The Economy, Markets and Interest Rates

The US economy continues to remain strong. In September, the US economy added 254,000 jobs – much more than the 150,000 expected. The resiliency of the consumer, coupled with the expectation of interest rate decreases, have been key reasons why stock markets continue to trade near all-time highs. While markets expect interest rates to continue decreasing – there are five interest rate decreases expected over the next year (each decrease is typically one quarter of one percent) – we would not be surprised to see inflation begin to increase again. Higher inflation could lead to fewer interest rate decreases. A few factors that could lead to higher inflation include higher wages (ie unions demanding significant wage increases), stimulus from the Chinese government (which will lead to higher demand for goods and services) and potential tariffs (which would lead to higher prices of goods). A ‘reset’ of interest rate expectations could be problematic for markets. Clearly, there are positive and potentially negative factors impacting markets and the economy. We continue to remain in the ‘cautiously optimistic’ camp.

US Election

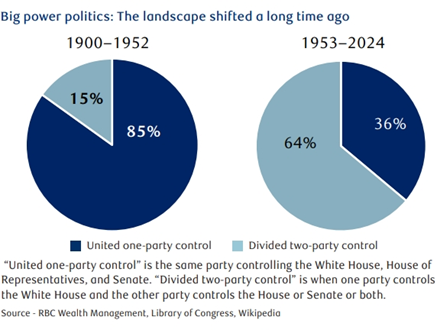

With financial markets near all-time highs, many investors do not seem too concerned regarding the outcome of the election. Financial markets prefer to have checks and balances in government (ie representation of both parties in the House, Senate and White House), so a one-party sweep would be an unfavourable outcome. For example, the difference in tax proposals is stark. Currently, the basic corporate tax rate is 21%. The Republicans want to move it to 15% and the Democrats want to move it to 28%. Without sweeping the House, Senate and White House, neither candidate would be able to make radical changes if they faced gridlock. The probability of a one-party sweep is low, and history would suggest it is unlikely. The picture below illustrates that, since 1953, one party has had united control only approximately one third of the time.

Residential Real Estate

Home ownership in Canada continues to be a challenge for many. While the market has softened over the past year, purchasing a home is still challenging. Two of the recent government incentives for first home buyers include an increased limit of borrowing from RRSPs (increased to $60,000 from $35,000) and the introduction of First Home Savings Accounts (FHSAs). If you or any family member is interested in speaking about these options, we are happy to connect at any time.

Pearlstein Wealth

We recently hosted a webinar on elder caring with Audrey Miller, the founder and managing director of Elder Caring Inc. The webinar was very informative and thought provoking. We think it was helpful to children with aging parents and to individuals enjoying their golden years. If anyone would like a recording, please reach out to us.

Wishing everyone a happy and healthy fall!

Pearlstein Wealth