Stock Markets

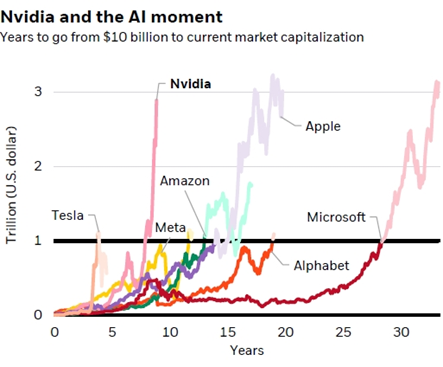

In the US, much of the year-to-date gains have been concentrated in a handful of companies. Six stocks have accounted for 60% of the gains throughout the first half of the year. Furthermore, three stocks (Apple, Microsoft and Nvidia) account for more than 20% of the value of the US stock market – and the top ten stocks represent nearly 40% of the market value. Below is an interesting chart showing how quickly Nvidia has grown into a $3 trillion company:

Source: Blackrock

We own many of these stocks directly, or through Exchange Traded Funds (EFTs), as well as many other blue chip companies. Beyond the handful of technology companies, the remainder of the market is mostly out of favour. Understandably, there is significant optimism regarding artificial intelligence. However, the concentration of gains in such a small number of companies is disconcerting.

Canadian Economy

The Canadian economy continues to underperform the US. Our unemployment rate is now 6.4% - the highest since 2022. As well, the Bank of Canada has begun lowering interest rates (a sign of our slowing economy) whereas the US is likely not going to begin lowering interest rates until the fall. It has been well documented that Canada’s productivity has lagged most other G7 countries. The results of the recent by-election in St. Paul’s could be a signal that Canadians are looking for a change in leadership, which may help to improve Canadian economic growth.

US Politics

After the recent presidential debate and assassination attempt, the markets are pricing in approximately a 60% probability of Trump winning the election in November. We expect there will be many more discussions regarding Biden’s ability to lead as we approach the Democratic national convention taking place August 19 to 22. Peggy Noonan, the former speechwriter for Ronald Reagan, recently opined in the Wall Street Journal after the debate, that if Trump were smart, he would not agree to another debate. We expect that if Trump were to win the presidency, as well as the House and the Senate, there would be tax cuts, tariffs, and tighter border controls.

Pearlstein Wealth

We are excited to be hosting a webinar this fall with an expert on healthy aging. Look for information regarding the webinar later this summer.

Wishing everyone a great summer!

Pearlstein Wealth