Mutual funds and ETFs

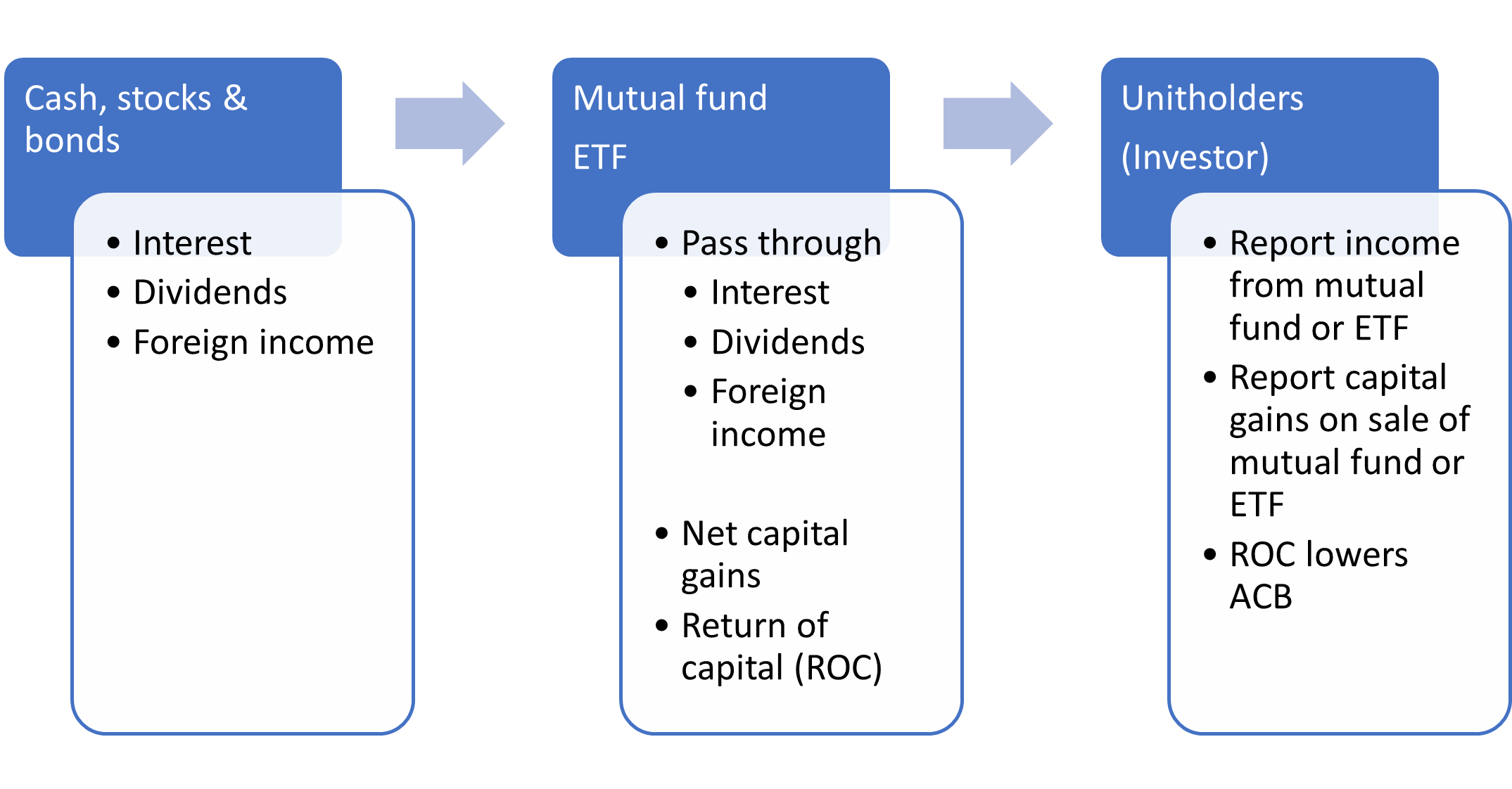

We previously discussed how investment income is taxed in our article Maximizing After-Tax Wealth. Many Canadians, however, invest in various types of investment funds so how in the world do you figure out how taxes are affecting your investment performance? Well, we can start high level at the structure of these investment funds. Most mutual funds and exchange-traded funds (ETFs) are set up as investment trusts. In a trust, all income must flow through to the ultimate beneficiaries of the trust. If it doesn’t, the trust will be subject to the highest marginal tax rate. This means a mutual fund or ETF distribute all the dividends, interest, or realized capital gains from its holdings (stocks, bonds, other funds, etc.) to its unitholders (you) who pay tax on the income. This is particularly important for realized capital gains – even if you did not sell anything directly, you may need to pay taxes based on the holdings sold within the fund. Figure 1 shows the flow of income from holdings through a mutual fund or ETF. Essentially, you receive the income and pay tax on the income as if you owned each holding within the fund which could be stocks, bonds, or another fund. Note we are not covering the differences between mutual funds and ETFs here but the mechanics of income and tax are the same.

Figure 1 Income from mutual funds and ETFs.

Corporate Class Mutual Funds

We stated above that most mutual funds are set up as investment trusts; however, mutual funds can also be set up as investment corporations (known as corporate class mutual funds) – just in case you weren’t lost yet … stay with me. The income the fund generates is taxed differently in this case. Like most Canadian corporations, the fund can offset income with expenses (including current and prior losses) of the fund which reduces the interest and foreign income you receive. The fund can only pay out Canadian dividends and capital gains which are taxed more favourably in Canada. However, any income not offset or distributed will be taxed to the corporation and reduces the net performance of the fund. Figure 2 shows the flow of income from holdings through a corporate class mutual fund.

Figure 2 Income from corporate class mutual funds.

Factors to Consider

Let’s sum this up into how you can apply this new knowledge.

- Asset location – Generally, hold funds generating interest and foreign income in tax-advantaged accounts and funds generating Canadian dividends in tax-exposed accounts. Also consider holding corporate class mutual funds in tax-exposed accounts.

- Underlying holdings – The underlying holdings dictate the tax impact, so it is important to consider this when selecting a fund. However, you also need to consider your return and risk objectives.

- Investment strategy – Most funds have a specific strategy they stick to sometimes called a mandate. The mandate will have an impact on the income and taxes. Example: A fund with a very active approach to trading will typically generate more taxable income versus a fund with a passive approach to trading. Holding active funds in tax-advantaged accounts and passive funds in tax-exposed accounts may be a way to optimize.

If you are interested in professional help to apply these strategies to your specific situation, please contact us today – we are happy to help.