Now that Sarah has set up her budget and chosen the right investment accounts (TFSA, FHSA, RRSP), she’s ready to explore what to actually invest in. Imagine her investment account is a garage. It’s the place where she can store investments. Inside the garage, she has different vehicles—these are investment products. Just like choosing the right vehicle for a trip, Sarah can choose different investments depending on where she want to go (goals), how fast she wants to get there (timeline), and how much risk she’s willing to take (comfort level).

Stocks (Equities): A fast car that can go far and fast, but the ride may be bumpy.

When you buy stocks, you are essentially purchasing a small ownership stake in a company. Think of it like owning a powerful, high-performance car. This car has the ability to accelerate quickly, symbolizing the potential for significant growth in your investment over time. Just as a fast car can zoom ahead of slower vehicles, stocks have the potential to deliver higher returns compared to many other types of investments.

However, the ride can be bumpy. Stock prices can swing sharply in the short term due to market conditions, company performance, or investor sentiment. Most of the time the journey feels smooth and exciting and stocks are the most efficient way of getting to your destination, though potholes will be inevitable along the way. The most important thing is to not panic during the short lived bumpiness, and remember the destination.

Mutual Funds: A tour bus where someone else drives, and you share the ride with others for a smoother journey.

Investing in mutual funds is like joining a guided tour bus rather than navigating the journey on your own. Instead of managing your own fast car (stocks), you hand over the steering wheel to a professional driver, a fund manager, who navigates the route for you.

This bus carries many passengers, symbolizing investors who pool their money together. This means your money is spread across a variety of stocks, bonds, or other assets. Seeing these different “sights” helps reduce risk, because you are not relying on only one investment to perform well. This is called diversification.

Because an expert driver is behind the wheel, you benefit from professional management. The fund manager researches companies, monitors market conditions, and makes decisions to help maximize returns while managing risk. This is ideal if you want to invest but don’t have the time, knowledge, or desire to pick individual stocks or bonds.

Just like a bus can’t always avoid traffic, mutual funds aren’t immune to market downturns, so your investment can still fluctuate. And because you’re sharing the ride, you pay fees (called expense ratios) for professional management, which can slightly reduce your overall returns.

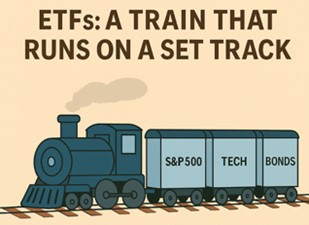

ETFs: A train that runs on a set track

Investing in an ETF is like boarding a train. It’s fast, efficient, and takes you across a wide range of investments with one ticket. Each car on the train represents a different company, sector, or type of investment. When you buy a share of an ETF, it’s like getting a ticket for the whole train—not just one car. This is a great way to diversify.

Just like a train follows a set track, an ETF follows a specific index. Most ETFs are passively managed, meaning they aim to copy the performance of that index rather than having a manager pick individual stocks. This makes ETFs low-cost and transparent, so you know exactly what you're investing in.

For example:

• An S&P 500 ETF includes 500 of the largest U.S. companies.

• A tech ETF might hold Apple, Microsoft, and NVIDIA.

• A global ETF includes companies from different countries.

Bonds (Fixed Income): A scooter that is very safe and steady

Investing in bonds is like riding a scooter on a smooth path. They do not go too fast, but keep your money moving safely and steadily. When you buy a bond, you’re lending money to a government, company, or organization. In return, they promise to pay you back over time with regular interest payments. At the end of the term, you also get your original investment back (the face value of the bond).

Just like a scooter is perfect for slow, careful trips rather than fast journeys, bonds typically offer lower risk and lower volatility than stocks. They won’t deliver huge gains, but they can bring steadiness and reliability to your investment portfolio. However, because bonds are meant to be held until maturity, they can have liquidity risk—meaning it may be harder to sell them quickly without losing value—so they’re best suited for investors with a longer time horizon.

Bonds are a popular choice for those who value predictable income and want to avoid the big bumps and sharp turns of the stock market, making them an important part of a balanced financial plan.

Cash & GICs: A bike that is steady slow, and stable

Cash and GICs (Guaranteed Investment Certificates) are like riding a bicycle. It may not be as fast or exhilarating as a race car (stocks) or as diversified as a tour bus or train (mutual funds and ETFs), but they offer a steady and reliable ride.

When you put your savings into cash or GICs, your investment is protected—you’re guaranteed to get back your original amount plus a small, fixed amount of interest (like getting a small push forward with each pedal). One drawback is that GICs often come with liquidity risk—your money is locked in until maturity, and they typically offer returns that may be too low to keep up with inflation over the long term.

Just like riding a bike on a flat path, cash and GICs tend to move slow and steady, without the dramatic ups and downs of stocks. That makes them a good option for conservative investors or those nearing retirement who want predictable income and lower risk.

Just like planning a long journey, investing can feel overwhelming without a clear route. That’s where working with an investment advisor can make a big difference. An advisor acts like your financial GPS, helping you build a personalized roadmap based on your goals, timeline, and comfort with risk. They’ll help you choose the right mix of vehicles—whether it’s the fast car of stocks or the steady bike of GICs, and make adjustments along the way to keep you on track toward your destination.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information.

The strategies and advice in this newsletter are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change.