There’s weather folklore that posits if the weather at the beginning of March is bad, it should give way to better weather at the end of the month—in like a lion, out like a lamb—which is certainly something those of us in the coldest of climates hope for, with limited success, each and every spring.

And given historic global market volatility and tumult that have transpired through the first part of March, investors must undoubtedly be hoping for the same.

Time for a rethink

While financial market conditions at the moment could hardly be characterized as lamb-like just yet, market uncertainty apparently subsided enough over the past week to give policymakers at the Federal Reserve enough confidence to deliver the central bank’s ninth rate hike of the past year, bringing its target policy rate to a range of 4.75 percent to 5.00 percent; the highest level since 2007. But what now?

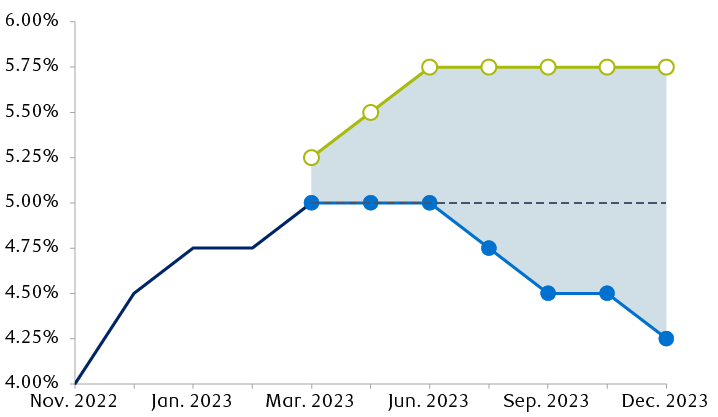

The chart shows just how dramatic the market’s reassessment of the expected path of the fed funds rate this year has been. At the beginning of March when the Fed was teeing up the idea of continued aggressive rate hikes, markets were looking for hikes to a level as high as 5.75 percent this year. Following the banking stress of recent weeks, markets are now looking for rate cuts.

After the Fed’s latest rate hike, markets now look to rate cuts

Line chart showing the Fed's rate hikes since November 2022 from 4% to 5% as of the last meeting on Mar. 22, 2023. Chart also shows where markets were previously expecting the Fed to raise rates to approximately 5.75%, markets now believe the Fed is done, and that policymakers will cut rates to around 4.00% by year end.

Source - RBC Wealth Management, Bloomberg; Fed funds futures rate expectations as of 3/22/23

We think the market broadly has it right. We believe the Fed is indeed done raising rates and that it will need to pivot to two 25 basis point rate cuts later this year as U.S. recession risks materialize, with rates ending 2023 at 4.50 percent, well below the Fed’s current projection of 5.25 percent.

Withdraw first, ask questions later

We also maintain our view, and emphatically so, that recent events and stress within the U.S. banking system remain isolated events which are not signs of systemic problems—but there will be ripple effects that impact the flow of credit and economic activity.

At the heart of the matter, particularly for smaller regional banks, is the ongoing risk of deposit outflows. Though a portion of the negative market reaction this week can be attributed to the Fed’s rate hike and Chair Jerome Powell’s reluctance to concede the possibility of rate cuts this year, there was also seeming disappointment with some comments made by U.S. Treasury Secretary Janet Yellen, also around the time of the Fed’s Wednesday meeting. In remarks at the American Bankers Association conference, she said there were no plans or ongoing discussions with respect to guaranteeing all deposits in the U.S. banking system beyond the standard $250,000 level.

Ultimately, we believe that something will need to be done with respect to deposit guarantees in order to stem the tide of deposit withdrawals from smaller banks, deposits which may flow to the larger “too big to fail” banks, or to other alternatives such as money market funds. Powell stated that the Fed has seen a decline in such activity over the past week, but it will take more time, and perhaps even months, to assess whether it’s a sustained trend and that we are indeed past the acute phase of deposit outflows. Regardless, we still think more needs to be done.

A different kind of rate hike?

Powell noted during his press conference that the knock-on effects of recent bank turmoil could potentially come in the form of reduced willingness on the part of banks to extend loans and credit—the impact of which would be slower economic growth and reduced inflationary pressures.

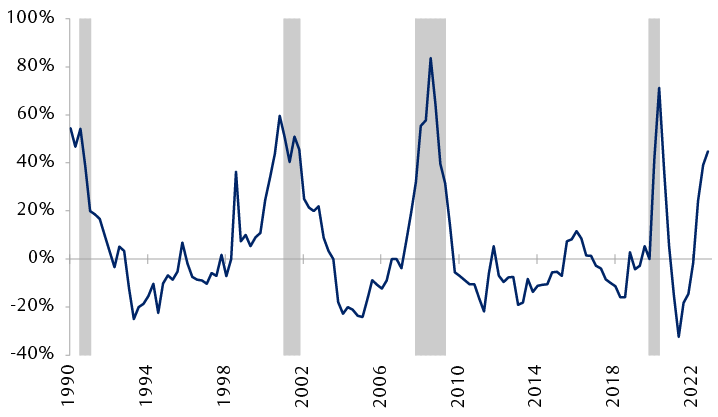

But as the chart shows, lending standards in the Fed’s quarterly Senior Loan Officer Survey were already tightening in Q4 of last year—the latest data available. Recent stress is only likely to amplify the tightening of lending standards when the Q1 2023 report is made available sometime in April.

Even before recent bank failures, loan officers were tightening lending standards

Commercial & industrial loan standards tightening

Line chart showing the net percentage of loan officers tightening lending standards for commercial & industrial loans from 1990 through Q4 2022. Even before recent financial system stress, which the Fed expects to amplify the tightening of lending standards, lending standards had already tightened to levels not usually seen outside of officially dated recessions.

Source - RBC Wealth Management, Bloomberg, Federal Reserve Senior Loan Officer Survey for Q4 2022. Gray columns represent U.S. recessions.

This both adds to our conviction that the U.S. economy is at greater risk of a recession this year—though mild—and that the Fed will end its rate hike cycle as a result. In a sense, reduced lending and tighter financial conditions would be doing the Fed’s job, so layering in further rate hikes on top of that would only raise economic jeopardy.

Are the pieces in place?

At this stage, it may be too much to ask that global markets go out like a lamb in March, but we do feel that the pieces are now in place for broad market volatility to continue to fade. The S&P 500, despite all the stress stocks have had to weather, has now turned slightly positive on the month. Its focus going forward will likely be on the economic impact of the regional bank stress and recession risks, along with the Q1 earnings season that will begin in mid-April.

High Treasury yields—which have been a headwind for markets throughout this rate hike cycle—have dropped precipitously as a result of the market’s rate cut expectations and recession fears. The decline in yields should also help to ease market angst, and reduce pressures in the financial system, some of which contributed to the bank failures that sparked this latest round of volatility.

While recession risks are perhaps now higher in the aftermath of the March banking stress, we are always quick to remind investors that recessions are a normal part of economic cycles, and that any recession is likely to be mild on the back of strong U.S. labor markets and still-resilient consumer spending.

In fact, we think a mild recession could even speed up the Fed’s achievement of its inflation goals, bring demand and supply back into balance, and form the foundation of a longer, stronger, and more sustainable economic expansion.