Last week we witnessed a serious rupture in US-Saudi relations. Such a severe tension between the two states would have dated back to 9/11. Below I discuss the impact of this situation on U.S.-Saudi relations and on the economy.

Relationship Goals

The disappearance of journalist Jamal Khashoggi has created growing pressure for the US to cut off arms sales, and retaliatory responses from Saudi Arabia to restrict oil supplies. The commentary from Riyadh has shifted from outright denial to now blaming rogue elements in the state security services for the Istanbul operation.

Thus far, the US has invested an enormous amount of support to the young Saudi prince, Mohammad bin Salman, in an effort to modernize the Kingdom and contain the Iranian regional threat. This recent situation however may significantly jeopardized their main sponsor and the essential security guarantee that they receive from the US. We hope that there are some in the Saudi leadership who understand the enormous costs of a rupture in the US-Saudi relationship, and will encourage the King Salman to rein in his son.

When it comes to the US-Saudi relationship, the level of current congressional animosity towards Riyadh looks almost unprecedented. The Chairman of the Senate Foreign Relationship Committee stating, “…our relations with Saudi Arabia… are at the lowest ever.”

Economic Impact

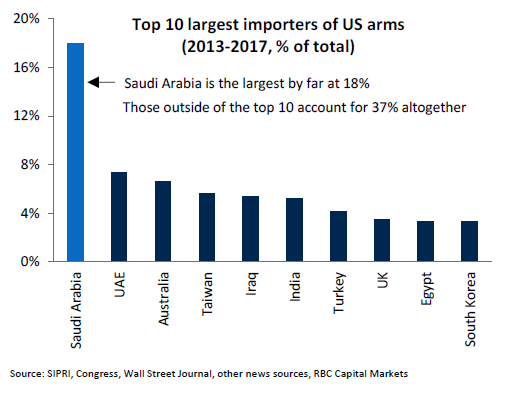

President Trump has declared severe consequences if the Saudi state is found guilty of the reported Khashoggi killing. He is however opposed to halting the arms sales, since the $110B arms agreement would cost American jobs. The Saudi Kingdom ranks as one of the most significant aerospace and defense markets for the US defense industry. See graph below.

Nevertheless, there is mounting bi-partisan support in the Senate for restriction weapons transfers. The concern over the arms restrictions has been occurring for a while now in Congress and a bill to block the transfer of missiles fell short in June 2017. Given the strong statements by the Senate Foreign Relations Committee, the likelihood of an arms restriction passing looks significantly higher this time around.

Even if investigations proved that the “rogue actor” theory provided by the Saudis is correct, the US Congress faces immense international pressure to implement punitive actions. The response from Riyadh on such moves has been far from restrained, and one media outlet even going as far as warning that oil would rise to $200/bbl if the Kingdom scaled back output to below 7.5 mb/d, and also suggested that Russia could establish a military base in Tabuk in order to satisfy the Kingdom’s security needs. The column stated: “the truth is that if Washington imposes sanctions on Riyadh, it will stab its own economy to death…”

Source: SIPRI, Congress, Wall Street Journal, other news sources, RBC Capital Markets

RBC Capital markets believes that Saudi leadership would be extremely reluctant to damage its reputation as the world’s stable, reliable oil central banker, and continue to act responsibly to keep markets balanced. However, given the unpredictable nature of some of Riyadh’s recent decisions, we cannot entirely rule out a deterioration in relations. The probability would be low, but the negative impact on the oil market would be very high. I guess we will have to wait and see. In the meantime... blame it on the rogue!

Yours truly,

Najia

Research Credit: RBC Capital Markets, Commodity Strategy Team