It wasn’t that long ago that the auto sector was on an open road to the car of the future. But will the gauntlet of potholes left by COVID-19 cause the sector to swerve? John Stackhouse, senior vice president, office of the CEO at RBC, and Joseph Spak, U.S. auto sector analyst at RBC Capital Markets, LLC, explore where the auto sector is going from here, and what that means for the prospects for autonomous and electric vehicles.

- The auto industry is restarting under COVID-19 protocols.

- Work-at-home requirements and an aversion to transit and ride-sharing may stimulate more demand for cars.

- Autonomous vehicle development is slowing, but electric vehicle development/production is gaining momentum.

John Stackhouse: The North American auto sector has started to reopen and plants are calling workers back to get production going again. How has the pandemic changed auto manufacturing?

Joseph Spak: First and foremost, we believe most companies have prioritized worker health and safety here as we begin to reopen. As production gradually ramps up, automakers, suppliers, and other industry stakeholders have really been engaged in a coordinated effort to bring the industry back online. We’ve seen companies institute new protocols that can require mandatory facemasks and other personal protective equipment, or PPE, temperature checks, greater line spacing, and sometimes physical barriers. Many plants have begun to operate on reduced or staggered shifts. And we’ve seen a lot of industry leaders like Aptiv, Magna, Ford, General Motors, and Lear publish playbooks and protocols for a restart that they also want their supply base to follow.

We wouldn’t be surprised if companies look for a means to add additional automation in the future, in areas of the vehicle where that’s feasible, to help with the new reality of plant layouts. And the other thing I would mention is that companies to date have really taken a lot of short-term temporary measures to help manage their margins. But we believe there’s a path for much of those temporary costs to become permanent and result in a more competitive cost structure in the future.

As we’ve seen, the crisis revealed some pretty significant supply chain vulnerabilities. What do you think manufacturers are doing to secure supply chains in this new environment?

Auto is a truly global industry. It’s been very interesting to watch the impact cascade into North America as the pandemic has evolved. So, in the early stages of the COVID-19 outbreak, automakers and suppliers were concerned about supply chain disruptions, primarily with parts sourced from China and maybe some other Asian countries.

Then the North American and European shutdowns occurred and, at the same time, China’s production was starting to ramp back up as the Chinese economy began to reopen. And during that time, we saw some supply chain disruptions around the globe. Even now in North America as production has restarted, we’ve seen some temporary shutdowns, in some instances because of confirmed infection cases in the plants. But other temporary shutdowns have been because of the supply chain operating in different regions with different protocols and maybe at different parts of the pandemic curve. For instance, Mexico is at a different part of the curve than the U.S. But many parts of the vehicle come from Mexico. Each of these individual temporary closures reverberate through the supply chain because it’s a very “just-in-time” industry, and a manufacturer can’t build a car with only 90 percent of the parts. So it stops ordering the other parts of the car, even if those parts are not necessarily the ones not arriving on time.

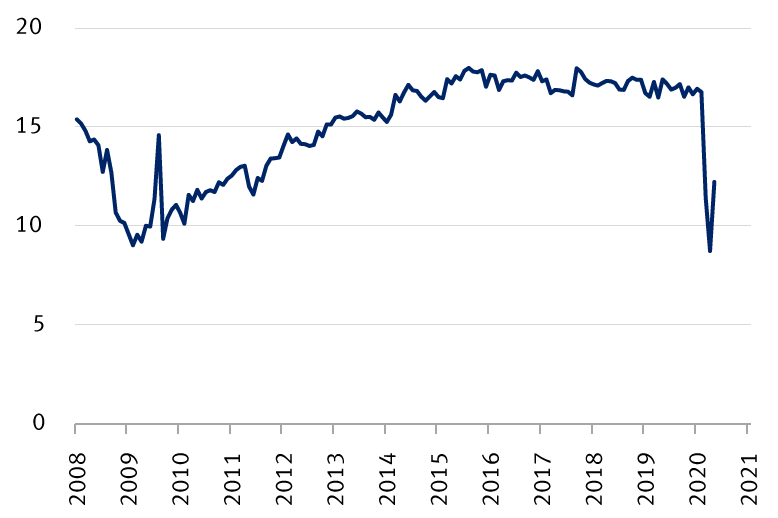

U.S. light vehicle sales

Millions of units, seasonally adjusted, annualized rate

U.S. auto sales rose by 40% m/m in May prompting manufacturers to step up production plans for June and July.

Source - RBC Wealth Management, U.S. Bureau of Economic Analysis

I wonder whether this causes “just-in-time” to shift a bit more toward “just-in-case.” But that also has some working capital considerations that the companies will have to think through. The pandemic has caused, in our opinion, some innovation and changes elsewhere within the auto value chain. For example, dealers have had to evolve to more online sales and touchless delivery. That’s probably a welcome development for many, but it also causes the dealers and automakers to rethink their technology and some of the marketing tools they’ve used to sell vehicles.

Before the pandemic, we had the “sharing economy” and there were a lot of prophesies of the death of the automobile. You posited that COVID-19 may be reversing that trend of declining car ownership. Can you give us some insight into what led you to that conclusion?

The automotive industry has four key secular themes known as CASE, or connected, autonomous, shared, and electric. Looking at shared, which I would say is ride-sharing, we saw a significant impact during the pandemic. Uber rides, for instance, globally were down about 80 percent in April. Some of this was clearly due to stay-at-home policies. But there’s also a consumer aversion to getting into a stranger’s car, not knowing who was there before.

And then there’s the original shared transportation—public transportation. In major cities around the globe, we saw public transport ridership—i.e., on subways and buses—fall by over 80 percent versus typical usage. Again, this was no doubt impacted by the stay-at-home policies, but also some aversion to being in a crowded space with strangers. Studies have suggested that subways, for instance in New York City, were one of the superspreaders of the virus. So these things, in my mind, have a way of playing into the human psyche.

In China, we’ve already seen some automakers attributing part of the sales rebound in April and May to consumers opting for the safety of their own car versus China’s public transport system. We’ve heard anecdotal evidence of that here in the U.S. as well. Residents in major cities like New York or San Francisco that maybe never had vehicles before now, are purchasing one. Perhaps that’s also a way to get out of the city when they want to on the weekend or during the week.

But there are two other aspects we have thought about. One is, for years we’ve heard of the trend toward more urbanization where ride-sharing and vehicle-sharing is more convenient than ownership. But does some urbanization reverse in the wake of the pandemic? That would increase the need for personal vehicle ownership in my mind.

And second, there’s the work-from-home trend. Pandora’s box may have opened a little here. From here on, we may see a greater number of employees working remotely. That means the household is more full during the day. There are currently about 1.9 vehicles per U.S. household. But we wonder if working at home will cause vehicle density to tick up. And if you’re more spread out in the suburbs, the vehicle miles traveled in the U.S. would increase as well, which would impact the longevity of vehicles. There would also be massive repercussions for municipal budgets, urban planning, and real estate.

As you mentioned, two of the other big trends underway before COVID-19 were the prospect of autonomous vehicles and the growth of electric cars. Has COVID-19 altered the trajectory of those trends?

Autonomous has already proven to be a tougher and more costly engineering endeavor than many thought a few years ago. I think development may take a little bit of a step back just from a funding perspective. Capital could be a little tighter. The first use case for autonomous vehicles was robo-taxis—if vehicle utilization could be increased, that would really help the economics of the model, considering that autonomous vehicles would be more expensive. But again, going back to the heightened concerns around ride-sharing, now that might be tougher to achieve.

There are two things I could see happening here. One is probably some consolidation amongst autonomous vehicle software providers. And two, maybe some companies try to pivot to autonomous delivery or possibly long haul, or some other uses of autonomous technology that don’t involve ride-sharing.

As for electric vehicles, they are more expensive today than their internal combustion engine counterparts. So, maybe there’s a little bit of a near-term impact if the consumer feels more economically stressed. But, you know, I don’t think the investment in electric vehicles can really abate given the regulatory requirements. And governments in some countries, such as Germany and France, and even the broader EU, are offering stimulus to the auto industry, but it’s geared around cleaner vehicles. So, no, the trend to electric might actually be accelerating somewhat.

As for the last theme—connected—cars are becoming computers on wheels, and I think there’s an opportunity for more connectivity in the car in the wake of COVID-19. So, musing about things like biometrics and health monitoring … can the vehicle become an important tool that helps enable telemedicine? There’s already a lot of sensors in each new auto. And cars are already connected to the internet and equipped with cameras. At the Consumer Electronics Show in January 2020, I saw a vehicle equipped with different sensors and artificial intelligence that can track in-cabin body temperature, respiration, and heart rate. That seemed somewhat superfluous, not even six months ago. But it may be more relevant now.

We entered this year with a bit of a war on the car globally, certainly a war on the internal combustion engine. In your view, what does the future of the car look like now?

The vehicle of society remains the car. The personal car, in my opinion, remains an important part of broader mobility. I think what propels that car in the future is certainly going to change. I think it will be more electric and more, potentially, alternative propulsion.

And the consumer demands for what the car really offers is going to change, in my view. You can even see it in the commercials today. No longer are cars sold on horsepower and performance, but really more on the interior experience and some of the connectivity trends. And I would expect that in the long term, there will be a trend toward more autonomous vehicles, although that is still some ways out.

This article is updated from an interview released on June 3, 2020.

Non-U.S. Analyst Disclosure: Jim Allworth, an employee of RBC Wealth Management USA’s foreign affiliate RBC Dominion Securities Inc. contributed to the preparation of this publication. This individual is not registered with or qualified as a research analyst with the U.S. Financial Industry Regulatory Authority (“FINRA”) and, since he is not an associated person of RBC Wealth Management, may not be subject to FINRA Rule 2241 governing communications with subject companies, the making of public appearances, and the trading of securities in accounts held by research analysts.

In Quebec, financial planning services are provided by RBC Wealth Management Financial Services Inc. which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RBC Dominion Securities Inc.