U.S. trade policy continues to become more protectionist and unpredictable.

Let’s attempt to examine the events of the 2018–2019 U.S.-China trade war to assess the potential impact of tariffs.

Tariffs can generate revenue, safeguard domestic industries, and gain leverage in negotiations.

While the immediate economic effects can be stimulative, the longer-term consequences can prove less than desired.

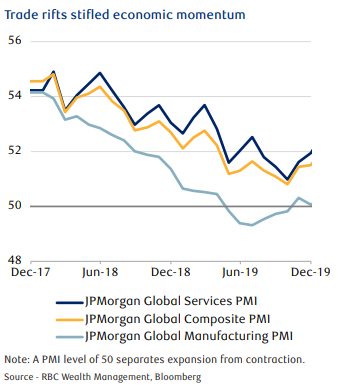

In the 2018–2019 U.S.-China trade war, the global manufacturing Purchasing Managers’ Index (PMI) slid into contraction, and business capital spending slowed markedly (chart at right).

The inflationary impact of tariffs can also follow an “up-and-then-down” sequence.

Initially, tariffs push prices higher as increased import costs filter through to consumer prices. As higher prices eat into purchasing power and reduce demand, inflationary momentum tends to dwindle.

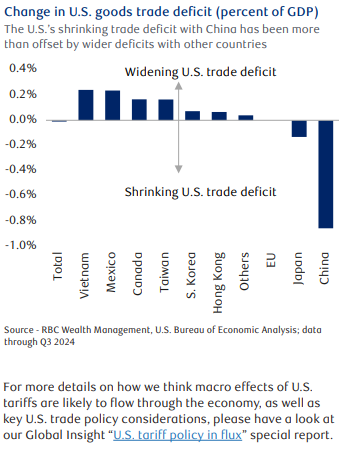

The 2018–2019 trade war primarily targeted China,  allowing businesses to reroute trade flows and soften the economic fallout.

allowing businesses to reroute trade flows and soften the economic fallout.

While tariffs on Chinese imports have helped shrink the United States’ goods trade deficit with China, the United States’ overall goods trade deficit is little changed relative to 2016, as importers substituted goods from elsewhere in Southeast Asia and North America (chart at right).

There is a risk that tariffs could be longer-lasting if they are viewed as a key source of revenue, or to support other fiscal objectives (U.S. tax cuts).

The world economy in 2018–2019 was on relatively steadier footing. Low inflation and strong growth gave the world economy the ability to absorb economic shocks.

Today, global GDP growth is expected to slow. Average consumer inflation is running closer to 3 %, above the typical 2 % target pursued by major central banks.

Unlike in 2018, today’s economy has less room to absorb shocks. How aggressively the U.S. administration pursues its trade agenda remains uncertain.

The lack of clarity and predictability means businesses and investors currently face a wide range of potential outcomes (table below). The estimates below verify the belief that tariffs are generally “lose-lose” for trading partners and for the countries that implement them.

Trade policy is likely to remain a persistent source of downside risk to the economic outlook. Even without new tariffs, the mere unpredictability of what comes next in U.S. trade policy salvos alone can act as a headwind to economic activity through the “confidence” channels.

If you have any questions or comments, please feel free to let me know.