Despite a second consecutive rate cut, a hawkish turn from the U.S. central bank this week supports the view that it is now on hold until at least next year.

While that might have previously caused alarm, investors are content with the idea the Fed has already done enough.

A common phrase used during Fed Chair Jerome Powell’s tenure: “policy is not on a preset course.” It is as a reminder for markets that the Fed doesn’t know what it is going to do at any given meeting – despite belief to the contrary.

Prior to this week’s meeting, markets were pricing a near 100 % chance that the Fed would cut rates again at the December meeting. Powell could have easily noted that “policy is not on a preset course” and got on with things.

Prior to this week’s meeting, markets were pricing a near 100 % chance that the Fed would cut rates again at the December meeting. Powell could have easily noted that “policy is not on a preset course” and got on with things.

He deliberately chose not to. “…not a foregone conclusion—far from it” That, in so many words, is how Powell characterized the chances of another rate cut in December.

With that statement, the markets now see the likelihood of a December rate cut as below a 70 % probability. Prospects for future cuts into 2026 have also dimmed.

The Fed cut rates for a second consecutive meeting to a target range of 3.75 % to 4.00 %. Rate hawks both have the edge over the doves, ultimately presenting a better case on the U.S economy.

The Fed has also taken out even more insurance against the risk of further labor market cooling.

Early signs already point to labor market stability. This week, ADP announced a new weekly index of hiring activity. The initial report note: “For the four weeks ending Oct. 11, 2025, the National Employment Report pulse shows that private employers added an average of 14,250 jobs per week. This growth in employment suggests that the U.S. economy is emerging from its recent trough of job losses.”

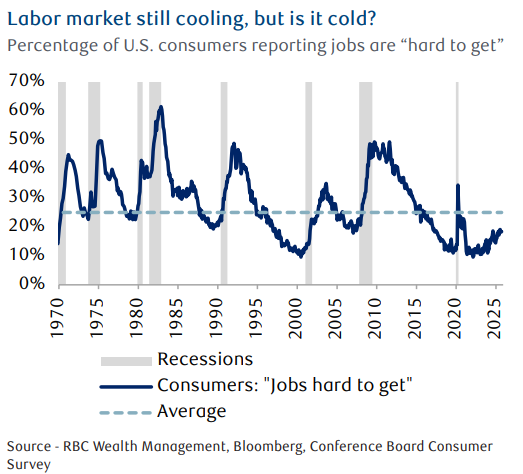

As the chart below indicates, only 18 % of those surveyed viewed jobs as “hard to get” in October – well off the record lows seen in prior years, below and far below levels seen during past recessions.

On that basis, the Fed would be prudent to hold rates steady into 2026.

Another quote from Powell this week: “What do you do if you are driving in the fog? Slow down... again, I am not committing to that, but I am saying it is certainly a possibility that you would say, we really can’t see, so let’s slow down.”

It was uncertain how the Fed might approach the ongoing government shutdown and the subsequent lack of economic data. The shutdown may take months to resolve.

Barring a downturn in labor market, the Fed will likely err on the side of doing too little, rather than too much. Rates now below 4 %, and ever closer to the Fed’s estimated 3 % “neutral” rate for the economy. Cutting rates into an economy that could ultimately prove to be stronger than the Fed might expect, would stoke further inflationary pressure, which would be wholly counter-intuitive.

Barring a downturn in labor market, the Fed will likely err on the side of doing too little, rather than too much. Rates now below 4 %, and ever closer to the Fed’s estimated 3 % “neutral” rate for the economy. Cutting rates into an economy that could ultimately prove to be stronger than the Fed might expect, would stoke further inflationary pressure, which would be wholly counter-intuitive.

While it seems that the Fed will cut more slowly, one can now see that as less of a risk for markets broadly.

Now that the gap has been narrowed, the muted reaction this week from risky assets such as equities and corporate bonds suggests that markets might be content with where the Fed stands.

Rates have already been cut by 150 basis points over the past 13 months. Policymakers stand ready to do more if needed.

Investors will move their focus back to key themes: AI, capital spending, strong earnings, and ever-higher valuations. The Fed is now just a subplot

As always, please let me know if you have any questions or comments.