“Thread the Needle” Rally

The lead section of this week’s comment feels like “groundhog day” when compared to what I wrote about in late 2019.

At that time stock markets were moving higher against the backdrop of flat earnings and large Fed overnight repo actions.

The summary statement to the 2019 comment was:

Every tick the S&P500 moves higher, the stock market valuations get stretched further. These conditions do not warrant higher stock market allocations in our portfolios and probably should have us thinking about reductions.

The March 2020 COVID-19 driven decline was breathtakingly sudden. Paralysis was a common feeling in the early weeks; fear was palpable in the final week of the decline.

Reducing market exposure was hard with such high volatility.

Right around the March 23rd bottom, the CNBC talking-heads were saying the US should close the stock markets and wait until a rational investment world returns.

Of course, when the stock market goes up irrationally, I don’t hear any talking heads worried that the stock markets should be closed until the world gets rational again…just sayin’.

I’m being sarcastic, but let me be deadly serious for a minute.

What does it mean when the stock market goes up with the backdrop of (a) 20+% unemployment, (b) 30% decline in S&P500 earnings, (c) massive government stimulus, and (d) huge US Federal Reserve intervention?

Here is an excerpt from well-known BEAR John Hussman, summarizing the market conditions of today:

The hallmark of “the Fed has my back” confidence is that investors have wholly ruled out the existence of market cycles, much less the possibility that valuations will ever again touch historically run-of-the-mill levels.

Yet even that is a problem. See, suppose you expect to receive a $100 cash flow a decade from today, and because interest rates are low, you’re willing to discount that future cash flow at a 0% rate of return. Well, on that assumption, it may very well be true that the “justified” price of that investment is $100 today. But if you actually pay $100 today for $100 a decade from today, you’re still going to get a 0% rate of return.

Put simply, when people say “low interest rates justify high stock valuations” what they actually mean is “low interest rates justify low future stock returns.”

Would you pay $100 for an investment today to get $100 back 10 years from now?

Hussman’s comment is somewhat complicated to understand, so let’s try another way to summarize what he is getting at.

Here is a list of things you need to believe will happen to justify buying stocks at the present levels:

- Fed has your back meaning liquidity will not be turned off no matter how high asset prices rise.

- The CV-19 vaccine is going to be available sooner rather than later, and it will be widely available enough to change MOST people’s behavior back to what it was in February.

- Before the vaccine is widely available, there will not be another significant breakout as the world opens up again.

- Interest rates will stay suppressed in the face of inflation and all this good news.

I was out riding my bike when I thought of that list of things.

Ironically, I was just coming to a section of the trail that is a bit like “threading a needle” at my skill level of riding.

“The trail goes through a dip with slippery cedar roots on weird angles laced through it, immediately it shoots up a side slope with a tree leaning in the pathway on the up-slope that needs to be ducked under, into a large fir root that must be accelerated into and hopped over, before descending into a tight, left turning, “skinny” trail with just enough room for your handlebars to get through.”

Once I cleared this spot (I did have to put my foot down once – sigh), it occurred to me that is kind of what the next few months are going to be like for the stock market from the present valuation point.

Only, the stock market can’t put its foot down!

Seriously, even with more than 30 years of experience in this industry, it nearly feels beyond my scope of expertise to handicap all of those points and forecast the schizoid stock market.

Before I move along, maybe one more perspective on valuation.

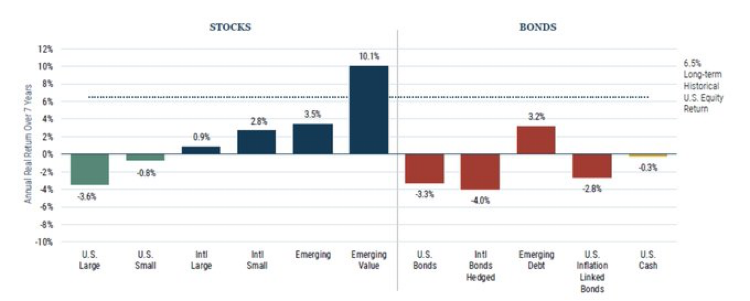

The following chart is from Jeremy Grantham at GMO, and shows the expected total rate of return expectation over the next seven years for a number of asset classes.

Grantham’s forecast numbers are really saying the same thing using similar data to Hussman.

In summary, each investor needs to be comfortable with how they approach their personal holdings here.

How much risk do you want to hold? Do you know how much risk you hold? What is your plan if something goes wrong with the “threading the needle” sequence above?

This has been a great recovery rally. It is time to be careful and taking profits is not a bad thing to do.

Finally, let’s list the billionaires that are saying be careful with their own money:

- Warren Buffett,

- Stanley Druckenmiller,

- Howard Marks,

- Jonathan Tepper,

- Ray Dalio…

I’m not saying they are correct, but what do they have in common?

They have nothing to sell you. Makes you wonder.

Short Gold Comment

The drum to buy gold is beating pretty hard these days.

The gold BULLS are taking of victory laps and speaking as though they have been right all along.

Let’s do some more homework on the gold story for this weekly comment.

The picture above is from an old industry award that holds a half ounce gold wafer. I thought it would be fun to see how this little bit of gold has held its value since it was given to me in 1995.

The chart below shows the US dollar denominated price per ounce of gold for the last 30 years.

If you look back on the chart you can see an ounce of gold in 1995 was worth about US$380.

When converted to Canadian dollars, ironically, the exchange rate from US to Canadian is almost the same as today…about 1.40. Therefore, an ounce of gold in Canadian was worth about $532 in 1995.

What would $532 have bought you in 1995?

Well back then, a Big Mac was just under $3.00, a new Mustang coupe would have run you about $20,000, and the average house price in Nanaimo was $155,000.

Today, an ounce of gold is worth $2,443 Canadian. This an increase of more than four times in nominal dollars.

In Canada, a Big Mac is $5.69 (twice as expensive), a new Mustang will cost about $35,000 to $40,000 (twice as expensive) and the average house in Nanaimo is now $585,000. (three and three-quarters as expensive).

The point I am making is that owning gold would have, more or less, kept your purchasing power of your savings constant.

The trouble with gold is you earn no income owning it.

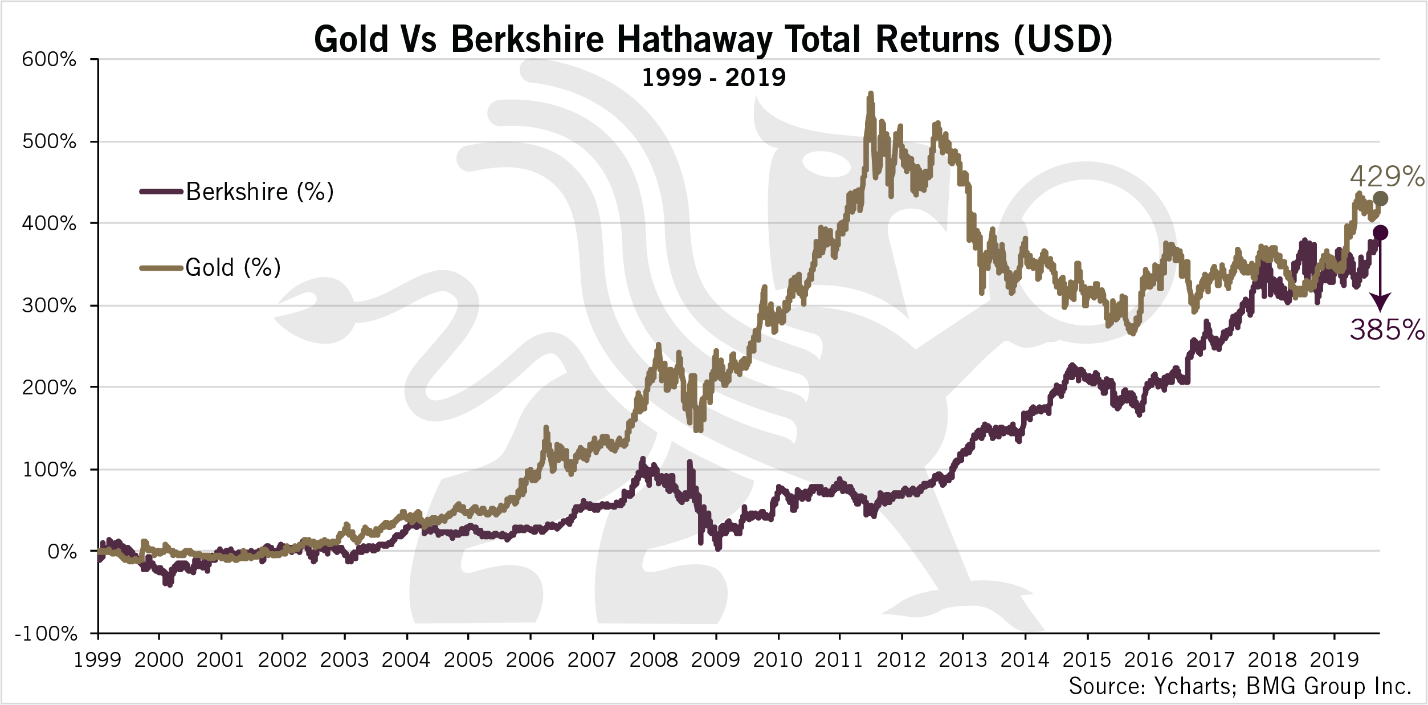

Another popular chart making the rounds is the “gold vs. Berkshire Hathaway shares” comparison.

Better comparison since Berkshire pays no dividends either.

Gold has been an excellent purchasing power maintainer for more than 5,000 years. It will likely continue to function in this capacity.

Bottom line: Gold is expensive here too. It has only slightly diverged from being correlated to stocks; I will be more comfortable with gold the more I see it hold its price against the backdrop of weaker stock and real estate prices.

It makes good sense to hold some gold, but have discipline with how much you hold and use stop losses on your positions.

***For clients – I am making some changes to portfolio composition due to the (a) stock market valuation extremes and (b) the possibility of how “threading the needle” doesn’t work out as a perfect trifecta bet. If you would like me to review your holdings with you, send me a reply back and I will call you.