Even as trade tensions eased further this week, the Federal Reserve continues to battle between the two sides of its mandate—price stability and full employment.

Policymakers see growing risks to each, setting up a potential duel within its dual mandate that could complicate what the Fed chooses to do next.

While the Fed meeting was largely inconsequential, developments that speak to larger themes did start to show themselves.

The Federal Reserve Board noted that, “The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen. If the large increases in tariffs that have been announced are sustained, they are likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.”

The Federal Reserve Board noted that, “The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen. If the large increases in tariffs that have been announced are sustained, they are likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.”

This theme is also increasingly being reflected in many analyst forecasts.

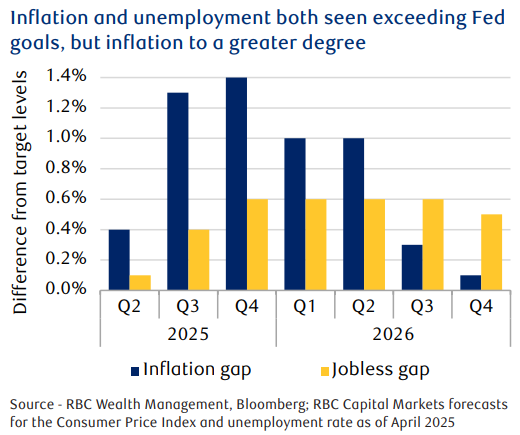

RBC Capital Markets’ economists expect inflation to deviate from the Fed’s 2.0% annual target. Unemployment is seen rising beyond the Fed’s 4.2% estimate of the “full employment” rate of unemployment.

Powell noted multiple times during his press conference, the prospects of both higher inflation and higher unemployment create “tension” with respect to achieving the Fed’s dual mandate of price stability and maximum employment. How it manages its monetary policy tools while also be an increasingly difficult task.

So, the question then is which mandate will the Fed prioritize when it next decides to act?

Conventional thinking is relatively straightforward:

- The inflationary impacts of tariffs will hit first

- The Fed on hold until the September meeting

- Rising unemployment, if realized, will trigger the first of a series of rate cuts

RBC sees three this year followed by three next year—even in the face of elevated inflation.

Inflation begins to fade, and unemployment stabilizes, through 2026. However, even in the best of times, forecasts are just that - forecasts.

Powell has routinely stated that the Fed’s job is to keep the one-time inflationary impact of tariffs from transforming into a larger inflation problem.

Consumer inflation  expectations have been rising sharply since the beginning of the year. Though Powell downplayed this at the March meeting as “too soon to draw conclusion,” four months nearly makes a trend. May data will be reported next week.

expectations have been rising sharply since the beginning of the year. Though Powell downplayed this at the March meeting as “too soon to draw conclusion,” four months nearly makes a trend. May data will be reported next week.

This dynamic shouldn’t be ignored.

Historically, the Fed largely achieved its goal of “anchoring” inflation expectations. By and large, expectations have held within a tight range. This break, if sustained, could signal a material shift in consumer psyche as it relates to prices.

One wonders whether, if this round of tariff-induced inflation fears wasn’t coming off the back of an actual inflation wave which has only recently appeared to trough, it might prove to be a one-off episode.

Rising inflation expectations also pose economic risks. If consumers fear higher prices ahead, they may spend now, and that could be what is currently holding up economic activity.

Amid rising questions about the consumers’ capacity to spend and growing fears about their willingness, higher consumption now could mean lower consumption later.

While the Fed meeting largely failed to move markets in any direction, the announcement of a framework trade deal with the UK today has done so. The S&P 500 has pushed higher toward 5,700, while the benchmark 10-year U.S. Treasury yield has risen to 4.33%.

RBC has maintained its Market Weight recommendation for both U.S. equities and U.S. fixed income, but recent volatility and market uncertainty present a precarious setup.

Current RBC Capital Markets projections for year-end:

- S&P 500 closing level of 5,550—nearly 3.0% downside from current trading levels.

- 10-year Treasury yield to end the year at 3.75%. Currently at 4.39% (Implied Total Return of 7%).

Should tariff and trade fears continue to ease, there is perhaps some modest upside to both of those forecasts. In an environment such as this, perhaps it’s best just to follow the Fed’s lead and simply wait and see.

If you have any questions or comments, please let me know.