Authors

Joseph Wu, CFA

Portfolio Manager

joseph.wu@rbc.com; RBC Dominion Securities Inc. Dominick Hardy, CA, CFA, CPA

Senior Portfolio Manager

dominick.hardy@rbc.com; RBC Dominion Securities Inc. Analyst Certification

All of the views expressed in this report accurately reflect the personal views of the responsible analyst(s) about any and all of the subject securities or issuers. No part of the compensation of the responsible analyst(s) named herein is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the responsible analyst(s) in this report.

This report is issued by the Portfolio Advisory Group (“PAG”) which is part of the retail division of RBC Dominion Securities Inc. (“RBC DS”). The PAG provides portfolio advisory services to RBC DS Investment Advisors. Reports published by the PAG may be made available to clients of RBC DS through its Investment Advisors. The PAG relies on a number of different sources when preparing its reports including, without limitation, research reports published by RBC Capital Markets (“RBC CM”). RBC CM is not independent of RBC DS or the PAG. RBC CM is a business name used by Royal Bank of Canada and certain of its affiliates, including RBC DS, in connection with its corporate and invest- ment banking activities. As a result of the relationship between RBC DS, the PAG and RBC CM, there may be conflicts of interest relating to the RBC CM analyst that is responsible for publishing research on a company referred to in a report issued by the PAG.

Required Disclosures

With respect to the companies that are the subject of this pub- lication, clients may access current disclosures of RBC Wealth Management and its affiliates by accessing our web site at https://www.rbccm.com/GLDisclosure/PublicWeb/DisclosureLookup.aspx?EntityID=2 or by mailing a request for such informa- tion to RBC Wealth Management Research Publishing, 60 South Sixth Street, Minneapolis, MN 55402

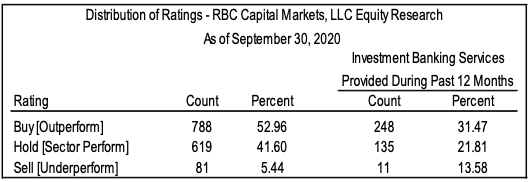

RBC Capital Markets’ Distribution of Ratings

For purposes of ratings distributions, regulatory rules require member firms to assign ratings to one of three rating categories − Buy, Hold/Neutral, or Sell − regardless of a firm’s own rating categories. Although RBC Capital Markets’ ratings of Outperform (O), Sector Perform (SP), and Underperform (U) most closely correspond to Buy, Hold/Neutral and Sell, respectively, the meanings are not the same because our ratings are determined on a relative basis.

Explanation of RBC Capital Markets’ Equity Rating System

An analyst’s “sector” is the universe of companies for which the analyst provides research coverage. Accordingly, the rating as- signed to a particular stock represents solely the analyst’s view of how that stock will perform over the next 12 months relative to the analyst’s sector average.

Ratings:

Outperform (O): Expected to materially outperform sector average over 12 months. Perform (SP): Returns expected to be in line with sector average over 12 months. Underperform (U): Returns expected to be materially below sector average over 12 months. Restricted (R): RBC policy precludes certain types of communications, including an investment recommendation, when RBC is acting as an advisor in certain merger or other strategic transactions and in certain other circumstances. Not Rated (NR): The rating, price targets and estimates have been removed due to applicable legal, regulatory or policy constraints which may include when RBC Capital Markets is acting in an advisory capacity involving the company. As of March 31, 2020, RBC Capital Markets discontinued its Top Pick rating. Top Pick rated securities represented an analyst’s best idea in the sector; expected to provide significant absolute returns over 12 months with a favorable risk-reward ratio. Top Pick rated securities have been reassigned to our Outperform rated securities category, which are securities expected to materially outperform sector average over 12 months.

Risk Rating:

The Speculative risk rating reflects a security’s lower level of financial or operating predictability, illiquid share trading vol- umes, high balance sheet leverage, or limited operating history that result in a higher expectation of financial and/or stock price volatility.

RBC Capital Markets analysts have received (or will receive) com- pensation based in part upon the investment banking revenues of RBC Capital Markets.

RBC Capital Markets Conflicts Policy

RBC Capital Markets Policy for Managing Conflicts of Interest in Relation to Investment Research is available from us on request. To access our current policy, clients should refer to https://www.rbccm.com/global/file-414164.pdf or send a request to RBC Cap- ital Markets Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th Floor, South Tower, Toronto, Ontario M5J 2W7. We reserve the right to amend or supplement this policy at any time.

Dissemination of Research & Short Term Ideas

RBC Capital Markets endeavours to make all reasonable efforts to provide research simultaneously to all eligible clients, having regard to local time zones in overseas jurisdictions. Subject to any applicable regulatory considerations, “eligible clients” may include RBC Capital Markets institutional clients globally, the retail divisions of RBC Dominion Securities Inc. and RBC Capital Markets LLC, and affiliates. RBC Capital Markets’ equity research is posted to our proprietary websites to ensure eligible clients receive coverage initiations and changes in rating, targets and opinions in a timely manner. Additional distribution may be done by the sales personnel via email, fax or regular mail. Clients may also receive our research via third party vendors. Please contact your investment advisor or institutional salesperson for more information regarding RBC Capital Markets research. RBC Capital Markets also provides eligible clients with access to SPARC on its proprietary INSIGHT website. SPARC contains market color and commentary, and may also contain Short-Term Trade Ideas regarding the securities of subject companies discussed in this or other research reports. A Short-Term Trade Idea reflects the research analyst’s directional view regarding the price of the se- curity of a subject company in the coming days or weeks, based on market and trading events. A Short-Term Trade Idea may differ from the price targets and/or recommendations in our published research reports reflecting the research analyst’s views of the longer-term (one year) prospects of the subject company, as a result of the differing time horizons, methodologies and/or other factors. Thus, it is possible that the security of a subject compa- ny that is considered a long-term ‘Sector Perform’ or even an ‘Un- derperform’ might be a short-term buying opportunity as a result of temporary selling pressure in the market; conversely, the secu- rity of a subject company that is rated a long-term ‘Outperform’ could be considered susceptible to a short-term downward price correction. Short-Term Trade Ideas are not ratings, nor are they part of any ratings system, and RBC Capital Markets generally does not intend, nor undertakes any obligation, to maintain or update Short-Term Trade Ideas. Short-Term Trade Ideas discussed in SPARC may not be suitable for all investors and have not been tailored to individual investor circumstances and objectives, and investors should make their own independent decisions regard- ing any Short-Term Trade Ideas discussed therein.

Conflict Disclosures

In the event that this is a compendium report (covers six or more subject companies), RBC DS may choose to provide specific disclosures for the subject companies by reference. To access RBC CM’s current disclosures of these companies, please go to https://www.rbccm.com/GLDisclosure/PublicWeb/Disclosure-Lookup.aspx?entityId=1.

Such information is also available upon request to RBC Dominion Securities, Attention: Manager, Portfolio Advisory Group, 155 Wellington Street West, 17th Floor, Toronto, ON M5V 3K7.

The authors are employed by RBC Dominion Securities Inc., a securities broker-dealer with principal offices located in Toronto, Canada.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by RBC. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof ), and all such parties hereby expressly disclaim all warranties of originality, accu- racy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if noti- fied of the possibility of such damages.

References herein to “LIBOR”, “LIBO Rate”, “L” or other LIBOR abbre- viations means the London interbank offered rate as administered by ICE Benchmark Administration (or any other person that takes over the administration of such rate).

Disclaimer

Dominion Securities Inc. (“RBC DS”) from sources believed by it to be reliable, but no representations or warranty, express or implied, are made by RBC DS or any other person as to its accuracy, completeness or correctness. All opinions and estimates contained in this report constitute RBC DS’ judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. This report is not an offer to sell or a solicitation of an offer to buy any securities. Additionally, this report is not, and under no circumstances should be construed as, a solicitation to act as securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. This material is prepared for general circulation to Investment Advisors and does not have regard to the particular circum- stances or needs of any specific person who may read it. RBC DS and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC DS and its affiliates may also issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC DS or its affiliates may at any time have a long or short position in any such security or option thereon. Neither RBC DS nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any means without the prior written consent of RBC DS in each instance.

In all jurisdictions where RBC Capital Markets conducts business, we do not offer investment advice on Royal Bank of Canada. Certain regulations prohibit member firms from soliciting orders and offering investment advice or opinions on their own stock. References to Royal Bank are for informational purposes only and not intended as a direct or implied rec- ommendation for investing in Royal Bank and all related securities.