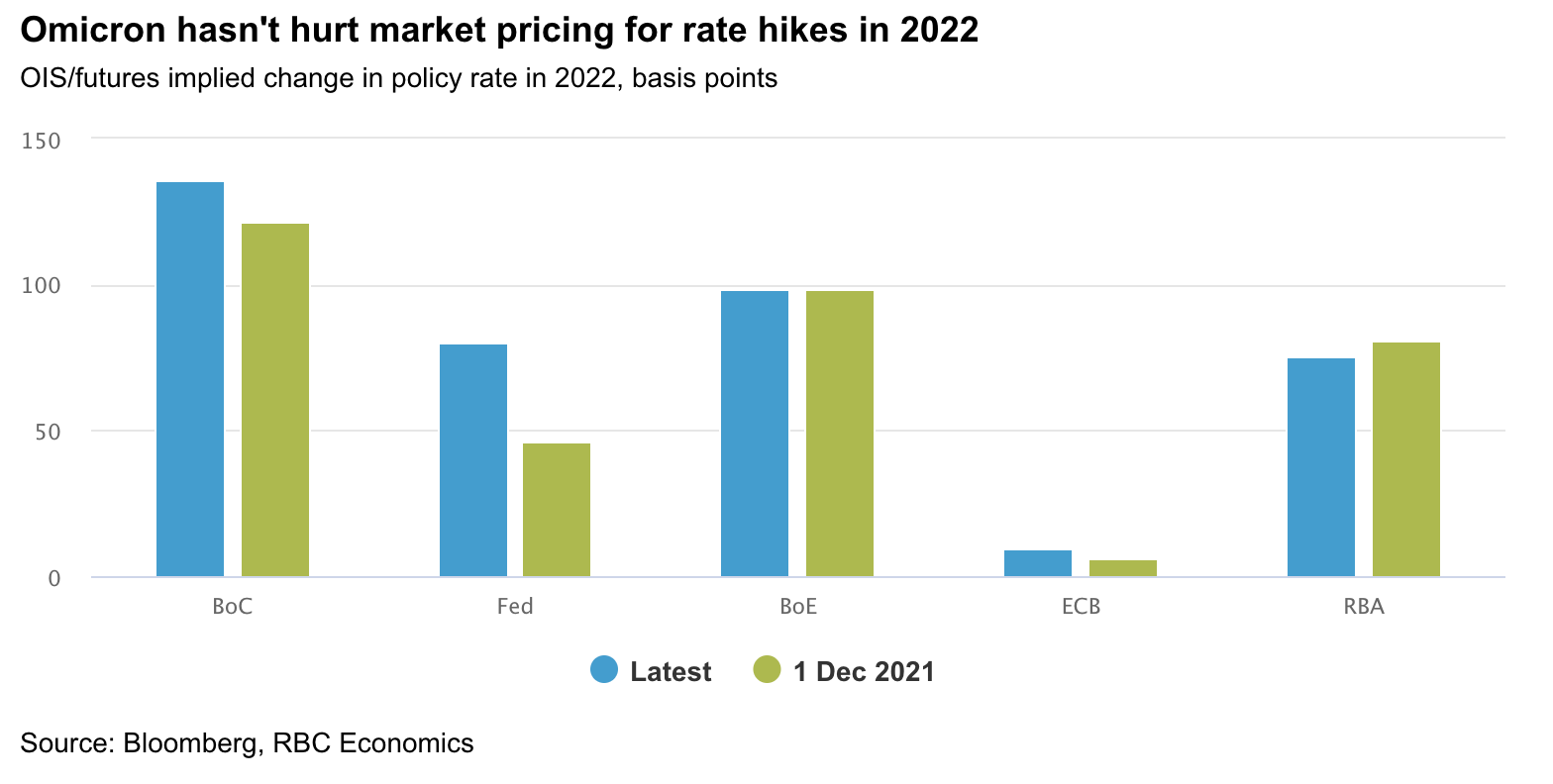

The BoC will provide an early litmus test on how central banks are managing evolving Omicron risks. Even with containment measures set to slow Canada’s recovery early this year, we think the BoC will lean hawkish in January and lay the groundwork for near-term rate increases. Markets likewise don’t see Omicron derailing central banks’ tightening plans with three or more hikes still priced in for the BoC, Fed, BoE and RBA this year.

- Hawkish central banks and concerns about persistent inflation drove a selloff in government bonds with 10-year yields closing in on 2021’s highs. We expect yields will continue to increase moderately over the course of 2022.

- At this state it looks like Omicron will be another speed bump in the economic recovery. Its impact on inflation is less certain as it could exacerbate supply chain bottlenecks and keep goods prices under upward pressure.

- The Fed’s hawkish shift in December was particularly notable given how carefully it laid the groundwork for its initial tapering decision. Accelerated QE wind-down suggests rates will rise in the first half of this year. The Fed could begin shrinking its balance sheet shortly thereafter.

- We also look for near-term rate hikes from the BoC and BoE. The latter began raising rates in December, despite growing Omicron risks, and we expect the BoC will also take the long view and signal rate hikes are coming even with some restrictions being reintroduced.

- The RBA and ECB will taper or end QE programs this year (the former abruptly in February, the latter over the course of 2022) though we’re not expecting rate hikes from either this year.