Traditionally, publicly traded stocks and bonds have been the foundation of diversified investment portfolios. Most investment advisors, mutual funds, and ETFs build portfolios using these publicly traded instruments, as they offer global depth and liquidity.

For the past 40 years, stock and bond markets have exhibited a loosely inverse correlation—when stock markets fell, bond markets typically rose, and vice versa. This pattern was driven by factors such as declining interest rates, lower inflation, globalization, and demographic shifts. As a result, investors could sleep at night relying on a balanced portfolio of stocks and bonds to mitigate risk.

However, this dynamic began to change in 2021.

By analyzing market trends beyond the past four decades, we recognize that stocks and bonds have, at times, moved in the same direction. Periods of volatile interest rate movements and geopolitical uncertainty necessitate expanding the tools used to manage client portfolios beyond traditional asset classes.

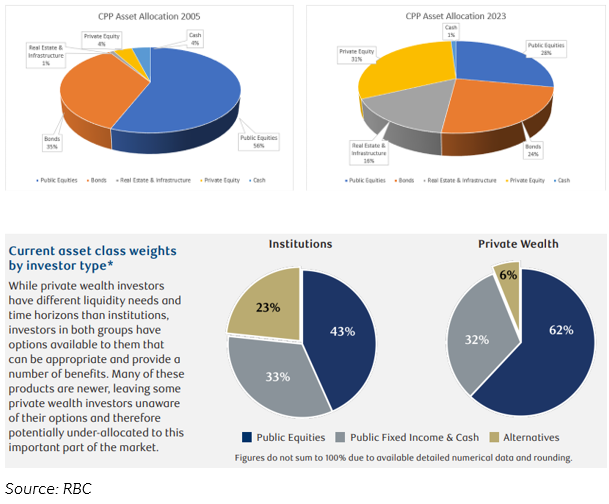

Long-term investors—such as global pension plans (with the Canada Pension Plan leading the way), endowments, and family offices—have long understood that a truly diversified portfolio should also incorporate alternative investments.

Today, more companies in North America are choosing to stay private, including businesses that have valuations over >$100bln, like SpaceX and Stripe. Historically, going public via an IPO was the traditional route for private companies, as the public markets provided more access to capital so businesses could continue to fund their growth. However, private market financiers and providers of capital have grown significantly over the past few decades leading to companies being able to support their growth by staying private longer, and sometimes for ever. Companies staying private longer mean more value is created for those investors who can access private market shares through alternative investments.

What Are Alternative Investments?

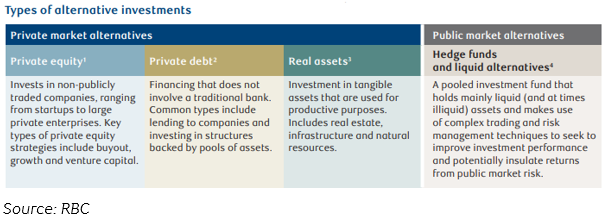

Alternative investments can be broadly categorized into private market alternatives and public market alternatives.

Investors in alternative assets typically seek higher returns or uncorrelated performance to compensate for the lower liquidity and higher risk associated with these investments.

Institutional investors have been increasing their allocation to alternative investments for years. Given their less liquid nature, a long investment horizon is essential. Individual investors should carefully assess their cash flow needs to ensure appropriate portfolio liquidity before investing in certain alternatives. The Canada Pension Plan’s asset allocation over the past 18 years exemplifies this shift to include more alternative investments in its portfolio. In 2005, over 90% of its investments were in traditional asset classes, but today, private market investments represent a significant portion of its portfolio as can be seen below.

Benefits of Alternative Investments

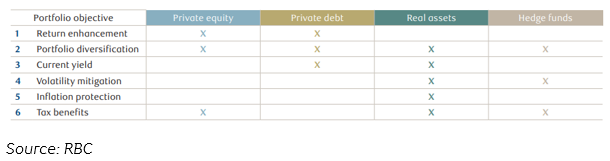

Alternative investments offer several advantages:

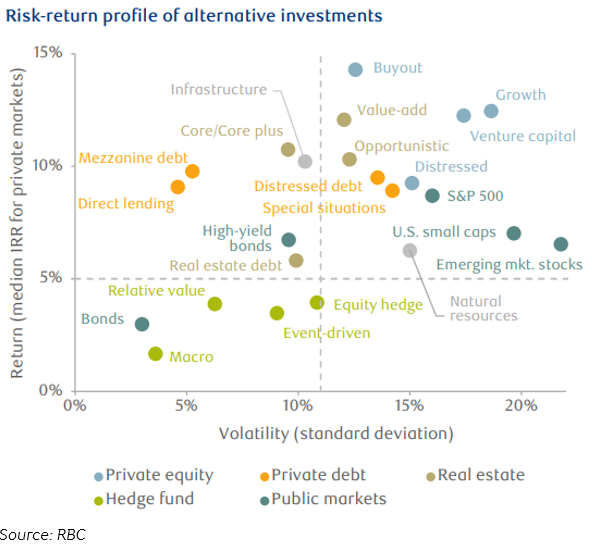

1. Return Enhancement – Investors can earn higher returns by taking on illiquidity risk and accessing less efficient market segments.

2. Portfolio Diversification – Alternatives provide exposure to asset classes beyond publicly traded stocks and bonds, enhancing diversification.

3. Current Yield – Private credit and real assets (such as real estate, infrastructure, and natural resources) often generate higher yields with lower volatility than public market counterparts.

4. Volatility Mitigation – Alternative investments tend to rely more on individual investment performance than broad market trends, potentially reducing portfolio volatility.

5. Inflation Protection – Certain assets, including real estate and agriculture, can hedge against inflation by benefiting from rising prices.

6. Tax Benefits – Some alternative investment structures, such as Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs), offer tax advantages.

Why Do Alternative Investments Offer Higher Returns?

Investors often wonder what drives the higher returns of alternative investments. Several key factors contribute to this premium:

• Liquidity Premium – Investors are compensated for giving up the ability to quickly liquidate their investments.

• Greater Control – Private asset managers have more influence over operational, governance, and financial decisions compared to public markets.

• Manager Alpha – The discrepancy between top- and bottom-performing managers is greater in private markets, allowing skilled managers to generate excess returns.

• Expanded Opportunity Set – The private market includes over 150,000 companies in the U.S. (with 20,000+ generating more than $100 million in revenue), compared to just 4,000 publicly traded companies.

While private markets do not always outperform public markets, investors with long-term horizons should expect incremental returns for taking on the associated risks. However, in the short term, relative performance between public and private markets can be highly variable. Historically, public markets have been prone to larger and more rapid swings between under and overvaluation, leaving public markets in a position to potentially outperform in periods that follow sharp drawdowns.

Fund Structures in Private Alternatives

Private alternatives typically fall into two main fund structures: closed-end funds and open-end funds.

Closed-End Funds

• Traditionally used for private market investments.

• Illiquid assets with no liquidity provisions, eliminating liquidity mismatch risks.

• Investors commit capital during a fixed fundraising period (6–18 months).

• Capital is deployed over a 2–5 year investment period.

• Funds distribute returns during a 5–8 year harvesting period.

• Total lifespan is typically 10–15 years, with no redemption features.

• Investors seeking liquidity must sell in secondary markets, often at a discount.

• Investment managers collect fees on total capital commitments.

Open-End Funds

• Hold illiquid assets but maintain a portion in liquid assets to facilitate redemptions.

• Allow ongoing purchases and redemptions, potentially creating liquidity mismatches.

• No termination date.

• Provide liquidity quarterly at Net Asset Value (NAV), subject to fund limits (e.g., 3–5% of assets per quarter).

• Lower minimum investment requirements.

Integrating Private Market Solutions into Portfolios

Alternative investments can be used strategically to enhance returns and manage risk:

• Asset Allocation – Private market investments generally enhance returns, while hedge funds and liquid alternatives serve as diversification tools.

• Diversification – Equity exposure can be split between public and private markets, while fixed income exposure can incorporate private credit.

• Inflation Hedging – Real assets provide inflation protection.

Due Diligence on Alternative Investments

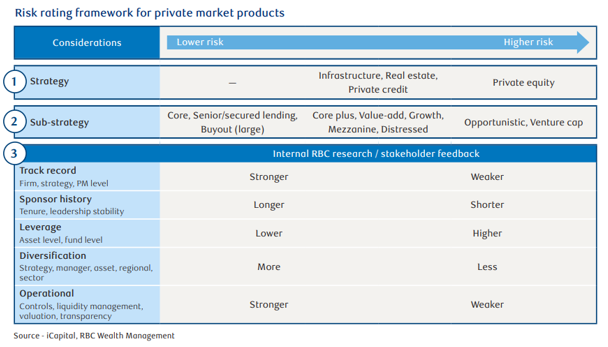

Evaluating alternative investments requires a rigorous due diligence process. RBC Wealth Management has a dedicated Alternatives Investment Team, led by Mikhial Pasic in Vancouver, to research and vet investment opportunities.

RBC Wealth Management’s approach:

- RBC Wealth Management has a dedicated team, building out a “shelf” of open-end and closed-end private market offerings from a range of leading global and domestic fund managers.

- RBC Wealth Management is positioned advantageously in this market due to its size and scale in the Canadian marketplace, and its ability to leverage relationships and activities with RBC Wealth Management US and the investments it is making in this space. Our focus on delivering attractive, globally sourced solutions via Canadian registered vehicles that are suited to domestic client needs can serve as a differentiator to cross-border activity from the larger US wealth mangers.

Their evaluation process includes:

• Track Record – Analyzing historical performance, investment strategy, and market adaptability.

• Sponsor History – Assessing management tenure, team stability, and compensation structure.

• Leverage – Examining both asset-level and fund-level leverage.

• Diversification – Reviewing sub-strategy and company diversification within funds.

Risks of Alternative Investments

Despite their benefits, alternative investments also carry risks:

1. Liquidity Risk – Private assets lack active markets, making them difficult to sell. Holding periods should typically range from 5–10 years.

2. Regulatory Considerations – Private investments are not subject to the same regulatory protections as public market assets.

3. Valuation Challenges – Private assets lack transparent pricing, requiring valuation by fund managers and independent appraisers.

4. Leverage Risk – Private companies and fund managers may use high leverage, increasing risk exposure.

5. Higher Fees – Alternative investments often have elevated fees, including management, performance, and administrative costs.

Conclusion

The Pamela Yoon Group recognizes the strategic benefits of incorporating both return-enhancing and risk-mitigating alternative investments into client portfolios. In collaboration with RBC Wealth Management’s dedicated Alternatives Investment Team, we thoroughly vet each opportunity before integrating it into investment strategies. This blog serves as an introductory guide to our perspective on alternative investments.

If you have any questions, please contact Pamela Yoon or Liam Voykin.