A Word About Simple, Short Answers…

Occam’s Razor: “Where two explanations exist, the one that requires the least speculation is usually correct.”

H.L. Mencken: “For every complex problem, there is an answer that is clear, simple, and wrong.”

Trying to be simple and short has both risks and rewards.

What I have noticed over the past few months is that people are tuning out longer written comments and explanations. I’m not sure why, I just know it is true.

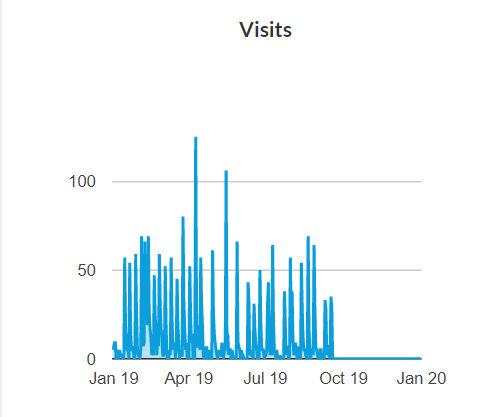

Normally, readership declines in the summer and jumps again in the fall, however that has not been the case this year.

Below shows the number of visits to our website/blog for 2019, and since Labour Day, my weekly comments have had the lowest readership of the year.

Most of the time, it makes no difference to me how much readership I have for the weekly comments, as it is the writing process itself that helps me stay focused on the themes that are important to manage portfolios.

If those who read it get some value from my thoughts, that is an awesome added benefit to the work.

But that is not how I feel right now.

I believe I have something important to say to you, so I am going to write it out in two bullets below so there is no mistaking my message:

- It is time to “de-risk” portfolios.

- It is time to review your financial plan and make sure it is relevant in the world of expensive real estate and stocks.

When I say de-risk, I am not saying to SELL and sit in cash.

In financial lingo, my goal is to leave the asset mix of stocks, bonds and cash approximately the same, but to lower both the alpha and beta in the portfolio.

In English, my goal is to lessen exposure to riskier investments within asset classes and buy safer ones.

As an example, for those who own bank stocks and utilities, my process would sell some of your riskier bank stocks and buy more utilities.

You would still have the same amount of overall stock market exposure, just less in an area that would be more negatively impacted by a recession.

The financial plan review would be to update the “stress tests” used in your personal plan.

Long term rates of return in stocks, bonds and real estate are subject to revision to the mean.

Let me add two charts to this comment.

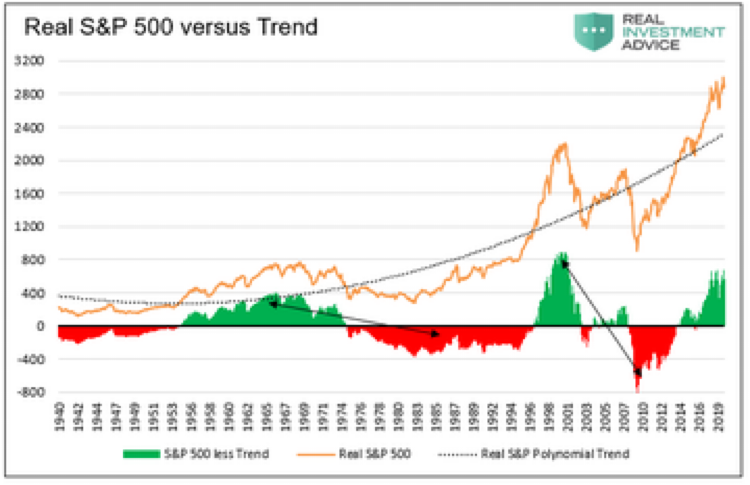

The first chart uses the US broad index of the stock market and shows it relative to its own performance. Has it done better or worse than its historical average?

Clearly, the US stock market is above trend.

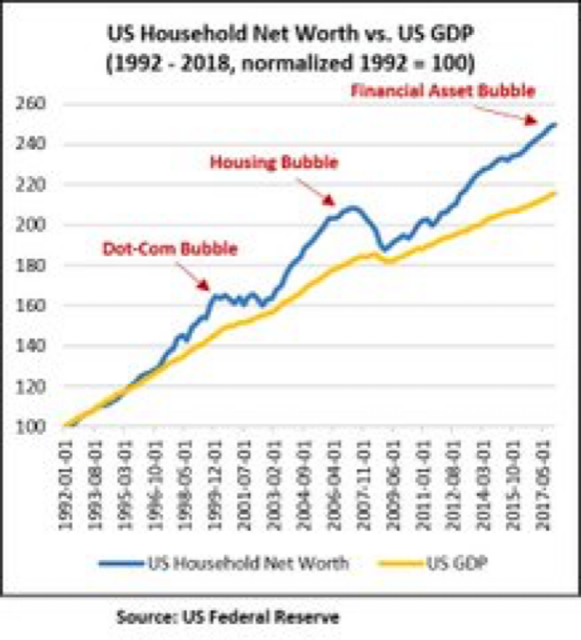

The second shows US household net worth relative to US Gross Domestic Product (GDP).

Again, this chart shows how American net worth is running hot vs. American GDP.

Neither of these charts make me BEARISH on stocks or real estate in and of themselves. They do make me believe the expected rate of returns for stocks and real estate will be lower than has been experience in the past 10 years.

I’m not the only one feeling this way.

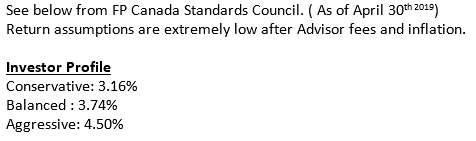

Below are the expected rates of return for 2019 based on the type of investor profile issued by the FP Canada Standards Council. Note, these returns are BEFORE management expense ratios (MERs).

How does your plan stand up to these rate of return expectations?

Please take some time to think about these two points.

Feel free to email or call with any questions.

European QE Infinity

Mario Draghi, the outgoing European Central Bank (ECB) chair, will go down in history as the chair who never raised interest rates.

Actually to sum up Mario Draghi’s legacy: He came to office, he cut interest rates, he printed money, and he ultimately failed to inspire a recovery in European economies.

Put another way, Draghi was the arsonist at the scene of the European economic bonfire who yelled for the fire department to do their job.

In his final pressor, Draghi reinstated every non-conventional monetary policy ever used in human history to try and fight the economic malaise that categorized the vast majority of Europe.

What is meant by unconventional?

- Cut the ECB overnight borrowing interest rate from -0.40% to -0.50%

- Exempted banks excess liquidity from negative interest rates in a 2-tier system.

- Scraps calendar based guidance. In essence, this is Quantitative Easing (QE) infinity.

- Net monthly QE purchases will begin in November at 20 million Euro per month.

- Lowered interest rates on targeted longer-tern refinancing operations (TLTROs), lengthen the maturity from 2 to 3 years.

Simple terms, the ECB is farther down the “rabbit hole” than it has been at any time in the past 10 years!

It is actually even a bit crazier than just that…

Let me talk straight about what happened in a 24 hour period of time on September 11th.

- China tariffs were delayed.

- President Trump Tweeted that the US Federal Reserve had no clue what it was doing and should cut interest rates to zero.

- The meeting above with the ECB took place and, again, every possible monetary tool was launched to try and get the Euro-economy going.

- President Trump then Tweeted and “interim China deal” would be acceptable.

The results: Not much of anything. Markets more or less just accepted the information as “normal.”

But when I look at that list of announcements, I see anything but normal.

Of course, last week the US Federal Reserve had their scheduled meeting for September.

Financial markets were basically “on hold” waiting for the announcement from the US Federal Reserve at 11:00 a.m., on Wednesday, September 18th.

The US Fed cut interest rates by 0.25% as widely expected. They went on to talk about how they stood to do “whatever is needed” in the future to maintain the functionality of financial markets etc. (Again, same old, same old).

At the end of the day, the path of least resistance for stock prices continues to be higher. But I want to be clear about something:

If you had told me that in the same week that a large percentage of Saudi oil would be taken off line and that the US Federal Reserve would have to try to bring down the overnight lending interest rate with $128 billion in repurchase agreements, I would not have bet you stock prices would have held basically flat.

The level of complacency in financial markets is high. This is not news and does not appear to be changing at this moment.

That said, risk happens fast and complacency can evaporate like a puddle on a hot day.

As talked about in section one, this is a great time to review your thoughts about your portfolios and to talk about what might be on your mind; touch base any time.