Watch our video here:

Building and growing your wealth early is key to long-term financial success—and at The Pamela Yoon Group, we’re committed to helping you feel empowered to make smart, lasting financial decisions.

Over the coming months, we’ll be releasing a five-part series exploring the most important topics young adults should understand. To make these concepts more relatable and applicable, we’re introducing a fictional character: Sarah.

Sarah is 23 years old, freshly graduated from university, and just started her first full-time job earning $50,000 a year. Like many young professionals, she’s figuring out how to manage her income, build good habits, and make smart decisions with money. Through Sarah’s journey, we’ll walk you through key financial concepts and practical strategies to set a strong foundation for the future!

1. Start with the Foundation: Budgeting

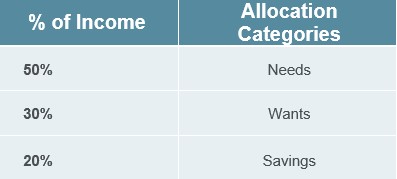

Let’s start Sarah’s financial journey with the foundation of any solid financial plan – budgeting. Sarah wants to learn how to budget with intention. A simple and effective approach Sarah is using is the 50/30/20 rule:

- 50% of her income goes to needs like rent, groceries, and transportation

- 30% to wants like dining out, entertainment, and hobbies

- 20% to savings and investments for the future.

She sets up a simple excel spreadsheet and downloads a budgeting app to track her spending. Sarah quickly starts to notice where her money is really going, like how much she's spending on delivery apps or streaming services she forgot he subscribed to! This kind of tracking helps her spot patterns, make adjustments, and stay focused on her goals. It's the first step in turning income into long-term wealth.

2. Power of Compound Interest

Albert Einstein once famously said “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” Let’s see how this ties in with the 20% from the 50/30/20 rule we learned from the budgeting blog earlier.

Compound interest is one of the most powerful concepts in finance. The magic lies not in how much you invest, but in how long you let it grow. Let’s look at a real-life example using the charts below.

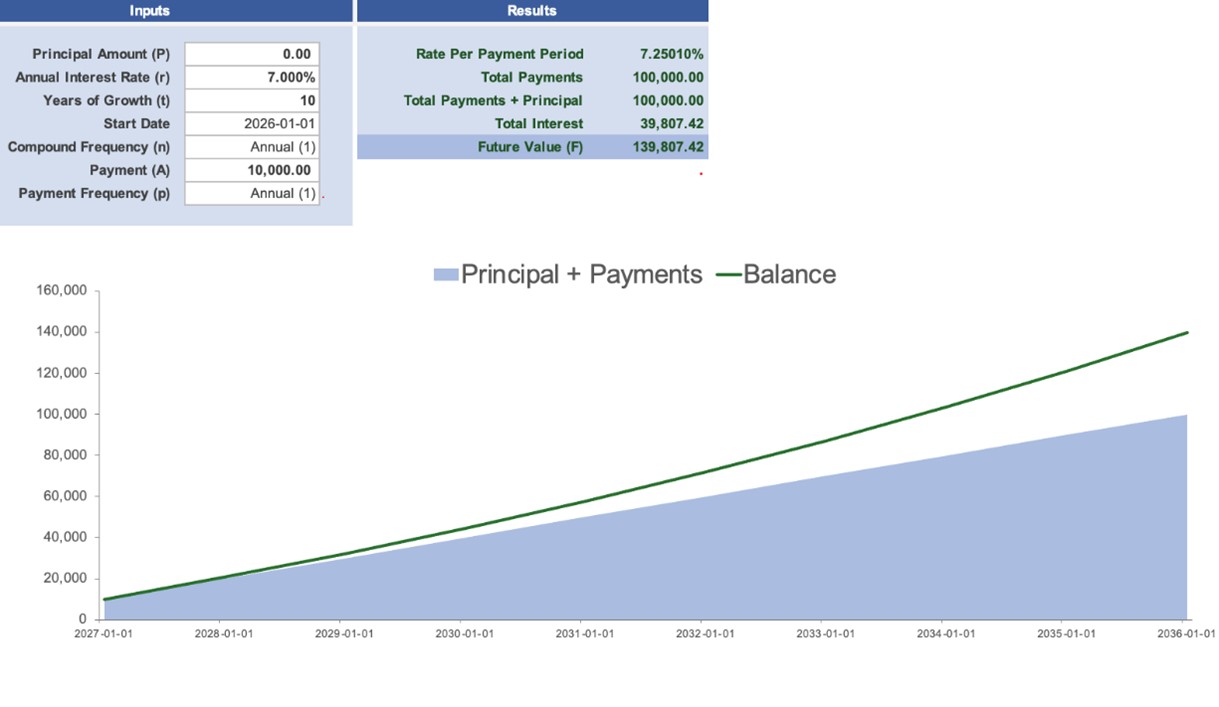

Suppose Sarah invests $10,000 (20% of her annual salary) a year at a 7% annual return. After 10 years, her investment grows to $139,807.42, generating $39,807.42 investment growth.

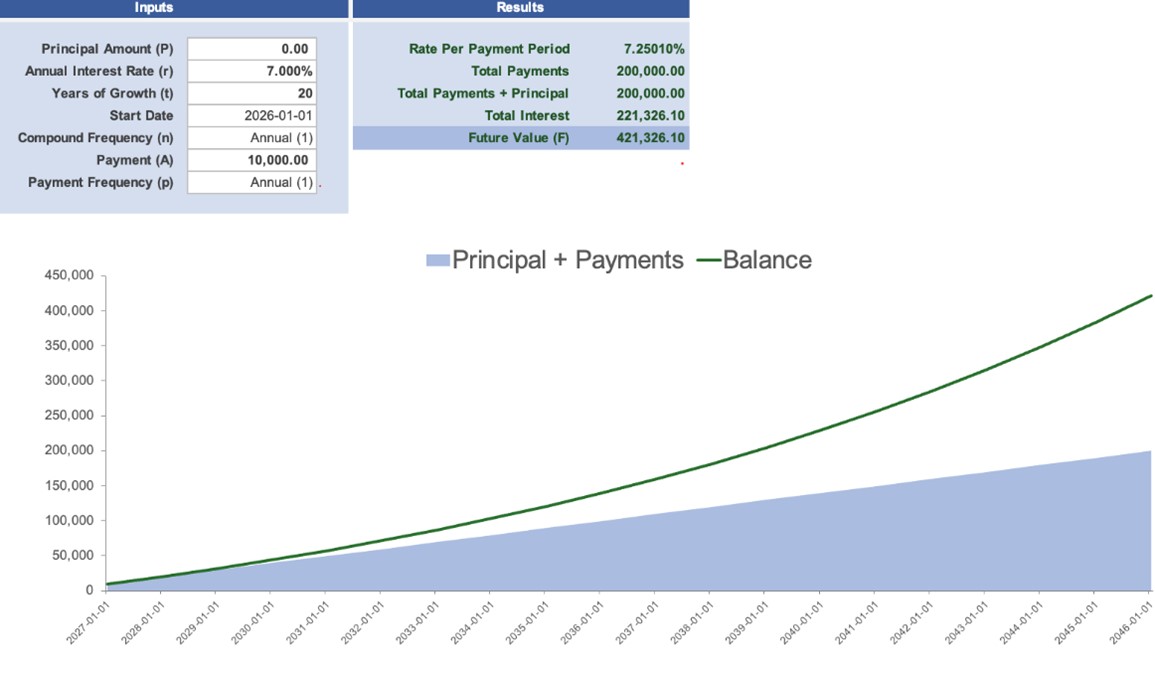

Stretch that same investment plan over 20 years, and the balance grows to $421,326.10, generating $221,326.10 investment growth.

But the most powerful example comes after 30 years: $10,000 annually grows into $988,197.06 generating $688,197.06 growth. That’s the exponential power of compounding. The key takeaway is the earlier you start, the more opportunity your money has to grow through compounding.

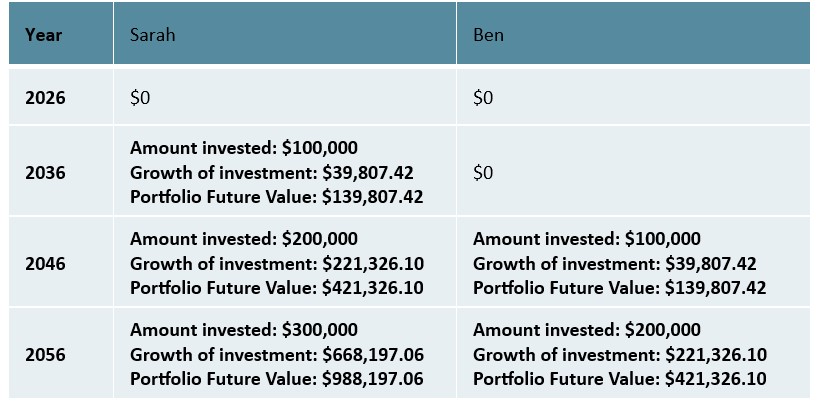

Sarah, who learned about investing early on, decides to start putting away $10,000 every year beginning January 1, 2026. Her best friend Ben on the other hand, delays investing for 10 years, starting on January 1, 2036, contributing the same $10,000 annually. By 2056, Sarah's investments—just by compounding for 30 years have earned $668,197.06 investment growth, compared to Ben who compounded for 20 years, earning him $221,326.10. That’s three times more growth, just because Sarah started earlier!

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information.

The strategies and advice in this newsletter are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change.