- The December labour market data was mixed, but on balance adds to evidence that economic activity remained soft through Q4.

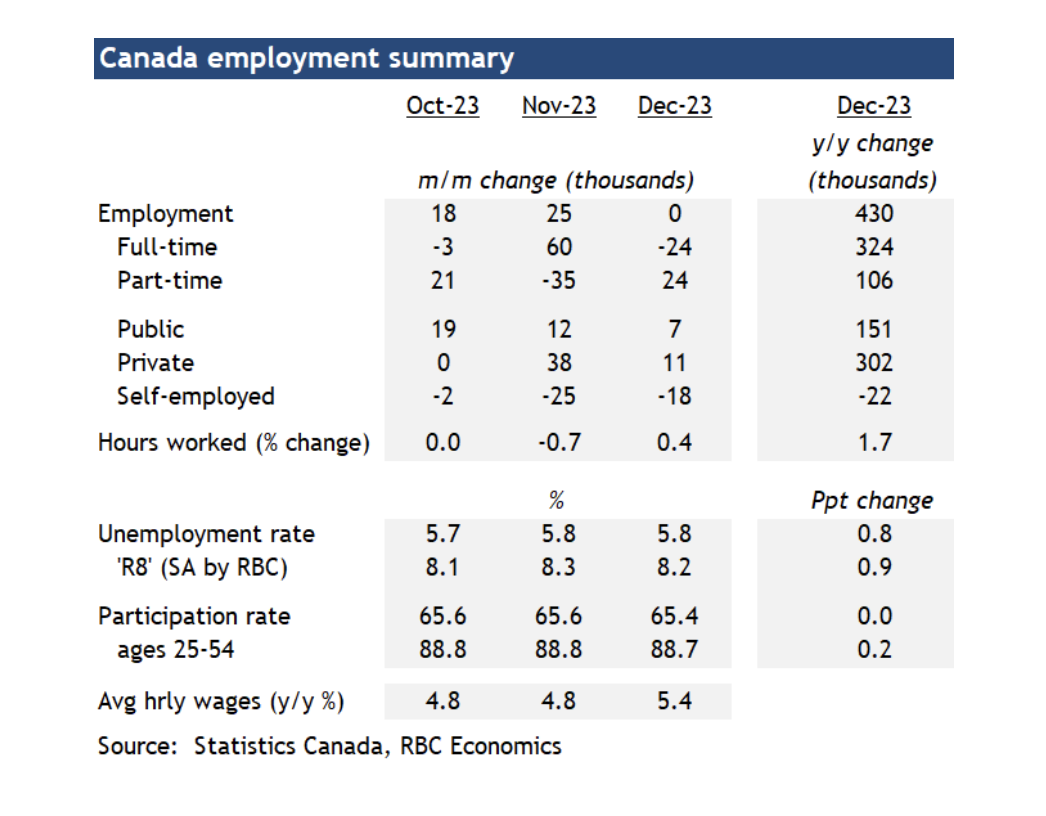

- Employment was essentially unchanged in December, the softest reading since a 6k decline last July. And the unemployment rate held at 5.8% - still up 0.8 percentage points from the spring.

- A 24k drop in full time employment was offset by a rise in part-time work. Trade (retail and wholesale) employment fell for a fourth straight month and manufacturing employment fell by 18k with offset from a 46kjump in professional services jobs.

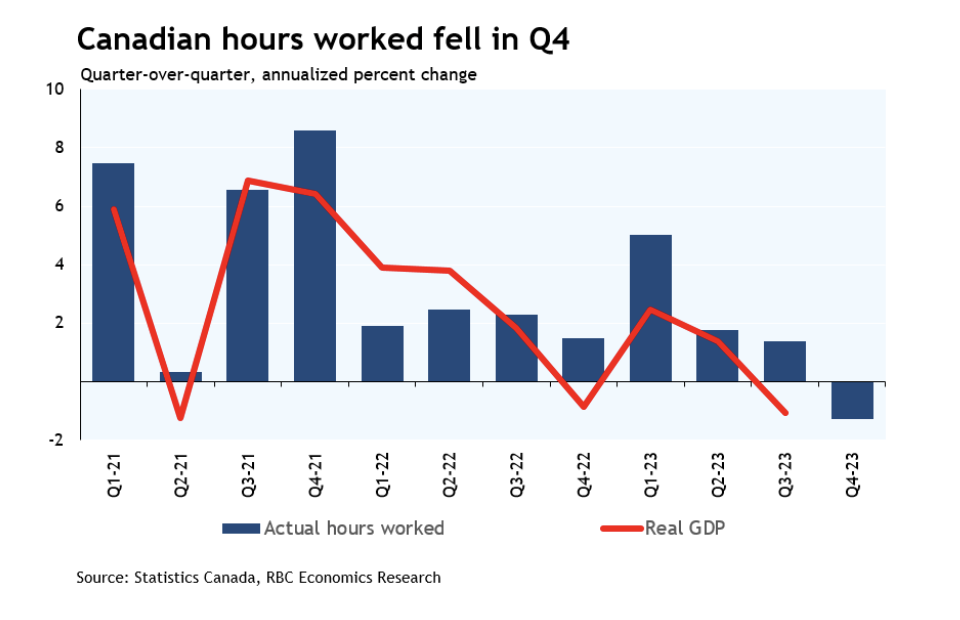

- Total hours worked still edged up 0.4% but that followed softer November and October readings. In Q4 as a whole, hours worked declined 1.3% at an annualized rate - consistent with earlier GDP reports pointing to another quarter of soft output.

- Population growth continued to surge higher (+74k) but the share of the population that participated in the labour force (ie. working or actively looking for work) ticked down to 65.4% (the lowest since December 2022.)

- Wage growth, though, remained a hot spot with average hourly earnings up 5.4% from a year ago. There is still scope for wages to move higher near-term, particularly for unionized workers as wages continue to catch up to inflation. But business surveys and softening labour markets continue to suggest the pace will slow.

- Bottom line: The bottom wasn't falling out from under Canadian labour markets in December. But employment growth has slowed, the unemployment rate is still up significantly from the spring, and (despite still surging population counts) hours worked outright declined in Q4 of last year for the first time since Q2 2020. The Bank of Canada will still be cautious about pivoting to rate cuts too quickly - and wage growth is still running above the pace historically consistent with their 2% inflation target. But our own expectation is that the economic backdrop is soft enough for inflation to continue to move lower and that the BoC will start to push the overnight rate lower around mid-year this year.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.