Last week, I had a phone conversation with a lady whom my client had asked me to help. This lady lamented that she is now in her late 60's and not in a good financial shape. She said, "Pam, I wish I met you 25 years ago".

I have been advising clients for almost 3 decades; I have had a lot of client conversations. I have also built a lot of financial plans. One of my greatest joys in life is to hear a client tell me that when they first met me, they were apprehensive about their financial future. They were worried that they may not be able to achieve their financial hopes and dreams. And now, after having worked with me for many years (and following the plan I created for them), they are confident that they have a solid plan in place to achieve all their hopes and dreams; that even their grandchildren will be able to reap the rewards of this plan. Now, that is pure joy!

Do you have a clear written financial plan in place? One that shows you where you are at, where you want to be, and will you have enough to achieve all those hopes and dreams? And when something like a prolonged bear market hits, will that derail your plans to live a joyful & fulfilling retirement, free of financial worry?

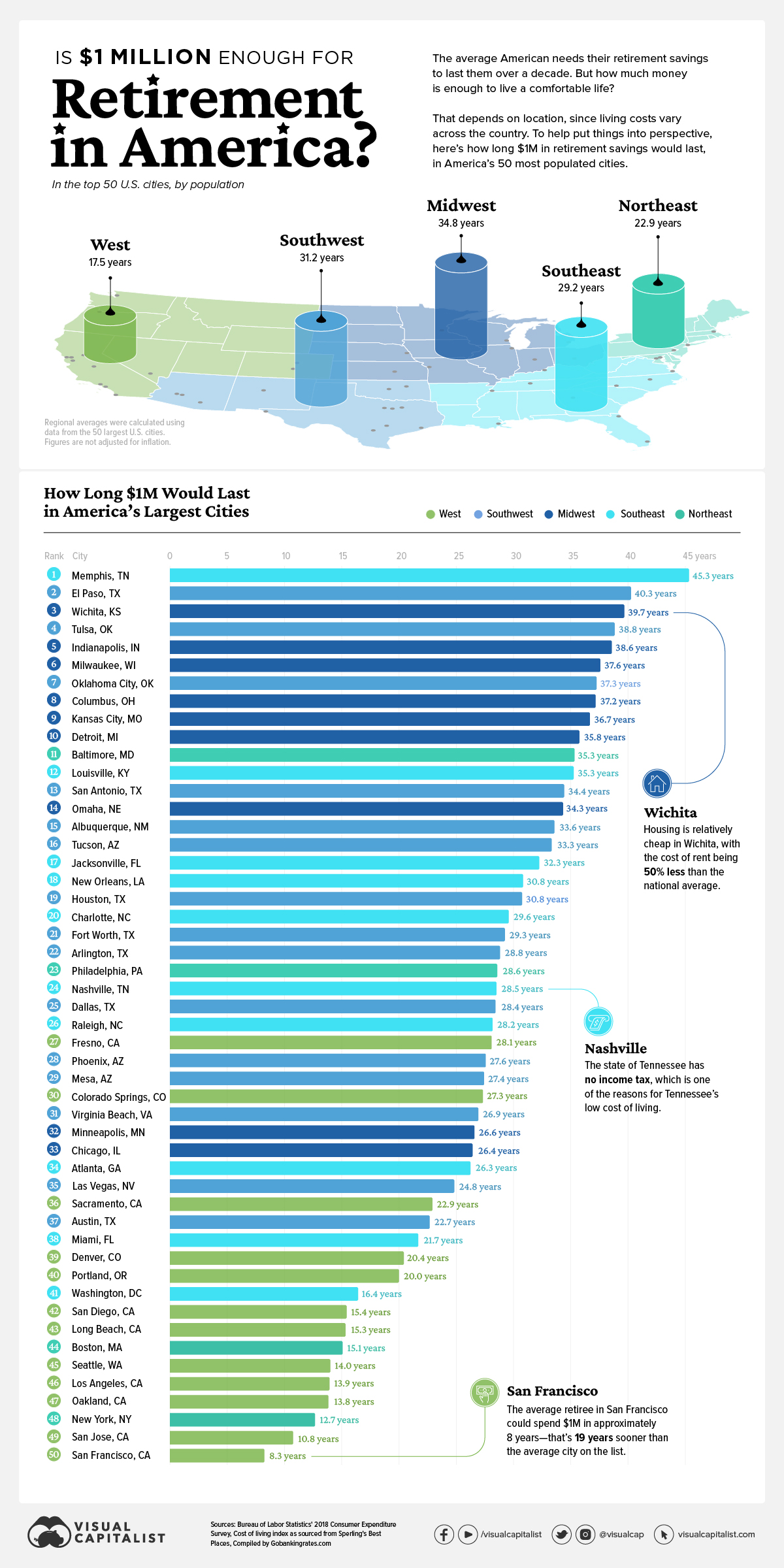

This chart below (from Visual Capitalist) shows American data, but Canadian data will be quite similar. You will see that there isn't really a clearcut answer whether $1 mill will be enough to retire on. It all depends on your expenses, your savings, your investment strategy and your dreams.

If you don't have a plan in place, come see me for one. I hope you never have the need to say me (25 years in the future), "Pam, I wish I met you 25 years ago".