As the end of the calendar year approaches, you may be giving more thought to your potential tax liabilities and tax planning in general.

This may be especially true for some investors this year, given the more recent market gains, as well as a feeling by many that higher taxes may be coming.

Whether currently or at any point during the year, for those in a situation where you’re sitting on concentrated stock positions with very large capital gains, it can sometimes feel like a bit of a catch-22. A market downturn could cause a loss of significant gains, but selling could create a high tax liability.

So what’s an investor to do? Now may be a good time to focus on your tax planning, and consider potential strategies that may help you save on taxes while at the same time taking some money off the table, letting you lock in gains and diversify.

Depending on the amount of your gain, there is a strategy and interesting formula that may help you pay zero taxes on a sale.

Revisiting your Grade 5 Math class

Take a moment to think back to the basic math equations you learned in elementary school. When you consider the equation of 1/3 + 2/3, as your Math teacher would’ve taught you, the obvious answer is 1. Now, what if you were to use that same formula for the sale of a stock but apply a layer of tax planning as well? With the right strategy, implemented in the appropriate circumstances, 1/3 + 2/3 can actually equal 0…in taxes, that is!

How it works

At the root of this formula is combining a sale of a percentage of your shares with an in-kind donation of another percentage of your shares to a charitable foundation. This type of approach can offer benefits that are threefold: you may pay zero in taxes, you’ll still be left with significant funds for your family, and you can build social capital. If it’s something you haven’t considered or explored before, this may be an especially empowering process of combining strategic tax planning with charitable planning, and tying everything together in a way that fits with your overall wealth objectives. Imagine having $1,000,000 to give to the charities that are important to you and having it cost only $200,000 out of your pocket.

An example

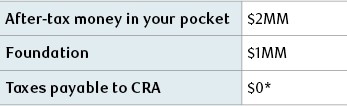

Let’s say you own 100,000 shares of a public company at $30 per share with a nominal cost base. Your shares are worth $3MM and selling all of the shares would result in a large tax bill of about $800,000 (assumes top tax rate — varies by province). This would leave you with $2.2MM after-tax in your pocket. Now let’s apply the tax-friendly formula of 1/3 + 2/3 = 0. You donate one-third of your shares (33,333 shares) in-kind to a charitable foundation and sell two-thirds of your shares (66,667 shares)*. The results?

*Donating publicly traded stocks in-kind results in the capital gain on the stock donated being exempt from tax and a donation receipt equal to the market value of the stock donated. With this formula, the donation tax credit on the stock donated in-kind may eliminate the capital gains tax on the stock sold and not donated. It’s assumed the full donation tax credit can be claimed in one year; however, note that donations can only be claimed up to 75% of net income, so tax may not be eliminated all in one year if there is not adequate other income. Any excess donations that can’t be claimed can be carried forward for five years.

With this formula, you have slightly less funds in your pocket than if you sold all of the shares and paid full tax, but the advantages become multifaceted:

- You still keep 90% of funds for yourself and your family ($2MM vs $2.2MM).

- You pay zero tax (compared to $800,000 in tax).

- You’ve now seeded a foundation with $1MM that can offer tax-exempt growth and that you and your family can be involved in to grant funds to your favourite charities over a number of years. The tax-exempt growth may allow you to give more than the $1MM that was originally donated making this a great strategy for your charities too.

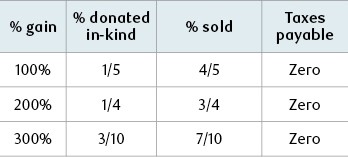

Keep in mind that this formula changes depending on your percentage gain. Here’s a quick reference table on what that may look like in different scenarios and that still lead to a result of zero taxes payable:

At the end of the day, for those who experience market growth and then wonder how to make the most of their gains, this formula illustrates how strategic tax planning can help you keep significant funds for your family while also reducing taxes and creating “wealth alpha” in the form of charitable dollars that can grow and be granted out to generate a meaningful impact over time.

To determine if this type of approach may be suitable for you, speak to a qualified tax advisor.

Your RBC wealth advisor can discuss the investment merits of selling and run personalized calculations using the RBC stock donation calculator.

Find out more about our approach and the many areas of planning expertise available to help you build towards and achieve your goals