From his first day in office as President, Donald Trump has aggressively moved to better position the US in the world. His unconventional and aggressive plans include annexing Canada and Greenland as well as assuming control of the Panama Canal. He is brokering a peace deal between Ukraine and Russia and has support for Russia in these negotiations. I suspect that Trump is trying to be friends with Putin to prevent a strengthening of Putin’s relationship with China, and to do this, he may be willing to give some ground to Putin.

Trump’s sudden re-drawing of the world alliances has shocked his allies. The withdrawal of US military support angered European countries, and Denmark and Canada have reacted negatively to Trump’s stated desire to take over both countries. The Chinese are angry that Trump arranged their divestment of the management of the ports of the Panama Canal. All of this has been a wake-up call to the World to become better organized economically and to arm up so they can defend themselves. The peace dividend has ended, and environmental policies to alleviate climate change may be sacrificed as countries’ increase their spending on defense. World trade routes will be re-drawn and a new world order that existed since WWII will be created anew.

Trump has implemented tariffs on most trading partners with his reason being that its trading partners were taking advantage of the US. Trump knows that the US is the largest global consumer, and that it represents 15%-20% of the world’s GDP. This gives him tremendous leverage.

The Canadian and US economies are closely integrated, and in many industries, goods cross the border several times before manufacturing is completed. The US administration claims that they want Greenland for strategic and defense reasons even though the US has a military base there and 60 years ago had 17 bases there. He wants Canada for defense of the Arctic. He says that the US doesn’t need anything from Canada. Really? What about Canada’s vast oil reserves, critical minerals, or water? (the US is in dire need of Canada’s water as the south-west of the US is built on a desert). His aspirations for control of Greenland and Canada are as much about resources than defense.

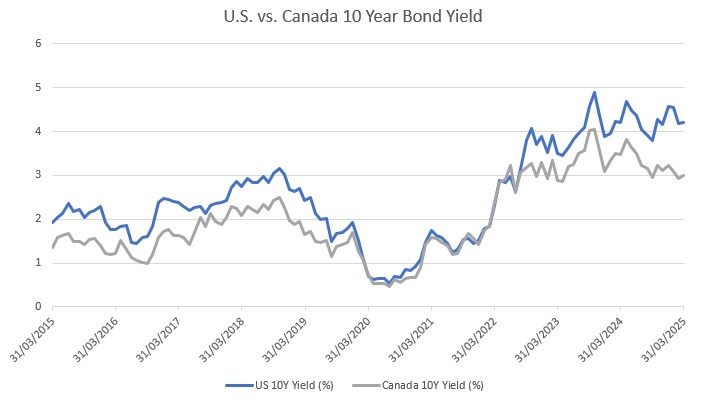

The world order that includes US defense of Canada and western Europe is being re-written by the current US administration. However, the US should tread carefully as angering one’s friends, partners and allies poses risks, and isolation. Boycotting of US goods is underway in Canada and Europe, particularly in the defense sector as trust in the US as an ally is eroding. Further, the US dollar being the world’s reserve currency may be under threat at some point, particularly given the poor state of the US financial health.

Most markets are responding badly to the uncertainty of US policies. President Trump has said that there will be ‘bumps in the road’ as he implements his policies. It will take many, many years for companies to adjust to this new world order and abrupt changes to supply arrangements.

Isolationist USA is an economic policy to pay for tax cuts and deficits (if you want access to our consumers – pay). Simply put, the US spent more than they should have defending the world and now they’re backing away from that responsibility and cost. However, that’s the cost of being the world superpower, and trade deficits with trading partners is the cost of being the world’s reserve currency.

Reminiscent of Germany in the 1930’s, China is building up the largest arms arsenal in peace-time history using the proceeds of being the manufacturer of cheap consumer goods that the west is hooked on. NATO countries are currently contemplating how to increase their defense capabilities and which programs should be cut to allow for increased defense spending.

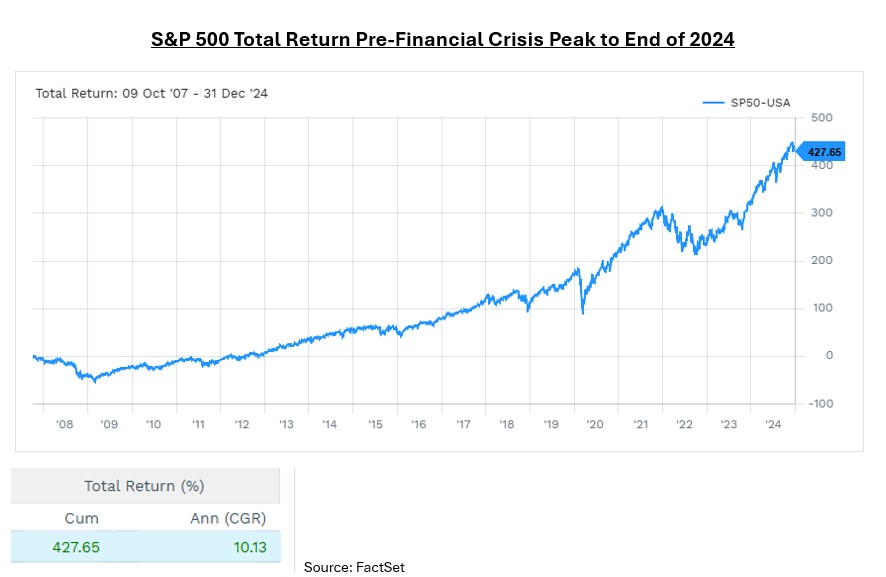

Today’s market volatility is not special. The crisis causing it, as always, is unique and as such comes with its own special set of concerns. It can feel very bleak in the middle of the storm, but we must remember that this too shall pass, one way or another. Our clients’ portfolios are high quality, the business that we own are well capitalized, have strong management teams and will come out the other side of this crisis. Periods like this are part of long-term investing. We continue to navigate this challenging environment on your behalf, and as always, will do our best to protect your interests.

Tony Pringle, CFA April 4, 2025