Cat on a not-hot roof: Working on an outdoor chimney installation last weekend, I gave my wife my excuse for the turtley progress -- Every afternoon, around 2:30, the sun starts its winddown, and just then a biting wind kicks up, and my 60+ bones say: “Rub A5-35 – Now!” December makes my dad-body a fading flashlight battery. Less energizer bunny and more limp string puppet whose puppeteer went for a walk.

The season also gives itself to year-end/new-year predictions fighting the e-waves with black Friday adds for every imaginable trinket. The year has felt about as tumultuous as a Trump combover in a windstorm, but here we are, somehow nearing a positive close in markets for 2025. Reward for a strong stomach I suppose.

Unstoppables: Around this time last year, one of our chief analysts, Jim Allworth, spoke about the. “unstoppables” – trends that will continue regardless of short-term fluctuations. Jim is not all sweetness and money. But his themes stand up well.

And they continue to hold promise for 2026 and beyond.

AI spending

Companies view AI as a matter of survival. Non-tech companies are also increasing their AI investments, despite uncertain returns.

Renewable power

The cost of renewable power has plummeted, making it the cheapest form of electricity generation in most economies. This is an economic driver that’s pushing utilities towards renewables, with installation rates surpassing estimates.

Aging population

As working-age populations decline, economies face challenges in growth and increased costs. However, this also presents opportunities for businesses catering to the elderly.

Electrification of everything

Cheaper electricity means more will be used. Many industrial processes fueled by fossil fuels today will transition to lower cost renewables over the coming decades.

Defense spending

Defense spending appears to be set on a course of steadily rising expenditure in response to worries about Russian expansionism and Chinese military build-up.

All of these “unstoppables’ will offer significant investable opportunities in the coming decades.

Before our weekly investment newsletter (below), here’s a few on-topic charts worth a glance:

Canada needs IPOs too: (see chart below from The Global and Mail): “Year to date, there has been only one new operating company on the TSX. In fact, the TSX has not seen more than two operating company IPOs in any year since the short-lived post-COVID tech bubble burst in the fall of 2021. At the same time, the pace of graduations from junior stock markets to the TSX has also declined. There’s a lot that can be done to solve this issue. Red-tape reduction, further harmonization of securities regulations across provinces and modernization of the IPO process are all essential. However, the depth of the challenge demands that we act more boldly by pursuing innovative policies.”

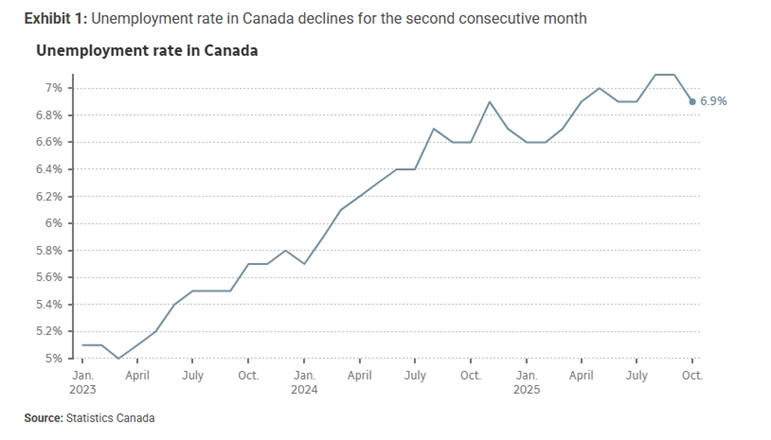

More slackers hidden under the headlines: “Youth Employment Drives November Job Gains, Unemployment Hits 16-Month Low.” Canada’s unemployment rate fell to 6.5% in November 2025, down from 6.9% in October. “… we note that much of the drop in unemployment was due to a 0.2% decline in the participation rate to 65.1%. A +18k increase in the population last month was more than offset by a -26k reduction in the size of the labour force.” The decline represents the second consecutive monthly drop in the unemployment rate, following a peak of 7.1% in September – the highest non-pandemic level since May 2016.

China China China China China – It’s always and forever about scale.

China’s strategic industrial lead over the rest of the world (see chart below from BAML): “Exhibit 1 makes clear, China is entering the next five years with an astounding lead in a number of strategic industrial activities. From robots to electric vehicles (EV) to nuclear reactors, you name it, China’s building it—and, in many cases, leading the rest of the world.”

- Power generation? China has twice the solar and wind capacity under construction as the rest of the world combined. Batteries? Two firms’ alone control nearly half of global EV battery production. Strategic minerals? China refines 99% of the world’s gallium, 95% of the world’s graphite, and 92% of the world’s rare earths, to name a few. Drones? A single company accounts for more than 90% of the global consumer drone market. Shipbuilding? China’s leading state-owned shipbuilder built more commercial vessels in 2024 alone than the entire U.S. shipbuilding industry has built since World War II. High-speed rail? China boasts a highspeed rail network longer than all other countries’ networks combined. You get the picture.

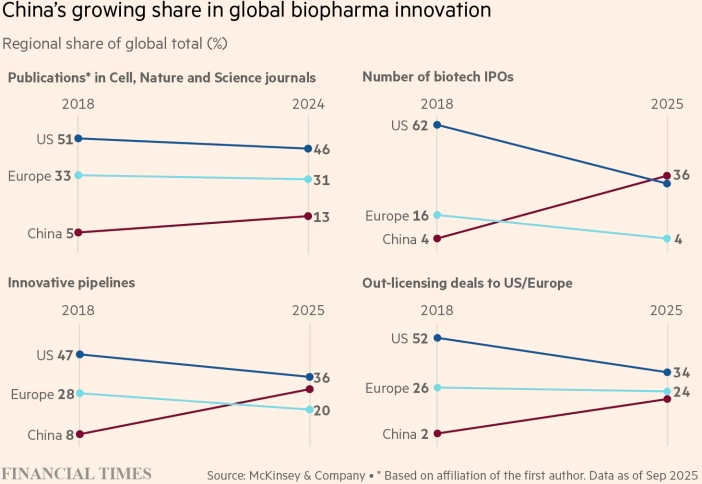

Chinese Bigger Big Pharma: A McKinsey report lays out China’s time-and-cost advantage at every stage of drug development. The consultancy estimates that Chinese drugmakers can move two to three times faster than the global average in advancing a target molecule into a drug candidate and into early clinical trials. China’s growing capabilities have drawn pharmaceutical multinationals to the country to either buy or co-develop innovative drugs. China’s share of out-licensing deals to the U.S. and Europe has risen from 2 per cent in 2018 to 20 per cent this year

And, as promised, here’s RBC Wealth Management's latest investment newsletter.

When a rising tide lifts some boats more than others

Not only has the U.S. equity rally been uneven in 2025, the segment of the market that has dominated during this bull market cycle has been narrow and concentrated mainly in the largest of large-cap stocks. Key charts illustrate what has occurred and why, and we provide guidance on how to factor this phenomenon into investment portfolio strategies in 2026.

Regional developments: Ottawa and Alberta set the stage for a potential new pipeline; AI developments and Fed policy dominating the U.S. market’s attention; UK budget brings opportunities in Gilts and domestic cyclicals; Comments from Japan’s prime minister put focus on Japan/China trade conflict

Full Report Here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Enjoy your weekend!

Mark