To my clients:

It was a mixed week for North American stock markets with the Canadian TSX finishing down 1.2%; the U.S. Dow Jones Index up 0.3%; and the U.S. S&P 500 up 1.3%.

Despite the release of the “Big 3” U.S. economic indicators this week, I’m going to begin, and focus more than usual, on Canada…

... as I noted in last week’s update, the Bank of Canada (BoC) was expected to be the first of the major western central banks to cut interest rates and, on Wednesday, the BoC delivered, lowering its benchmark rate from 5.0% to 4.75%. Further, most institutional followers, including the Royal Bank, expect more cuts to come before year-end (for what its worth, RBC Capital Markets expects another 0.75% of rate cuts through the end of 2024, and a full 1.0% of cuts in 2025). As BoC Governor Tiff Macklem stated:

“If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate.”

Now it’s true that inflation in Canada is cooling rapidly toward 2%, but unfortunately this is not necessarily all good news. A major reason inflation is cooling is because aggregate demand in Canada is also slowing which is indicative of a slowing Canadian economy. I’ve written many times about the growing divergence in economic prospects between Canada and the U.S., but the BoC’s first mover status is de facto evidence of these diverging paths. Further, given the much stronger economic data out of the U.S. (more on that below), it’s unlikely these diverging paths will re-align any time soon. Again, the BoC is aware of this when Governor Macklem states the following:

"There are limits to how far we can diverge from the United States, but we're not close to those limits.”

Macklem’s likely acknowledgement of a more rapidly lowering Canadian rate environment vis-à-vis the U.S. will, of course, also have implications for the Canadian dollar. RBC’s current expectation is that the Canadian dollar will decline approximately 5% vs the U.S. currency over the next year.

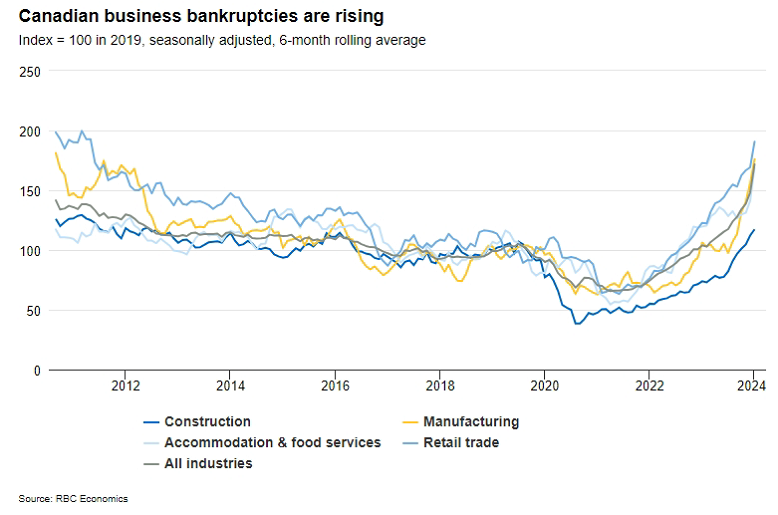

If more evidence is needed for the diverging economic paths, keep in mind that Canadian households are significantly more indebted than their U.S. counterparts, and further take a look at this internal chart showing the rise in Canadian business bankruptcies the past two years.

The preceding all said, it’s not all doom and gloom for Canada. The rate cut path that the BoC has now initiated will, in time, restimulate the Canadian economy as well as help to deleverage indebted Canadian households by reducing the debt service payments they make. But this will take time (at least a year and probably longer) and, for the foreseeable future, my preference to overweight U.S. equities in client portfolios stands.

Okay, that was a lot to take in. Turning now, much more briefly than usual, to the U.S. and the Big 3 economic indicators, suffice it to say that, as it has for most of the past two years, the ISM Manufacturing Index continues to modestly contract. But the much larger Services Sector, as it has too for most of the past two years, again reaccelerated and returned to expansionary territory. Meanwhile, the U.S. added a much stronger than expected 272,000 new jobs in May. Collectively, the indicators continue to point toward a healthy U.S. economy.

That’s it for this week. All the best,

Nick

Nick Scholte, CIM, FCSI

Senior Portfolio Manager

Scholte Wealth Management

RBC Dominion Securities Inc. │ Tel: 604.257.7569 │ Fax: 604.235.9950

3200-1055 West Georgia │ Vancouver, BC │ V6E 3P3

Toll Free: 1.844.665.9900 │Email: nick.scholte@rbc.com

Visit Our Website: www.nickscholte.ca

It’s an honor to receive referrals. If you have family or friends who would benefit from our services, please let us know.