2018 has been a tough year.

Canadian equities (S&P/TSX Composite Index) are down 7.9% for the year ending December 19 2018. The world stock market (MSCI World Index) was down 6.8% over the same time period.

This our second annual letter to our clients. We will share some of the highs and lows of the past year and as always your feedback is welcome.

What would we have done differently?

If we could go back to January 1, 2018, we would have allocated more money to our real estate and fixed income holdings. These assets held up pretty well over the last year whereas most other equity holdings no matter which sector or region were in negative territory.

Wealth Management Highlights and Updates

We had a family business advisor, Enette Pauze come in and give a chat about how to improve communication within family enterprises. The tools and ideas she shared are useful for all families, not just family enterprises. I summarized her discussion in this blog post.

We have introduced the secure inbox which is a great way for us to send you documents that contain sensitive information and vice versa. These messages stay on the RBC server and thus are more secure than sending emails. We encourage you to adopt using this platform when sending us information that should be kept secure.

Your 2018 tax documents can be accessed online so if you would prefer to receive these electronically instead of by mail please let us know or see our blog post here.

Education

Heather is planning on completing her Wealth Management Essentials course in 2018. Make sure to ask her how her studying is going when you speak to her. Her goal is to write the exam in September.

I completed the LLQP course which means that we can now help our Quebec based clients with insurance and annuities. I also completed Intermediate Accounting II and a finance course at Carleton University. In 2019 I will do two more courses: Accounting for Business Combinations and Audit I. I find the courses help to expand my horizons and they do help me to view our portfolios from a different perspective, so I will continue going down this path.

Best books of 2018

I have shared two books with many of you. The Wealthy Renter presented an interesting discussion about housing and it shared the pros and cons of home ownership and renting. I think this book is a great read for children and grandchildren of our clients that have just graduated university and are starting their careers and might have housing on their mind. The book generated much discussion and if I have not yet given you a copy please let me know.

Another book called the King of Main Street is a must read book for business owners. In the 1990’s the Wealthy Barber started a national conversation about retirement planning and investing and I think the King of Main Street will start a national conversation about business, mentorship, succession and legacy.

I will continue to try and find books that I think are relevant to you and will share them when I find a good one. Your book recommendations are also welcome.

Portfolio Lowlights and Highlights

Our worst performers over the last year ending November 31 2018 were: ZXM (First Asset Morningstar International Momentum Index ETF) which was down 9.08% and FXM (First Asset Morningstar Canada Value) which was down 11.57%. I see in our 2017 Annual Letter that ZXM was one of our best performers of 2017 being up 24%. That is an example of an assets being in favor one year and then being out of favor the next year.

On the fixed income side the worst performer was PPS (Invesco Canadian Preferred Share Index ETF) which was down 8.08%. I also see that in 2017 PPS was one or our best performers as it was up 16%.

The above re-enforces why our practice of rebalancing (taking profits from assets that are up and adding to assets that are down) the portfolios each year is such a sound strategy as it allows us to benefit and lock in the gain from when an individual asset is outperforming.

Our best performers were ZRE (BMO Equal Weight REITs Index ETF) which was up 9.9% and VFV (Vanguard S&P 500 Index) which was up 8.93%. On the fixed income side, Renaissance Floating Rate Notes were our best performer being up 4.92%.

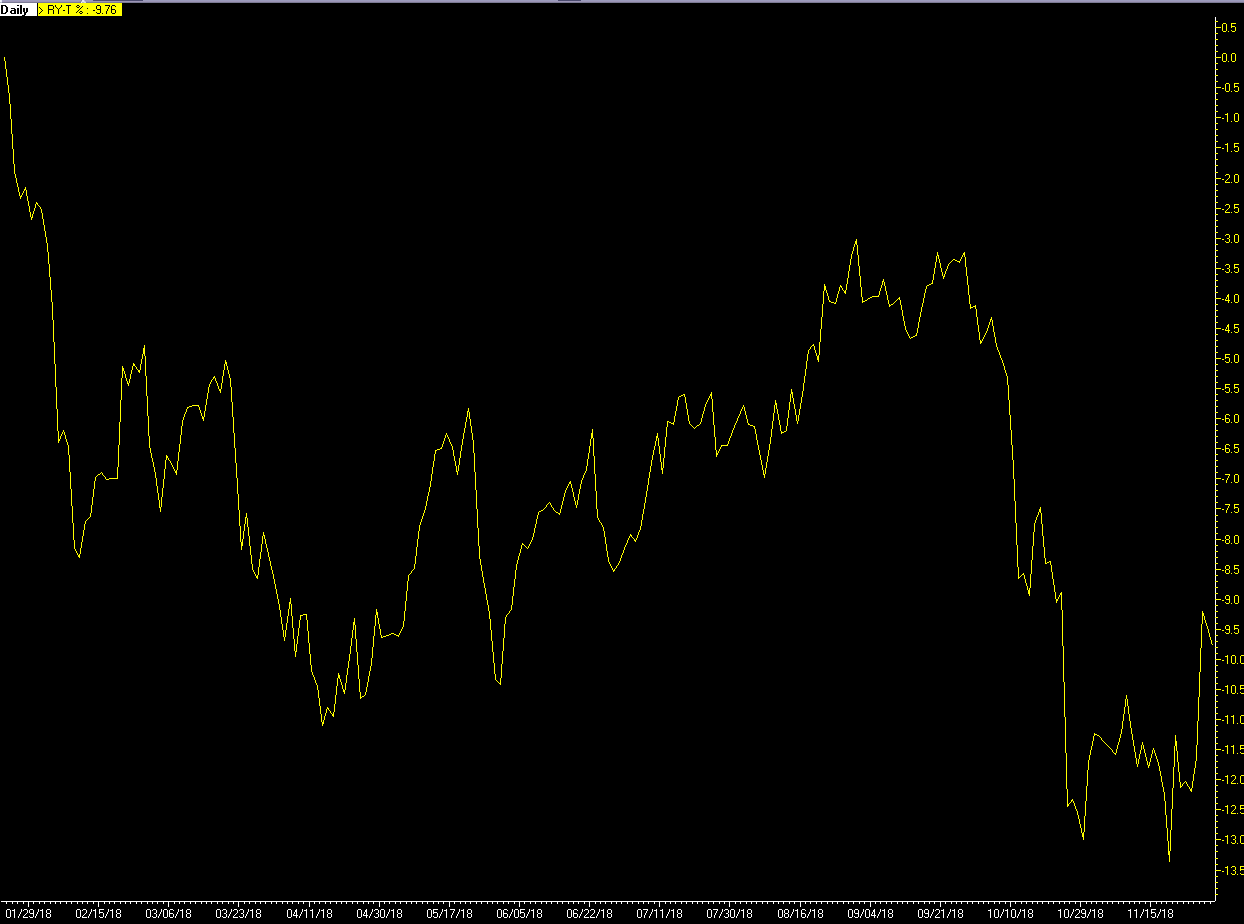

Our long term goal is to grow our balanced portfolios (made up of 50% equity, 50% fixed income) by 4 to 6% per year and that did not happen this year. In years such as these I try to focus on the fact that we have lots of protection through our fixed income holdings, and on the equity side the assets we own are quality. To give you an example, we can look at Royal Bank. In 2018 RBC’s profit was $12 billion dollars. I am comfortable owning a company with that kind of profitability and yet despite that, the stock was down almost 10% in between Jan 22 2018 and Nov 30 2018.

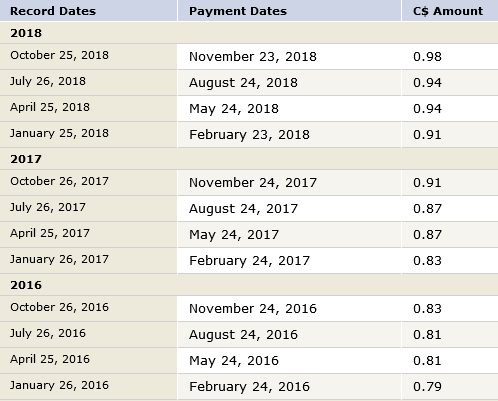

I am confident that RBC’s stock price will recover in due time and while we wait, we continue to collect tax efficient dividends that continue to grow each year. I am using RBC as an example but this is happening throughout our portfolio. Below you see the dividend growth of RBC shares since 2016.

To summarize the above point, in the short term the stock market can be irrational and in the long term I think that a company’s earnings and dividends will be reflected in the stock price. In Benjamin Graham’s own words: “In the short run, the market is a voting machine but in the long run, it is a weighing machine”

Modifications

We already have a lot of fixed income which did a good job of protecting our portfolios. One fixed income asset that underperformed were preferred shares which I think were oversold in 2018. This was bizarre as preferred shares are expected to do well in a rising interest rate environment. That being said I expect our preferred shares to have a good year in 2019. On the equity side we have slightly reduced our international exposure and slightly increased our US exposure as I think this will position us well going into the next year and beyond.

In March of 2019 it will be 15 years that I have been working as a portfolio manager. It has been an honor serving you and I want to thank you for your trust. I look forward to serving you for another 15 years and hopefully many more.

Merry Christmas and here’s to a successful 2019,

Michael Kirkpatrick