A compliment to RSPs and TFSAs

Have you maxed out your registered plans, your retirement savings plan (RSP) and tax free savings account (TFSA), and you’re wondering what to do next? Or perhaps you haven’t maxed out these plans and are wondering if alternatives exist. A non-registered account can be used as part of your portfolio to build wealth. However, careful attention to minimizing the impacts of taxes on this type of account is critical to maximizing your after-tax wealth over time.

Investing in a non-registered account

A non-registered account is funded by money you already paid taxes on. Unlike an RSP, there is no tax deduction for contributions, but withdrawals are not fully taxed. Unlike a TFSA, the investment income you earn in the account is taxed every year. Optimizing the types of investments you hold in your non-registered account versus your registered accounts can have a great impact on the after-tax performance of your portfolio.

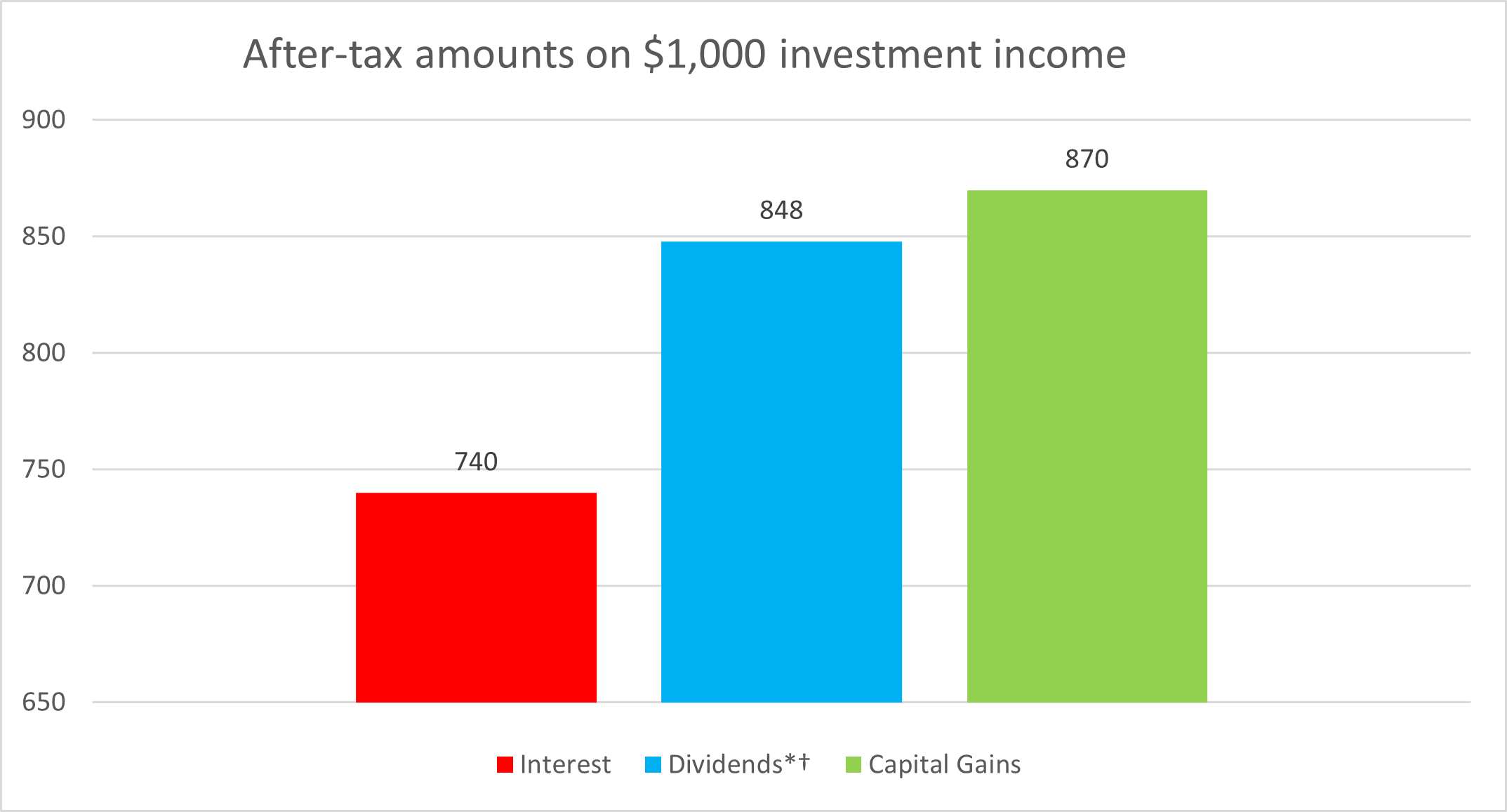

Figure 1 For illustrative purposes only. Assumes a marginal tax rate of 26%. Please note that tax rates are unique to the circumstances of each individual and province they live in. Tax rates are subject to change. * Includes only the Federal Dividend Tax Credit. † Represents eligible Canadian dividends. Note: All figures are rounded to the nearest whole number.

You can also hold a non-registered account jointly, through a trust, and through a corporation. We will explore using a corporation in another article.

Different types of investment income

Different types of investments produce various types of taxable income which have unique tax characteristics. Additionally, an investment may produce more than one type of income. Here is a summary of the different types.

| Type | Source | Tax Treatment |

| Canadian interest | Treasury bills, guaranteed investment certificates (GICs) and Canadian bonds | Fully taxable |

| Canadian dividends | Canadian stocks (publicly traded corporations) | Preferential tax treatment through dividend tax credits |

| Capital gains | Any investment sold for more than the purchase cost or adjusted cost base (ACB) | Preferential tax treatment as only 50% of the gain is taxable |

| Foreign non-business income | Dividends, interest, and other income from foreign stocks, bonds, and other investments | Fully taxable Withholding tax may apply |

| Return of capital (ROC) | Investor’s principal returned from mutual funds, exchange-traded funds (ETFs), and other investment funds | Not taxable Reduces the adjusted cost base Increases (decreases) capital gain (loss) when sold |

Factors to Consider

What factors do you need to consider based on the above information to make smart investment decisions and maximize after-tax wealth?

- Asset location – Generally, hold higher taxed investments in tax-advantaged accounts and preferentially taxed investments in tax-exposed accounts.

- Choice of investments – The types of investments you choose will have an impact on taxes but should be considered within your return and risk objectives. Example: non-dividend paying stocks are very tax-efficient but may not be suitable for every investor.

- Choice of investing strategy – The way you invest and make changes will have an impact on taxes. Example: overtrading may produce unnecessary taxable gains compared to a buy and hold strategy.

- Tax loss selling – Strategically triggering capital losses to offset capital gains can improve after-tax performance.

- Registered accounts – Allocating the right mix of cash flow to registered accounts and your non-registered account can make a big difference, especially when you retire and begin drawing income. Example: RSP/RIF income will be fully taxed in retirement and to your estate.

If you are interested in discussing strategies you can use for your specific situation, please contact us today – we are happy to help.