Good afternoon. The word of the week is: “nonlinearly.” As in, the trail up the mountain takes us higher in a nonlinear way.

A recent study out of Stanford suggests that we age nonlinearly -- old age is a curveball – and it really does sneak up on us. For a while I had been carrying around a fish-bonker to smack it (aging) on the head, but apparently the fact that I was doing that was itself a sign that decrepit curmudgeonry had already upsnuckered me, nonlinearly of course.

According to Dr. David B Agus, there’s good data showing that the extension of life achieved over recent years will continue, and in better ways, in part thanks to AI.

“Policymakers, regulators, insurers and pension funds should take note: If science delivers on its promise, people could live a decade or more longer—and those years would be spent in good health. That raises hard questions: Does retirement at 65 still make sense? How do we fund longer lives and keep them purposeful? We haven’t planned for such a future, and it’s time to start doing so.”

“Aging, once an inevitability, is becoming a frontier. And for the first time, science offers reason to hope that the future might be younger than it looks.”

As an aside: There’s a big-little word in the middle of that quote: “If…”

Also note that Dr. Agus’s last name is pronounced “egg-us” not “age-us,” which means he’s being relentlessly tracked by pesky onomatopoeia (his name sounds like it means something). Me have fish bonker for him.

It’s intriguing. And, fish-bonkage aside, I’m not qualified to be a good skeptic on biological studies. And I’d truly rather believe 70 is the new 60, but… dagnabit if you’re driving around in a ’62 Ford, you’d best be pals with a good mechanic.

Still, it’s worth keeping an eye on what dreams may come for those of us with a little grey around the temples.

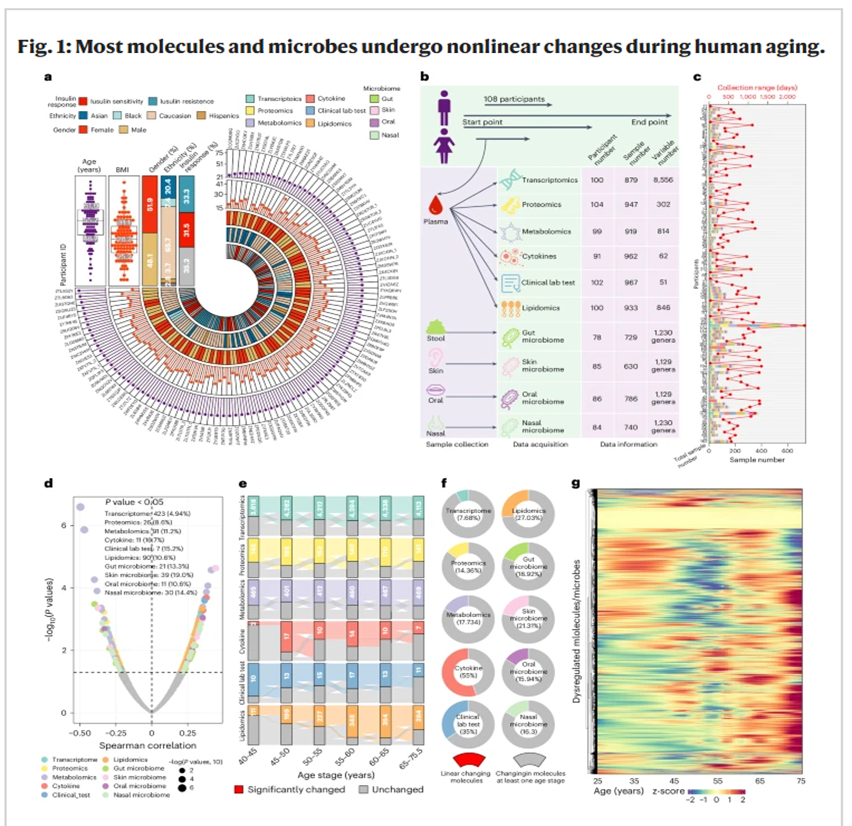

Data should be boring. Good data stands on its own shoulders. Shiny data makes me suspicious. A series of charts from the aforementioned study (see below) makes me think of those glossy business plans I used to adjudicate -- often developed by people with no actual plan, (and no actual money) who qualified for a sponsorship to a government-subsidized business planning class, at the back of which apparently sat a state-of-the-art printer.

(If you look closely at the gorgeous charts below, you’ll see a small green pile of… um… fecal material, with arrows pointing to “gut microbiome” data sets. It’s Stanford. They only eat greens.)

But we can still hope! If you’re interested in more seriously diving into the study, you can read it here: study.

Not boring, glossy-non-glossy numbers of the week: 4000, 7000

- Gold topped $4,000 an ounce for the first time ever. The precious metal is up more than 50% so far this year as geopolitical and economic uncertainty has sent investors in search of alternatives to U.S. assets. The U.S. government shutdown is the latest factor driving interest in gold, which is having its best year since the 1970s. The rising price of gold is also helping to drive up the stock price of companies that mine the metal.

- A Toronto steakhouse debuts cocktail that costs an unbelievable $7,000 per drink. The cocktail, which features a GRAN PATRÓN base and notes of cocoa and smoked cedar, arrives in a bespoke jewelry box, with a hidden bracelet tucked inside. (I don’t know what any of that means).

- To my daughters. If your date orders anything remotely like this, hold tightly onto that fish bonker I sent you, excuse yourself and sneak out the bathroom window. Call a cab and change your cell number. He’s an idiot trying to pretend to something grand.

Here’s RBC Wealth Management's latest investment newsletter.

U.S. Recession Scorecard: Stuck … with reduced visibility

The scorecard indicators remain mixed, including a shift in the yield curve indicator. The government shutdown has limited employment data, confirming a cautious investment approach is needed, as ongoing policy and trade shifts affect the economy.

Regional developments: Canada’s Department of Finance announced a series of reporting changes this week aimed at “modernizing the budget cycle” (see above regrading shiny data sets); Gold tops US$4,000 for the first time; French political turmoil reappears; New leader of Japan’s Liberal Democratic Party sparks market optimism.

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Here’s a few more charts for the week:

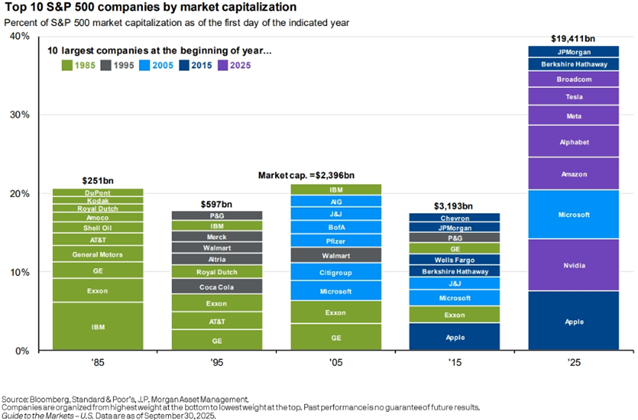

S&P 500: Top 10 companies by decade (see chart below from J.P. Morgan): The color coding highlights in which of the shown years the company first entered the top 10, highlighting the frequency of leadership changes.

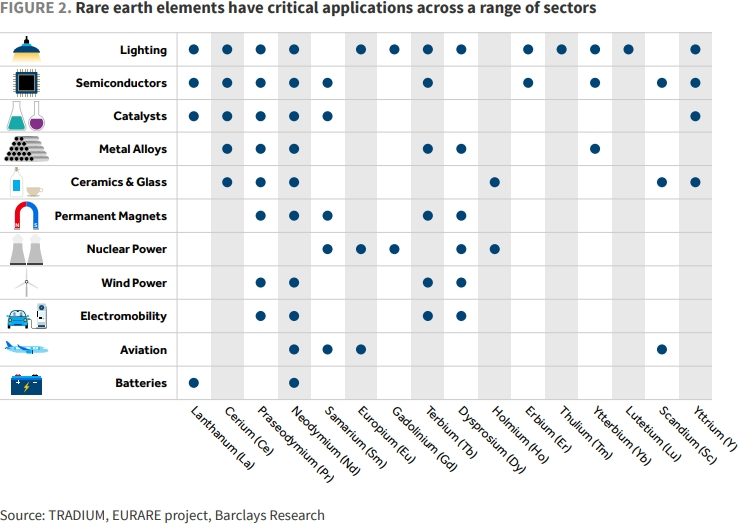

Rare earth elements: How are they used? (see chart below): “Applications of REEs span a range of industries such as aviation, semiconductors, and wind power. Figure 2 summarizes some of the main applications for each element. Neodymium, praseodymium, terbium and dysprosium stand out as having some of the most varied end-markets, whilst thulium and lutetium have substantially fewer use cases. From an end-use perspective, lighting, semiconductors, and catalysts rely on the widest variety of REEs.

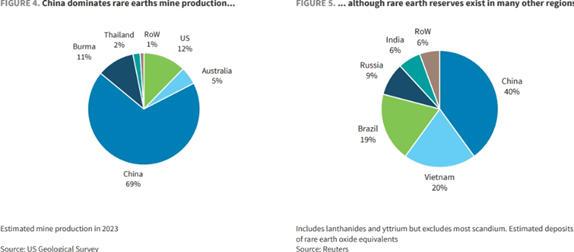

Rare earth elements: Where are REEs found? (see chart below): “Despite their name, many of the rare earth elements are not geologically scarce. In fact, they are relatively widely distributed and abundant in the Earth's crust. However, they often exist at low concentration and in combination with other minerals, making them difficult to extract and separate. Geographically, China dominates rare earth production (Figure 4) despite rare earths reserves being relatively widely distributed globally (Figure 5). China controls 70% of mining capacity, 90% of separation and processing, and 93% of magnet manufacturing.”

Enjoy a pleasant and abundant (but not too abundant) Thanksgiving weekend! Even with all the crazy, it’s a good life and it’s still a good time and place to live.

And of course…

GO BLUEJAYS GO!!!!

(I’ve played fall baseball and… it hurts the hands, but it’s fun to watch!)

Mark