This is Healthy…(smile)

There have been a number of times where clients have emailed or asked exactly how a negative interest rate mortgage would work, and to be honest, I wasn’t quite sure myself.

But now, thanks to a Danish bank, we know!

Below is an excerpt from a news article about negative mortgages in Denmark (from The Guardian):

A Danish bank has launched the world’s first negative interest rate mortgage – handing out loans to homeowners where the charge is minus 0.5% a year.

Negative interest rates effectively mean that a bank pays a borrower to take money off their hands, so they pay back less than they have been loaned.

Jyske Bank, Denmark’s third largest, has begun offering borrowers a 10-year deal at -0.5%, while another Danish bank, Nordea, says it will begin offering 20-year fixed-rate deals at 0% and a 30-year mortgage at 0.5%.

Under its negative mortgage, Jyske said borrowers will make a monthly repayment as usual – but the amount still outstanding will be reduced each month by more than the borrower has paid.

“We don’t give you money directly in your hand, but every month your debt is reduced by more than the amount you pay,” said Jyske’s housing economist, Mikkel Høegh.

So let’s put some numbers to what is being said here. If you had a $500,000 mortgage at a 15 year amortization with an interest rate of -0.50% what would your payment look like?

The principle payment would = $2,726

The NEGATIVE interest payment would be -$208

Therefore, the loan would decrease by $2,726 + 208 = $2,934 in the first month you made a payment.

This is pretty crazy.

To pay off a $500,000 mortgage in 180 payments you would only pay a total of $468,865.

What if we did a 30 year amortization?

The principle payment would = $1,288

The negative interest would still be -$208

Therefore, the loan would decrease by $1,288 + $208 = $1,496 in the first month of payment.

To pay off the $500,000 mortgage in 360 months you would only pay a total of $459,975.

In this environment, the purchaser has built in downside protection paid for by the lending institution.

The home buyer’s adjusted cost base on the property would actually decline by the negative interest amount paid by the bank.

I can’t imagine how negative interest rates won’t spur on the overheated property valuations Canada already experiences if they come to fruition.

We live in different times!

A Few Charts that Caught My Eye

To wrap up the weekly comment we will look a few charts that got me thinking last week:

More signs of US economic slowdown

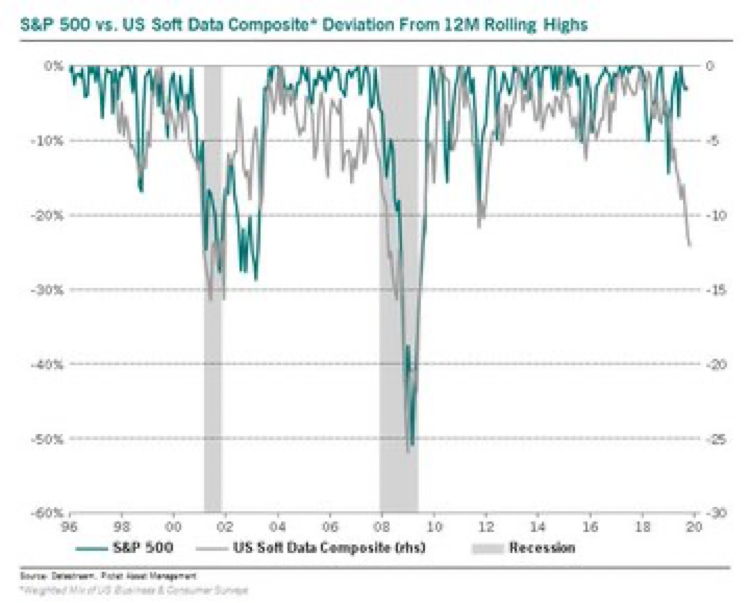

Large deviation “gap” between S&P500 percentage off of all time high and US soft data announcements. Note…it usually closes quickly.

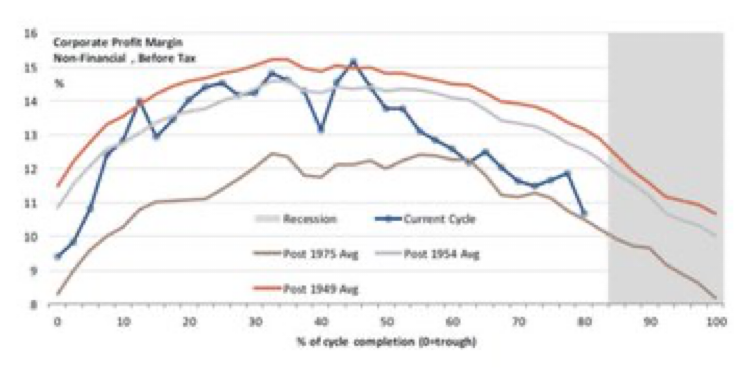

US corporate profits are behaving as expected…in a slowdown!

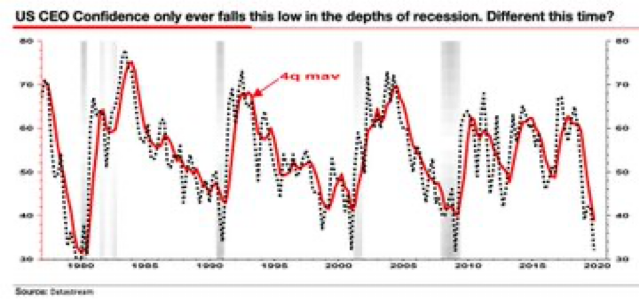

The next chart shows CEO confidence in the future trajectory of their business.

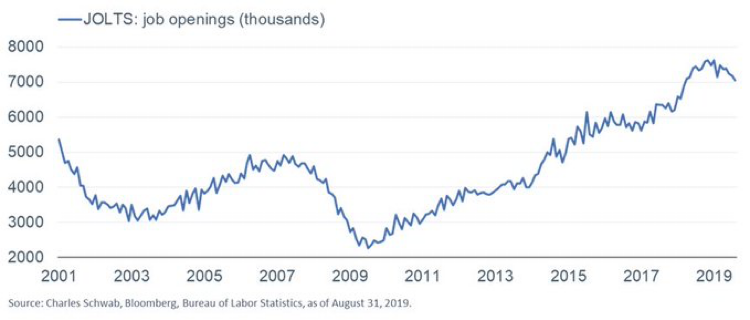

Economically lagging job opening reports are now rolling over lower.

Reality Check

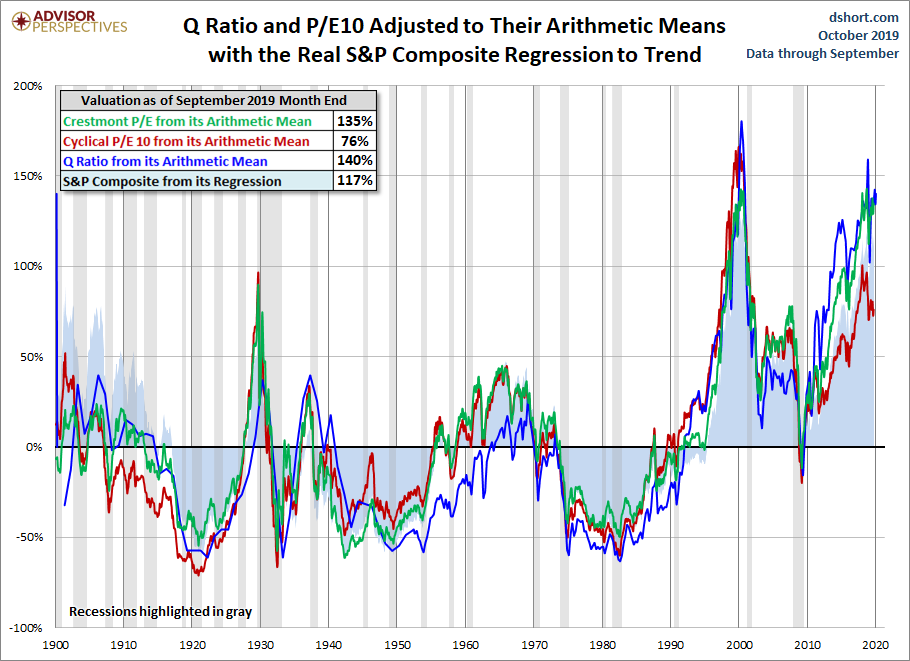

Think of the 0% line as the “fair value” of the S&P500. The rest of the chart speaks for itself. US stocks are not cheap no matter which standardized broad measuring stick is used but they do not have to decline in the short term either.

The next chart is overlapping the S&P500 with the SKEW Index. SKEW is a way of measuring “complacency” in the stock market by tracking how much people are willing to pay for protection against sudden moves.

The next chart is overlapping the S&P500 with the SKEW Index. SKEW is a way of measuring “complacency” in the stock market by tracking how much people are willing to pay for protection against sudden moves.

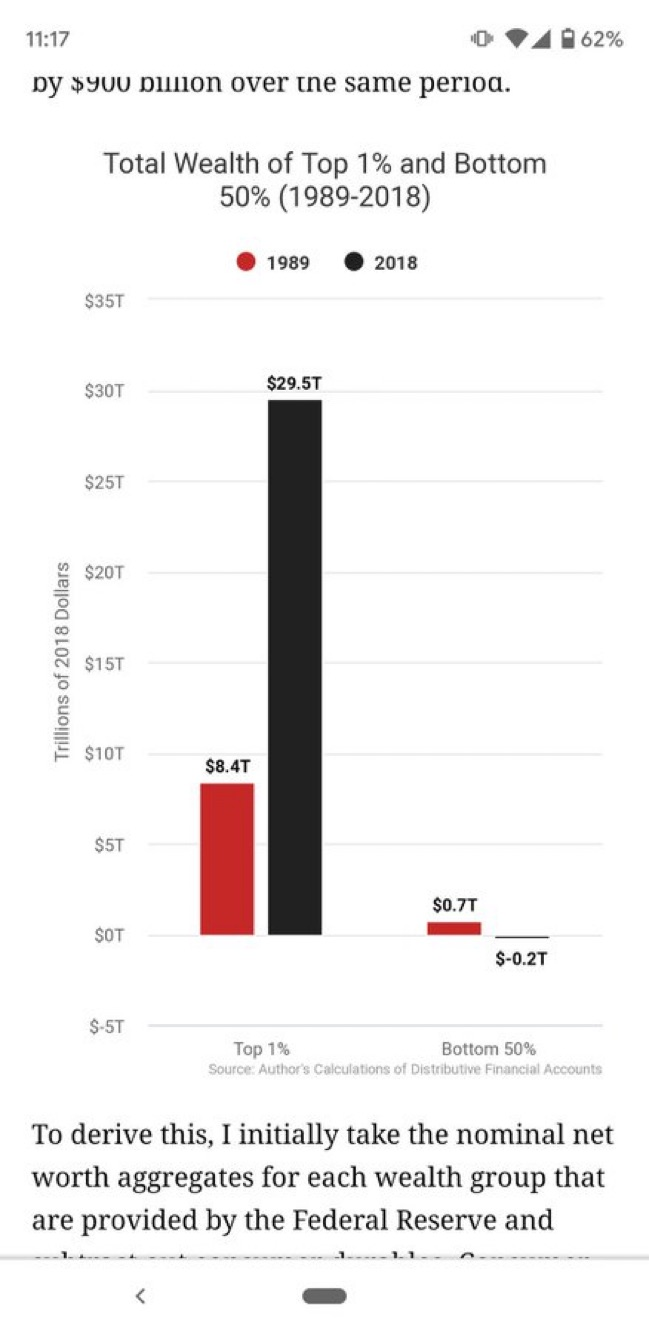

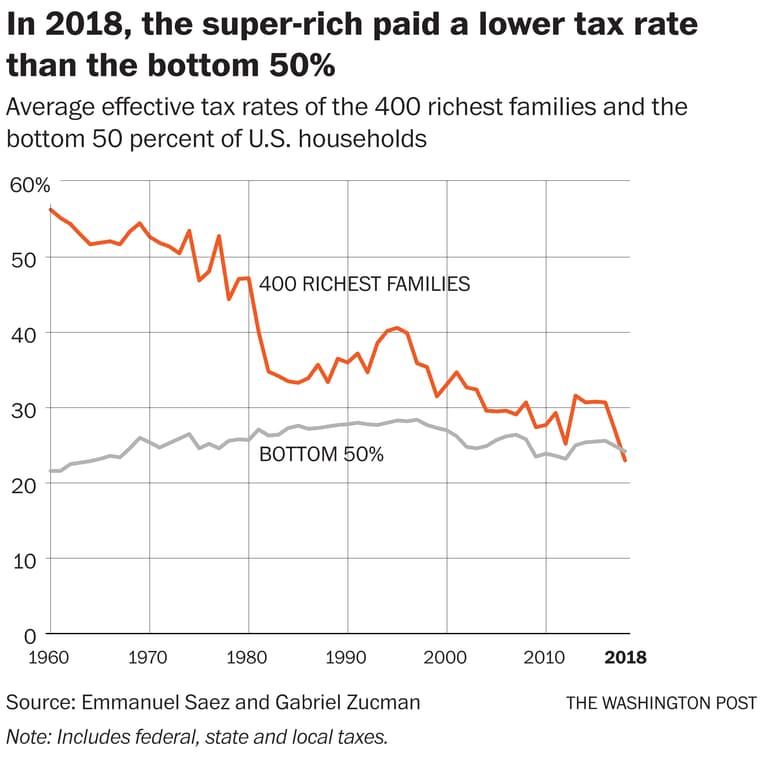

More signs of income/wealth disparity

In conclusion, financial markets are behaving in ways that they often do before an economic downturn.

History shows that markets have “muscle memory” from the preceding BULL market and tend to stay sticky in a sideways trend while underlying economic indicators deteriorate.

This is where I believe markets reside at present.

The other reality of the present cycle is that central bank monetary and interest rate manipulation, Presidential Tweets, non-GAAP earnings, and stock buybacks cause traditional signals to drag out in time.

An interesting juxtapositional mix, to say the least.