Last week the comment used a number of charts showing large directional moves in different financial markets. It is a very short comment with mostly charts. You can view it by clicking here.

I realize it is August and financial markets are not top of mind, but the rising recession risk should not be ignored.

Why?

- The risk is global. Growth is slowing everywhere in the world.

- Interest rates are already very low. In the event of a recession, there is not much room to cut interest rates to stimulate the economy.

- Debt is high for governments, corporations and individuals. Significant amounts of borrowing has been done at every level. It will not be easy to lever-up further in a declining asset environment.

Taken together, these characteristics of the present financial landscape coupled with the heightened risk of recession, should inspire everybody to review their personal financial situation.

That advice is not just for investments.

Discretionary spending, cash flow, new capital expenditures, vacation budgets and the likes should all be reviewed.

Hey, if it is a false alarm…no harm, foul.

Feel free to call and chat if you have any questions.

Weakness in Preferred Shares

Preferred shares have been a difficult investment to hold. Yes, they pay great yields, but the capital fluctuations have be large and made them a break-even type proposition over the last eight years.

The “rate reset preferred shares” have been the most difficult of all to hold because their prices have been the most volatile in the sector.

The idea behind a rate reset preferred is to hold a security that benefits from a rising interest rate environment. In 2010 and 2011, when rate reset preferred shares were popular, rising interest rates were considered a “slam dunk.”

That sounds like a silly idea now given where global interest rates are, but many of these shares were issued back when Mark Carney was still Bank of Canada Governor. It was nearly a weekly basis at that time when Minister Carney would warn Canadians to “get their financial houses in order and prepare for higher interest rates.”

Well, that proved to be a very poor forecast by Mr. Carney.

The expected economic recovery after the 2008 Great Recession never took hold and interest rates never recovered.

Last week RBC wrote up a report that specifies the issues surrounding Rate Reset Preferred Shares (the report is for internal use only since it mentions specific company names, but I will post a couple of the charts and report the general findings below).

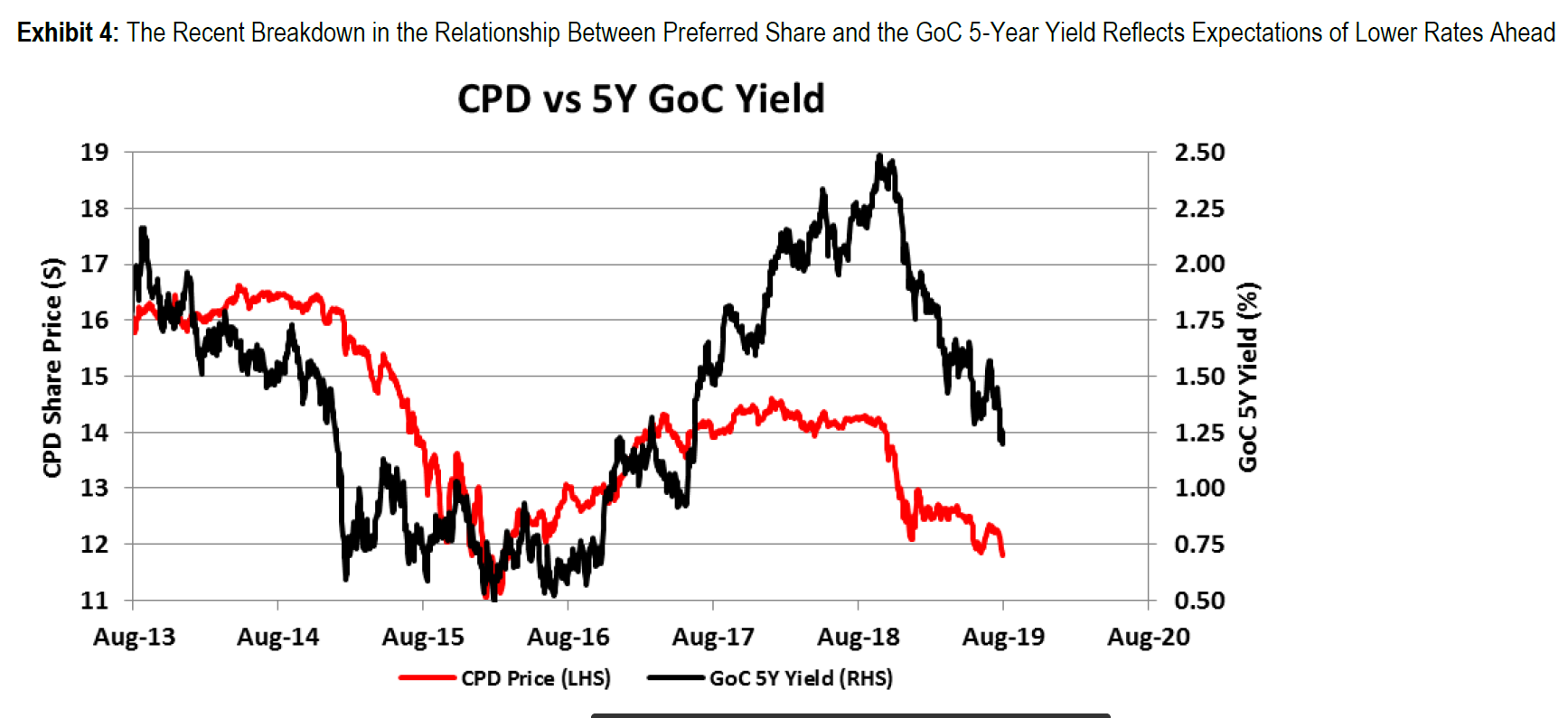

To begin, let’s view a chart of the rate reset preferred exchange traded fund (CPD) and the yield on the 5 year Government of Canada (GOC) bond.

The chart shows that when interest rates are climbing or anticipated to climb, the value of the rate reset preferred shares tends to rise. When interest rates are falling, rate reset preferred shares fall in price.

The chart shows that when interest rates are climbing or anticipated to climb, the value of the rate reset preferred shares tends to rise. When interest rates are falling, rate reset preferred shares fall in price.

This happens due to the fact that the dividend resets will be lower if interest rates are lower since the formula to reset the dividend is based on the five year government of Canada bond yield at the time.

As an example, here is a typical reset formula:

Original rate reset preferred share = 4.95% for five years.

New preferred share dividend = 3.50% + five year GOC bond yield (1.24%) totaling 4.74% for next 5 years.

The difference between 4.95% and 4.74% is not that large.

But here is the rub: The market price of the preferred shares is much more volatile than the change in dividends.

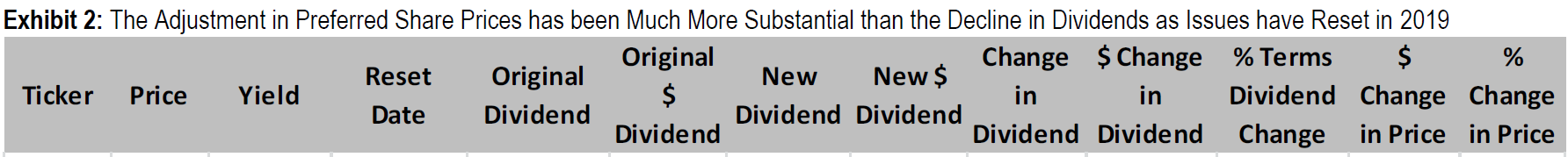

In the report, RBC used 30 rate reset preferred shares and took the average change in dividend as they reset relative to the average price change.

The results show that the new dividend yield ($1.07) is only $0.03 or 2% lower than the original dividend ($1.10) but the average drop in the share prices for the rate reset preferred shares has been 32%.

That is a large discrepancy and might signal some underlying value in the rate reset preferred share market.

That is a large discrepancy and might signal some underlying value in the rate reset preferred share market.

It is key to remember that rate reset preferred shares are at their core a math equation based on interest rate expectations. Prices are more volatile than the basic math equation but, all things being equal, the reality is their income stream is a formula based on a fixed rate plus the five year GOC rate.

In summary, as interest rates continue lower and the hunt for safe yield intensifies, the rate reset preferred shares will likely get a second look from investors. The time has not come for that yet, but it would make a lot of sense to sort through the rate reset “rubble pile” and hunt for some gems.

Gold vs. Warren Buffett

The following chart came across my Twitter feed last week. It made me smile…

I bet not a lot of you would have thought this to be true.

Since it is a bit blurry I will explain it.

It shows the price of gold bullion and Warren Buffett’s Berkshire Hathaway shares since the year 2000. Gold in blue…Berkshire in red.

Remember, Berkshire pays no dividend so it is an apples-to-apples comparison.

I think the Gold vs. Warren Buffett chart challenges our common knowledge views of what we believe has been the 20 year performance numbers for gold and stock markets.

These are interesting times and it is important to measure the facts about what is being said in the investment world. Try not to get caught up in the narratives being told to you to believe.

There are many other examples of this type of bias. Best to be aware and look to the facts.

Shoot us an email or give me a call any time; have a great week.