The AI investment cycle still has more runway ahead, but monetization timing, return on investment, and enterprise applications risks strengthen the case for diversifying within and beyond Big Tech to capture a broader set of opportunities

The launch of ChatGPT in late 2022 unleashed one of the largest capital expenditure cycles in decades. At its core is the infrastructure needed to train and deploy AI at scale, such as semiconductors, networking equipment, power systems, and data centres.

Leading the investment boom are the dominant U.S. Big Tech firms vying to establish leadership in what is increasingly viewed as a transformational general-purpose technology.

Capex among these firms has more than doubled in the last two years, reaching $427 billion in 2025.

Momentum shows few signs of fading heading into 2026, with projections pointing to a further 30 % year-over-year increase to roughly $562 billion. This spending is unevenly distributed, however, with Microsoft, Amazon, Alphabet, Meta and Oracle accounting for the bulk of the increase.

As of Q3 2025, these companies held cash and equivalents totalling $490 billion and generated nearly $400 billion in trailing 12-month free cash flow after capex outlays, implying most of the current AI-related spending has been funded by internal cash, and not external sources of financing.

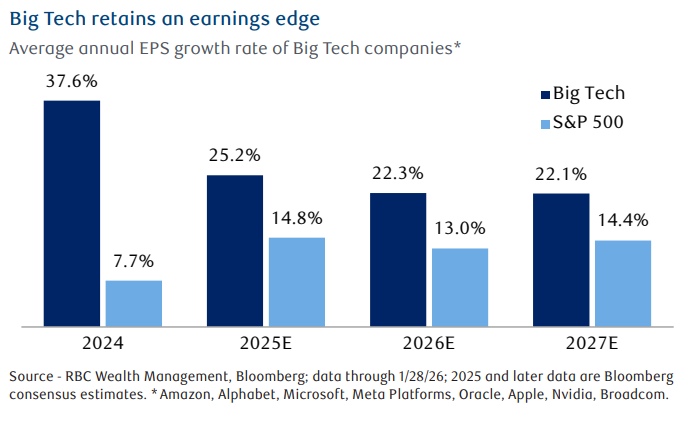

A meaningful slowdown in earnings growth could heighten scrutiny and test the market’s tolerance for continued elevated spending. Consensus expectations point to Big Tech’s earnings growth of roughly 22 % in 2026 and 2027, continuing to outpace the broad market, though by a narrowing margin

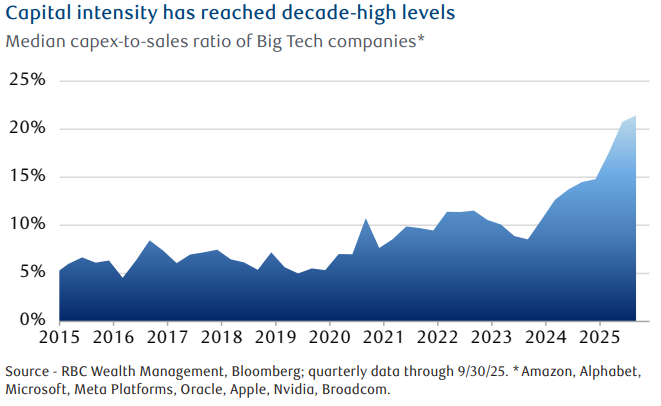

Another trend worth monitoring is capital intensity.

Big Tech’s capex as a share of revenue has risen to its highest level in over a decade. This marks a notable departure from the asset-light and capital-efficient business models, scaling through intellectual property, and software application, while spending relatively little on physical assets.

A more capital-intensive structure can still deliver attractive shareholder returns, but it can also introduce greater cyclicality to earnings. Asset-heavy businesses tend to be more sensitive to capacity utilization rates, pricing, and technological neglect.

Could large capex begin to crowd out share buybacks or push the AI ecosystem to increase reliance on debt ?

Big Tech’s return on invested capital remains elevated and earnings momentum continues to outpace the broader market. If sustained, the valuation premium can persist.

This Big Tech group, which now makes up roughly a third of the S&P 500’s market cap, trades at an average forward P/E multiple of 26.1x or about a 18 % premium to the index. The average premium since 2015 (39 %) and the five-year average (26 %)

AI will remain a central macro theme for years to come. The technology is still in the early phases of innovation and adoption, capital investment remains strong, and the potential to lift the long-term growth trajectory for the economy and corporate earnings is immense.

Nevertheless, historical transformative technologies (i.e. railroads and the internet) require periods of overinvestment before delivering long-lasting benefits.

For much of the past three years, the narrative has largely focused on the speed and scale of AI infrastructure buildout. As the cycle matures, this could evolve to a more discerning phase, with greater emphasis along two considerations:

- Monetization: The efficiency with which AI infrastructure investments translates into recurring revenues and generates sufficient returns on investment, defines the differentiation between tech companies that can fund AI spending through operating cash flow versus those more reliant on debt financing, with less certain prospects for sustainable returns.

- Applicability: Companies integrating AI in their businesses to accelerate automation, optimize cost structures, expand product and service capabilities, and boost productivity in ways that generate measurable value.

In this context, AI represents a potentially disruptive force that could create a technological divide across industries, making it critical for companies to successfully harness the technology, particularly in sectors where AI has the capacity to reshape long-term earnings power.

With Big Tech having delivered exceptional returns for many years and driving elevated market concentration, ensuring portfolios are well balanced and adequately diversified across and beyond the group appears sensible.

AI represents a potentially disruptive force that could create a technological divide across industries, particularly in sectors where AI has the capacity to reshape long-term earnings power.

Diversification allows one to navigate market leadership rotations and uneven performance among AI-linked companies.

If you have any questions or comments, please feel free to let me know.