The Federal Reserve not only held rates once again in July, but a surprisingly hawkish tone has likely pushed back the timing of any rate cut until at least December.

We look at some of the key drivers and why markets may need to prepare for a return of the “higher for longer” scenario.

If one thing was clear from this week’s Fed meeting—absent an outside force—the Fed is more than content to keep rates unchanged.

The Fed left its policy rate at a target range of 4.25–4.50% for the fifth consecutive meeting, as was widely expected. Fed Chair Jerome Powell summed up the justification as follows: “It seems to me, and to almost the whole committee, that the economy is not performing as if restrictive policy is holding it back inappropriately. Modestly restrictive policy seems appropriate.”

That sentiment may be hard to argue with.

When the Fed delivered the first of a series of rate cuts last September, core PCE inflation was running at an annual rate of 2.7%. As of this morning’s release for July data, that pace has picked up slightly to 2.8%.

When the Fed delivered the first of a series of rate cuts last September, core PCE inflation was running at an annual rate of 2.7%. As of this morning’s release for July data, that pace has picked up slightly to 2.8%.

Similarly, the unemployment rate was 4.1% last September and has continued to hold steady around that level this year.

So, with little changed with respect to both sides of the Fed’s mandate of price stability and maximum employment, it seems the inactivity behind current policy rates will continue.

Market expectations of a rate cut now imply less than a 50% chance of a move, compared to nearly 70% prior to the meeting. Many expect a rate cut by December at the earliest.

While the meeting was short on any real surprises, there were two notable developments:

- With more trade deals announced this week, and many tariffs finally to be implemented as of August 1, it will likely still take several months for any impact to show in the data. He also pointed out that rising goods prices, and potential for them to rise further, could arguably justify rate hikes.

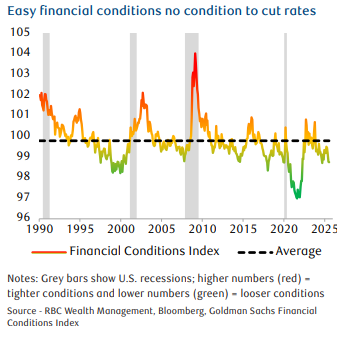

- Record-high stock indexes, tight corporate credit spreads to Treasury yields, and a weakening dollar are financial factors that could pose upside risks to inflation while bolstering economic activity. Cutting rates when financial conditions are already this easy amid a solid economic backdrop would likely amplify those risks.

An outside force attempting to exert his will on rates is, of course, President Donald Trump.

His attacks on Powell continued this week, but following recent developments with the Fed’s renovation project. Near-term risks of his firing Powell have likely subsided.

Notably, there were inside forces acting on the Fed at this week’s meeting. Governors Christopher Waller and Michelle Bowman dissented at this week’s meeting in favor of lowering the policy rate by a quarter of a point. It’s the first time that 2 governors of the 7 that typically comprise the board, have dissented since 1993.

As a practical matter it doesn’t matter much, and differing views are welcomed at the Fed, but Powell’s hawkish tone suggests that they remain outliers at the Fed and that the core of the committee supports the ongoing wait-and-see approach.

Waller has been the most outspoken on rate cuts, making the case that the Fed should move to get ahead of looming labor market risks—but does he have a case?

Labor market data, by and large, remain solid—but mixed. As noted, the unemployment rate has remained flat, if not edged lower, this year as moderating labor demand has been offset by a modest decline in the labor supply.

Labor market data, by and large, remain solid—but mixed. As noted, the unemployment rate has remained flat, if not edged lower, this year as moderating labor demand has been offset by a modest decline in the labor supply.

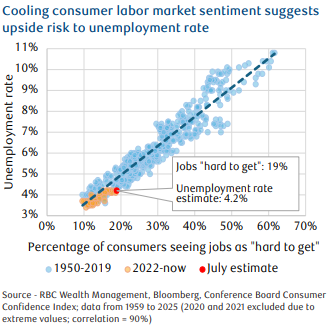

The percentage of consumers viewing jobs as “hard to get” has one of the higher correlations with the official unemployment rate. An index of the percentage of people seeing jobs as “hard to get” rose this week to 19% for July up from around 14% at the start of the year, despite the unemployment rate remaining flat.

Historically, when that index has been around 20%, the unemployment rate has been closer to 5%. While the unemployment rising to that level anytime soon, but it suggests upside risk to the current unemployment rate of 4.1%.

This morning, U.S. Non-Farm Payrolls announced that the U.S. economy added 73,000 jobs in July – below the consensus of 100,000. May and June figures were also revised lower.

These figures may simply reflect a normal decline in sentiment that tends to come at the later stages of most economic expansions and is not yet a sign that the labor market is near the point of cracking. Time will tell.

Recent stock and corporate bond market rallies have been fueled, at least in part, by market expectations that although rate cuts have been delayed, it would only mean more rate cuts next year.

RBC anticipates multiple rate cuts in the pipeline from the December meeting moving forward. In March we projected no rate cuts through 2026. Safe to say, the situation remain fluid.

With the worst of the tariff threats now seemingly in the rearview mirror, the focus will now move to the effects on the U.S. consumer – how much will costs increase and what is their ability to absorb them.

As always, please let me know if you have any questions or comments.